after so long, my rhb emerging market bond picking up the pace. wonder if can reverse the previous losses?

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Jan 26 2019, 01:16 PM Jan 26 2019, 01:16 PM

Show posts by this member only | IPv6 | Post

#16321

|

All Stars

17,515 posts Joined: Feb 2006 From: KL |

after so long, my rhb emerging market bond picking up the pace. wonder if can reverse the previous losses?

|

|

|

|

|

|

Jan 26 2019, 01:46 PM Jan 26 2019, 01:46 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(john123x @ Jan 26 2019, 12:35 PM) btw, government bond is very near FD rate. what's is the major difference in buying bond fund and bonds?there are other bond that are quite secure too. CIMB Group Holdings Bhd CIMBMK 5.800% Perpetual Corp (MYR) https://www.fundsupermart.com.my/fsm/bonds/...et/MYBPZ1600074 I wish to know in term of interest |

|

|

Jan 26 2019, 01:49 PM Jan 26 2019, 01:49 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(john123x @ Jan 26 2019, 12:35 PM) btw, government bond is very near FD rate. thk u bro. Itu cimb is corporate bond d....hmm....i think i should allocate some portion for corporate bond also, and some for gomen bond...there are other bond that are quite secure too. CIMB Group Holdings Bhd CIMBMK 5.800% Perpetual Corp (MYR) https://www.fundsupermart.com.my/fsm/bonds/...et/MYBPZ1600074 so...at this stage...can we conclude that there's no way we can have access to these bond except via FSM? Itu fund societies can pakai? |

|

|

Jan 26 2019, 01:53 PM Jan 26 2019, 01:53 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(Ancient-XinG- @ Jan 26 2019, 01:46 PM) bond fund = got a fun manager help you to hoot alot of other bonds, and get an aggregate result, diversified.bond = a bond. It can be a gomen bond. corporate bond. junk bond. |

|

|

Jan 26 2019, 02:37 PM Jan 26 2019, 02:37 PM

|

Senior Member

3,019 posts Joined: Oct 2005 |

QUOTE(Ancient-XinG- @ Jan 26 2019, 01:46 PM) bond fund = minimum 1k, fsm bond express min 10kbond fund = less risk, got pro manage , fsm bond = risks of default bond fund = only sales charge , fsm bond = lots of charge, platform fee, etc |

|

|

Jan 26 2019, 05:18 PM Jan 26 2019, 05:18 PM

|

Senior Member

5,752 posts Joined: Jan 2012 |

QUOTE(alexkos @ Jan 26 2019, 01:53 PM) bond fund = got a fun manager help you to hoot alot of other bonds, and get an aggregate result, diversified. bond = a bond. It can be a gomen bond. corporate bond. junk bond. QUOTE(john123x @ Jan 26 2019, 02:37 PM) bond fund = minimum 1k, fsm bond express min 10k then what is the exact advantage of bond?bond fund = less risk, got pro manage , fsm bond = risks of default bond fund = only sales charge , fsm bond = lots of charge, platform fee, etc some bond funds give 5% most of the bond also hovering around 6%.... and less liquidity ritr |

|

|

|

|

|

Jan 26 2019, 08:41 PM Jan 26 2019, 08:41 PM

Show posts by this member only | IPv6 | Post

#16327

|

Junior Member

78 posts Joined: Apr 2008 |

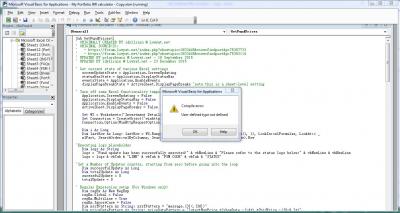

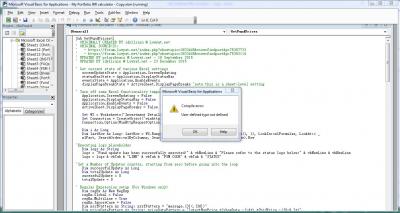

QUOTE(2387581 @ Jan 25 2019, 10:32 PM) Hi, I was trying to do the update myself - and it returned Hi 2387581, find this line in the GetFundPrices() routine (it's somewhere in the first 25 lines):When I tried download the new spreadsheet and without doing anything, click on the button, same thing happens. Any idea? [attachmentid=10171525] CODE 'Connection.Option(WinHttpRequestOption_SecureProtocols) = 2048 Remove the ' (single quote) from the front of that line to activate that line. Save and try again. That should stop the error. Edit (In case you're wondering why you're seeing that error and what that line does): You're seeing the error because FSM requires a secure connection established using the TLS 1.2 protocol and your computer attempted the connection using some other protocol (probably TLS 1.1). What that line does is to force the connection to be established using TLS 1.2. Btw, if the error still occurs, you will most likely need to update your copy of Windows as per this article: https://support.microsoft.com/en-my/help/31...protocols-in-wi This post has been edited by idyllrain: Jan 26 2019, 08:57 PM |

