QUOTE(Sitting Duck @ Jul 28 2023, 12:44 PM)

Received an email from FSM on RSP promotion for ETF.

"Dear Valued Investor,

Great news!

We're thrilled to announce our latest ETF Regular Savings Plan enhancement and a 0% subscription fee promotional campaign from 28 July 2023 to 31 December 2024, making it more rewarding to invest with us."

I wonder what is 0% subscription fee? Isn't it always been 0% subscription fee for RSP.

I've been RSP'ing into VOO for the past year about RM1000/month. I only know there are these fees for RSP ETF:

1. Processing Fees (USD 1.00)

2. MY Stamp Duty (USD 0.22)

I don't think these are "subscription fee". Any idea?

"Dear Valued Investor,

Great news!

We're thrilled to announce our latest ETF Regular Savings Plan enhancement and a 0% subscription fee promotional campaign from 28 July 2023 to 31 December 2024, making it more rewarding to invest with us."

I wonder what is 0% subscription fee? Isn't it always been 0% subscription fee for RSP.

I've been RSP'ing into VOO for the past year about RM1000/month. I only know there are these fees for RSP ETF:

1. Processing Fees (USD 1.00)

2. MY Stamp Duty (USD 0.22)

I don't think these are "subscription fee". Any idea?

QUOTE(Sitting Duck @ Jan 17 2025, 10:28 PM)

Hi Sifus,

For those that subscribing to US ETF RSP, did you notice in the Jan 2025 RSP, that FSM has started charging Processing fee of USD0.22 for every RM1,000 RSP?

The weird thing is that the processing fees is charged on my VOO and SMH RSP but not on QQQ RSP with the same RM1,000 on each of the fund.

Anyone has similar experience or know what's going on?

Here's the screenshot of the transaction:

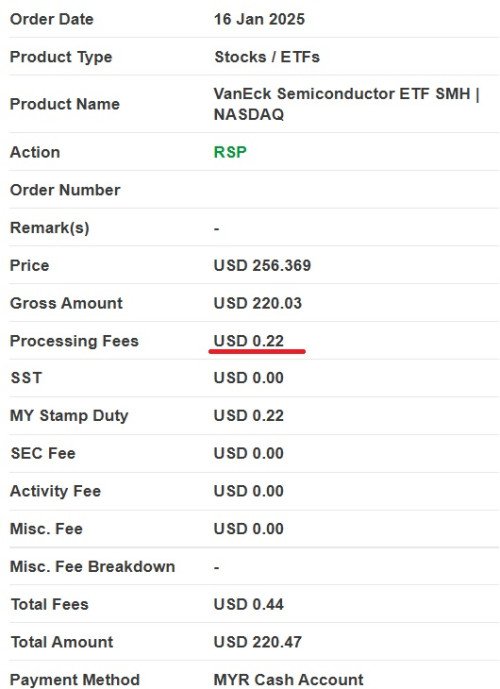

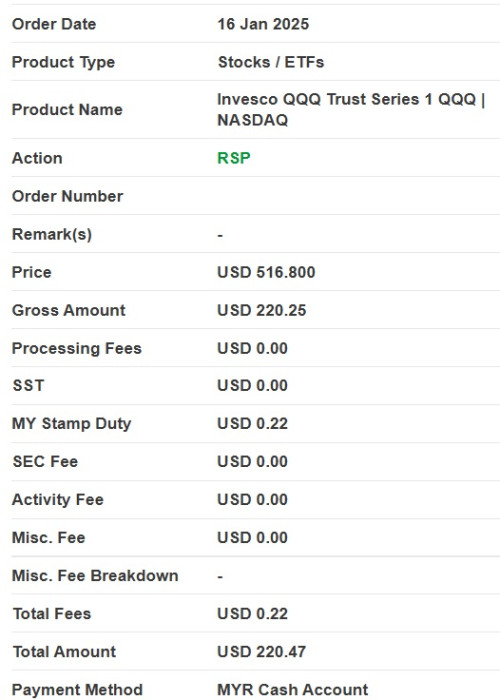

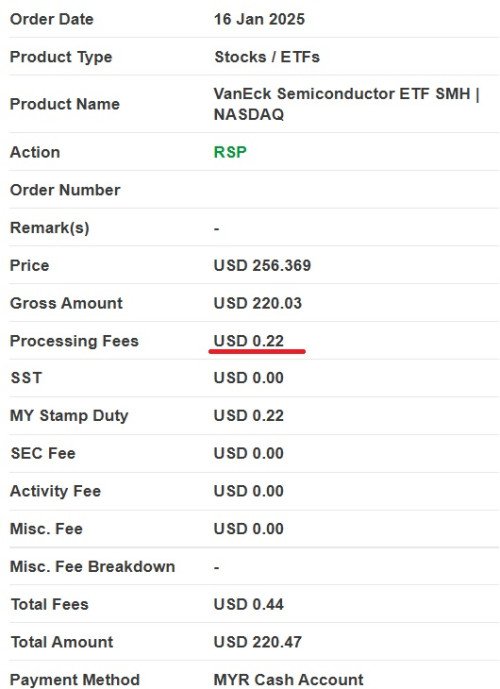

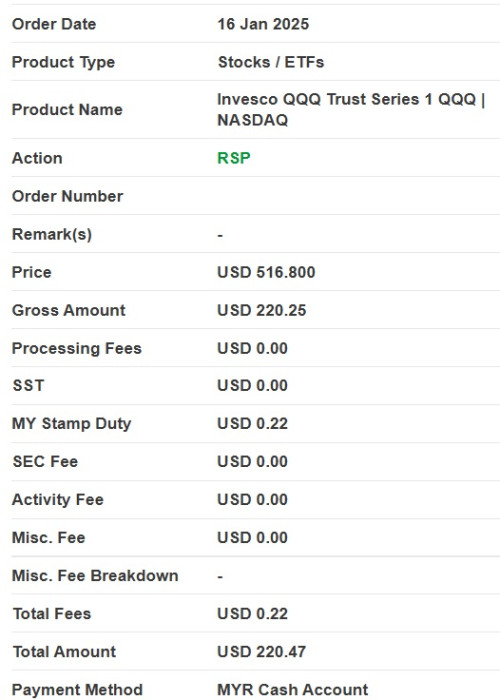

SMH with Processing Fees:

QQQ without Processing Fees:

Sounds like your promo period ended for your earlier RSPs.For those that subscribing to US ETF RSP, did you notice in the Jan 2025 RSP, that FSM has started charging Processing fee of USD0.22 for every RM1,000 RSP?

The weird thing is that the processing fees is charged on my VOO and SMH RSP but not on QQQ RSP with the same RM1,000 on each of the fund.

Anyone has similar experience or know what's going on?

Here's the screenshot of the transaction:

SMH with Processing Fees:

QQQ without Processing Fees:

QQQ RSP was probably started later than your VOO and SMH during a different promo.

This post has been edited by thecurious: Jan 18 2025, 01:15 AM

Jan 18 2025, 01:14 AM

Jan 18 2025, 01:14 AM

Quote

Quote

0.0301sec

0.0301sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled