Outline ·

[ Standard ] ·

Linear+

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

Medufsaid

|

Mar 31 2024, 05:53 PM Mar 31 2024, 05:53 PM

|

|

does FSM malaysia support London ETFs? seems like the answer is hidden unless you register & login to check.

also, you need to pay malaysian stamp duty right? so the minimal charges @ RM1,000 investment is still RM1 processing fee + stamp duty RM1

This post has been edited by Medufsaid: Mar 31 2024, 05:57 PM

|

|

|

|

|

|

Medufsaid

|

May 15 2024, 02:24 PM May 15 2024, 02:24 PM

|

|

FSM RSP is actually RM1 + RM1 (stamp duty). that's U$0.42.

not just that, current S&P500 annual dividend yield is 1.27%. you are losing out on RM19.05 annual savings per RM10k if u picked USA-domiciled etf funds

|

|

|

|

|

|

Medufsaid

|

May 16 2024, 03:44 AM May 16 2024, 03:44 AM

|

|

!@#$%^ for IBKR you can create a joint account. so that will solve some of those scenarios

|

|

|

|

|

|

Medufsaid

|

May 23 2025, 11:09 AM May 23 2025, 11:09 AM

|

|

QUOTE thats good but need to see other charges & stamp duty. also the selling fees for LSE CSPX are very expensive right? QUOTE LSE trading (min fee 0.15%/ GBP15) and RSP (0.15%/MYR 1) now available. Need to update apps first as long as you are sure you don't need to suddenly sell it to free up some cash then it's fine |

|

|

|

|

|

Medufsaid

|

May 24 2025, 12:31 AM May 24 2025, 12:31 AM

|

|

--deleted-- updated info hereThis post has been edited by Medufsaid: Jul 7 2025, 04:51 PM |

|

|

|

|

|

Medufsaid

|

Jun 4 2025, 11:34 AM Jun 4 2025, 11:34 AM

|

|

--deleted-- updated info hereThis post has been edited by Medufsaid: Jul 7 2025, 04:51 PM |

|

|

|

|

|

Medufsaid

|

Jun 6 2025, 11:52 AM Jun 6 2025, 11:52 AM

|

|

--deleted-- updated info hereThis post has been edited by Medufsaid: Jul 7 2025, 04:51 PM |

|

|

|

|

|

Medufsaid

|

Jun 11 2025, 05:15 PM Jun 11 2025, 05:15 PM

|

|

BarricadeQUOTE(terriblyrawtea @ May 23 2025, 01:43 PM) There's rsp scheduled selling of ETFs at 0.15% (min MYR 1) for LSE Source here: https://support.fsmone.com.my/hc/en-us/arti...RSP-investmentsgranted, it's not real time sell and there's opportunity cost to wait for it to sell This post has been edited by Medufsaid: Jun 11 2025, 05:17 PM

|

|

|

|

|

|

Medufsaid

|

Jun 18 2025, 09:18 AM Jun 18 2025, 09:18 AM

|

|

watermineralQUOTE There's rsp scheduled selling of ETFs at 0.15% (min MYR 1) for LSE Source here: https://support.fsmone.com.my/hc/en-us/arti...RSP-investments