|

|

Jan 26 2019, 09:37 PM Jan 26 2019, 09:37 PM

Show posts by this member only | IPv6 | Post

#16328

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(alexkos @ Jan 26 2019, 01:49 PM) thk u bro. Itu cimb is corporate bond d....hmm....i think i should allocate some portion for corporate bond also, and some for gomen bond... Corporate bond can usually be bought if you a priority customer able to fork out RM250k/bond.. so...at this stage...can we conclude that there's no way we can have access to these bond except via FSM? Itu fund societies can pakai? So only way you can buy is 1) be priority customer 2) via FSM. |

|

|

Jan 26 2019, 11:44 PM Jan 26 2019, 11:44 PM

|

Senior Member

2,275 posts Joined: Jun 2010 |

QUOTE(Ramjade @ Jan 26 2019, 09:37 PM) Corporate bond can usually be bought if you a priority customer able to fork out RM250k/bond.. woohoo sad yo. ayam net worth below 6 figure....So only way you can buy is 1) be priority customer 2) via FSM. ok, let fsm eat.... no choice... but only earn like 1%+, might as well hoot FD? This post has been edited by alexkos: Jan 26 2019, 11:44 PM |

|

|

Jan 27 2019, 12:30 AM Jan 27 2019, 12:30 AM

|

Senior Member

2,932 posts Joined: Sep 2007 |

QUOTE(wankongyew @ Jan 26 2019, 09:40 AM) No, not a good idea, yet.The China-USA tariff negotiation is still on-going and has a deadline of 1st March. If there is no agreement then, tariffs will shoot up to 25% from the 10% now. Trump just lost the "The Wall" funding battle. So, it is unlikely he will back down on the tariff issue, when he already has a big bruise on his ego. China is unlikely to back down as well. In addition, China's economic growth has been slowing down, and the tariff war does not help. Expect more volatility, and I wouldn't put my money into China funds. Not just yet. My 2 sen. |

|

|

Jan 27 2019, 02:05 AM Jan 27 2019, 02:05 AM

|

Senior Member

756 posts Joined: Dec 2016 |

QUOTE(idyllrain @ Jan 26 2019, 08:41 PM) Hi 2387581, find this line in the GetFundPrices() routine (it's somewhere in the first 25 lines): I have done with the line above. Now there's another error.CODE 'Connection.Option(WinHttpRequestOption_SecureProtocols) = 2048 Remove the ' (single quote) from the front of that line to activate that line. Save and try again. That should stop the error. Edit (In case you're wondering why you're seeing that error and what that line does): You're seeing the error because FSM requires a secure connection established using the TLS 1.2 protocol and your computer attempted the connection using some other protocol (probably TLS 1.1). What that line does is to force the connection to be established using TLS 1.2. Btw, if the error still occurs, you will most likely need to update your copy of Windows as per this article: https://support.microsoft.com/en-my/help/31...protocols-in-wi

I have also checked the said windows update, which was already installed in my Windows 7 x64 laptop at home. I have also tried the same excel file in my office desktop, which is running Windows 10 x64 (via AnyDesk), same error as above happens - Tried with the quote mark (deactivated line), the same error as above returns. |

|

|

Jan 27 2019, 02:11 PM Jan 27 2019, 02:11 PM

Show posts by this member only | IPv6 | Post

#16332

|

Junior Member

78 posts Joined: Apr 2008 |

QUOTE(2387581 @ Jan 27 2019, 02:05 AM) I have done with the line above. Now there's another error. Hmm this error happens when a non-native variable type is used incorrectly or a reference isn't loaded. Can you PM me a blanked copy of your file? I'll look into it.

I have also checked the said windows update, which was already installed in my Windows 7 x64 laptop at home. I have also tried the same excel file in my office desktop, which is running Windows 10 x64 (via AnyDesk), same error as above happens - Tried with the quote mark (deactivated line), the same error as above returns. |

|

|

Jan 27 2019, 04:42 PM Jan 27 2019, 04:42 PM

Show posts by this member only | IPv6 | Post

#16333

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(howszat @ Jan 27 2019, 12:30 AM) No, not a good idea, yet. China already back down. Why do you think they decide to agree to buy US product and lower trade deficit to 0%?The China-USA tariff negotiation is still on-going and has a deadline of 1st March. If there is no agreement then, tariffs will shoot up to 25% from the 10% now. Trump just lost the "The Wall" funding battle. So, it is unlikely he will back down on the tariff issue, when he already has a big bruise on his ego. China is unlikely to back down as well. In addition, China's economic growth has been slowing down, and the tariff war does not help. Expect more volatility, and I wouldn't put my money into China funds. Not just yet. My 2 sen. China got not enough firepower as US tax is hurting them more than it's hurting US. |

