QUOTE(no6 @ Jul 26 2020, 03:48 PM)

1:3 ratio for bond:equities is good enough from your experience ?

which other equity replacement is worth looking at since TAGTF & Greater China is higher now.

will read more Amchina-A, tq

which other equity replacement is worth looking at since TAGTF & Greater China is higher now.

will read more Amchina-A, tq

QUOTE(WhitE LighteR @ Jul 27 2020, 10:45 AM)

The ratio is really up to your risk tolerance. It depend on how much u can stomach a drop. This depends on your financial goals. If u are older, then u need a more stable portfolio, usually more bonds and lesser equity, and vice versa.

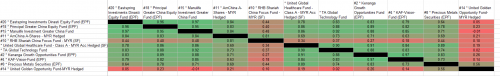

At this moment I dont see anything to replace TAGTF & Greater China. All relative performing funds are also very high right now for me.

My thoughts:At this moment I dont see anything to replace TAGTF & Greater China. All relative performing funds are also very high right now for me.

If you invest for retirement, and you are just in your 30+, investing in bond fund is not necessary. Our EPF has similar risk like bond funds.

But if your investment horizon is 2-3 years, then you can consider bond funds.

Jul 27 2020, 01:55 PM

Jul 27 2020, 01:55 PM

Quote

Quote

0.0271sec

0.0271sec

0.54

0.54

6 queries

6 queries

GZIP Disabled

GZIP Disabled