|

|

|

|

|

|

Medufsaid

|

Jul 7 2025, 04:50 PM Jul 7 2025, 04:50 PM

|

|

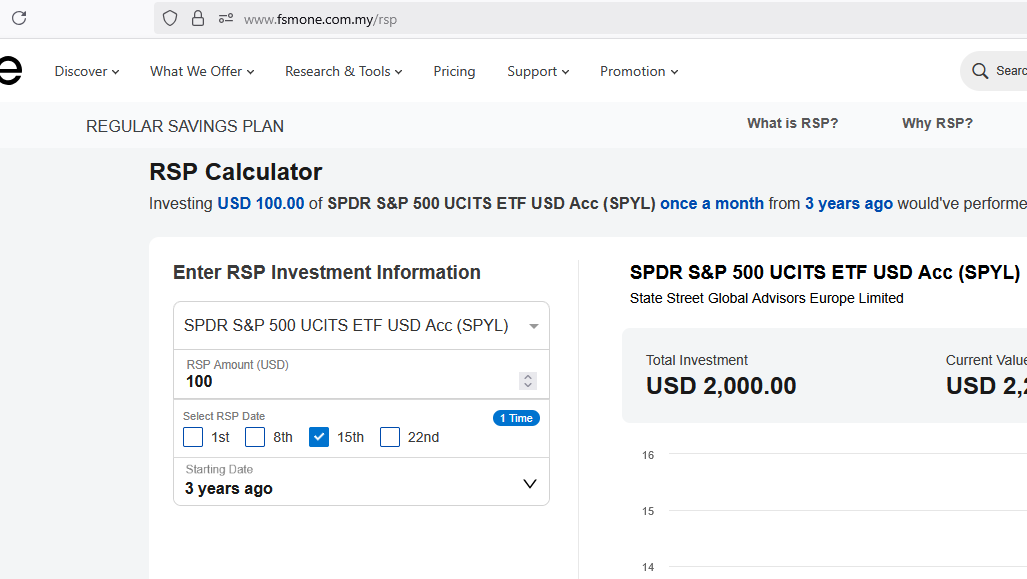

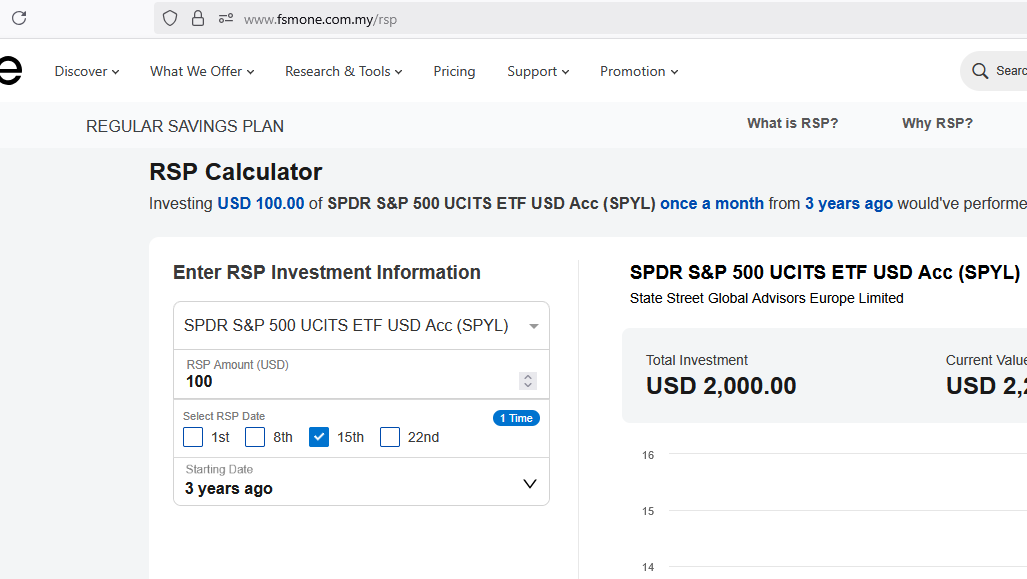

looks like SPYL is available on FSMOne  This post has been edited by Medufsaid: Oct 19 2025, 11:27 AM This post has been edited by Medufsaid: Oct 19 2025, 11:27 AM |

|

|

|

|

|

Medufsaid

|

Jul 12 2025, 03:55 PM Jul 12 2025, 03:55 PM

|

|

kazekage_09 FSMOne. currently FOC (only malaysian stamp duty need to pay)

|

|

|

|

|

|

Medufsaid

|

Oct 24 2025, 10:32 AM Oct 24 2025, 10:32 AM

|

|

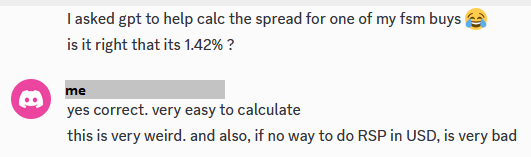

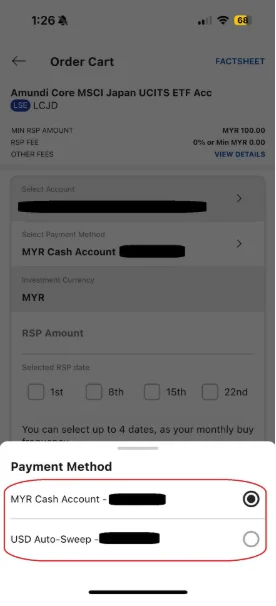

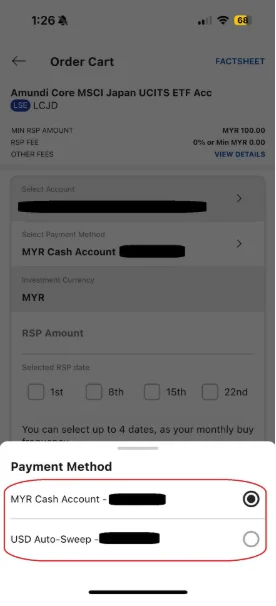

jutamind use autosweep. someone calculated that for MYR cash auto-conversion to USD for RSP, FSM will charge you twice the forex fee compared to you manually converting to USD inside FSM

|

|

|

|

|

|

Medufsaid

|

Oct 27 2025, 01:22 PM Oct 27 2025, 01:22 PM

|

|

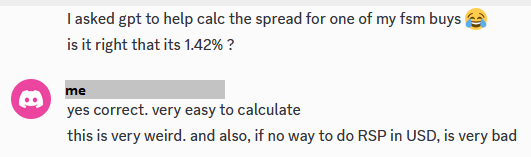

QUOTE(tadashi987 @ Oct 27 2025, 12:13 PM) FSM shouldn't charge twice the forex fee just because we are using cash account no. i mean FSM is charging you subpar MYRUSD rates if u let it take from MYR balance  👆 my conversation with another FSM user. luckily we found a way to get FSM to deduct from USD auto-sweep. so all is good (just a bit leceh)  create RSP order to take from USD auto-sweep acct This post has been edited by Medufsaid: Oct 27 2025, 01:50 PM |

|

|

|

|

|

Medufsaid

|

Nov 27 2025, 05:16 PM Nov 27 2025, 05:16 PM

|

|

kimi0148 yes but because USD will fluctuate, your intended investment of RM1,000 might suddenly become RM1,050 or in other words RM1.00 stamp duty becomes RM2.00 so you have to create a custom RSP order every time

This post has been edited by Medufsaid: Nov 27 2025, 06:07 PM

|

|

|

|

|

Mar 31 2024, 05:53 PM

Mar 31 2024, 05:53 PM

Quote

Quote

0.0569sec

0.0569sec

0.63

0.63

7 queries

7 queries

GZIP Disabled

GZIP Disabled