|

|

|

|

|

Jan 27 2019, 05:09 PM Jan 27 2019, 05:09 PM

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Ramjade @ Jan 27 2019, 04:42 PM) China already back down. Why do you think they decide to agree to buy US product and lower trade deficit to 0%? in what sense? China got not enough firepower as US tax is hurting them more than it's hurting US. most of the news reported soy beans, pork meats and jobs in steel industry suffers by usa.. for china, recently reported their gdp dropped.. nth much reported... |

|

|

Jan 27 2019, 05:22 PM Jan 27 2019, 05:22 PM

Show posts by this member only | IPv6 | Post

#16335

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(xcxa23 @ Jan 27 2019, 05:09 PM) in what sense? Why do you think they agree to bring the trade deficit down to zero percent? most of the news reported soy beans, pork meats and jobs in steel industry suffers by usa.. for china, recently reported their gdp dropped.. nth much reported... Latest news also said China GDP is slowing down. If they can withstand the US trade war, why would they wave the white flag so early? This post has been edited by Ramjade: Jan 27 2019, 05:23 PM |

|

|

Jan 27 2019, 06:44 PM Jan 27 2019, 06:44 PM

|

Senior Member

2,932 posts Joined: Sep 2007 |

QUOTE(Ramjade @ Jan 27 2019, 04:42 PM) China already back down. Why do you think they decide to agree to buy US product and lower trade deficit to 0%? No, they haven't backed down. They are still negotiating. Otherwise, they would just announce the "back down" agreement now and that's the end of that. You don't lower trade deficit to zero anyway, that's meaningless.China got not enough firepower as US tax is hurting them more than it's hurting US. What do you mean by "US tax"? You mean tariffs? The issue is not just about tariffs and trade imbalance. Otherwise, that's easily solved, as all China has to do is to agree to buy more goods from the US. Which they already did. The sticking points are about technological "transfers" and "piracy" and these things are not that quickly solved. |

|

|

Jan 27 2019, 08:21 PM Jan 27 2019, 08:21 PM

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Ramjade @ Jan 27 2019, 05:22 PM) Why do you think they agree to bring the trade deficit down to zero percent? seriously i have no idea, and wars regardless trade or real combat wars hurts participating parties so it will be wise to stop ASAP. andLatest news also said China GDP is slowing down. If they can withstand the US trade war, why would they wave the white flag so early? you mentioned hurting them more than it's hurting US. so im curious in what sense/section/department/industry did china suffers (other than just reported china gdp slowest growth in 20+years) i would appreciate if you willing to share it. having much knowledge helps ALOT in making logical decision.. thanks! |

|

|

Jan 27 2019, 09:12 PM Jan 27 2019, 09:12 PM

|

All Stars

24,387 posts Joined: Feb 2011 |

QUOTE(howszat @ Jan 27 2019, 06:44 PM) No, they haven't backed down. They are still negotiating. Otherwise, they would just announce the "back down" agreement now and that's the end of that. You don't lower trade deficit to zero anyway, that's meaningless. I don't think Trump cares about technological "transfers" and "piracy". All he cares is how much money he can makes from a deal and how good is he a business man to the American public. What do you mean by "US tax"? You mean tariffs? The issue is not just about tariffs and trade imbalance. Otherwise, that's easily solved, as all China has to do is to agree to buy more goods from the US. Which they already did. The sticking points are about technological "transfers" and "piracy" and these things are not that quickly solved. QUOTE(xcxa23 @ Jan 27 2019, 08:21 PM) seriously i have no idea, and wars regardless trade or real combat wars hurts participating parties so it will be wise to stop ASAP. and China export majority of their stuff to US. By taxing China items, it's making China products more expensive. Hence US companies will look elsewhere. When they do it, factory output decreases. When factory output decreases, business drops. Business drops, people start losing jobs. When people start losing job, they cannot pay back loans. you mentioned hurting them more than it's hurting US. so im curious in what sense/section/department/industry did china suffers (other than just reported china gdp slowest growth in 20+years) i would appreciate if you willing to share it. having much knowledge helps ALOT in making logical decision.. thanks! China govt is cutting taxes for local companies in order try to make their people spend. If economy is good, you don't need to that. If is not affecting China, they won't bother offering to make trade deficit zero. They will just ignore US. This post has been edited by Ramjade: Jan 27 2019, 09:12 PM |

|

|

Jan 27 2019, 09:22 PM Jan 27 2019, 09:22 PM

|

Senior Member

2,932 posts Joined: Sep 2007 |

|

|

|

Jan 27 2019, 09:47 PM Jan 27 2019, 09:47 PM

|

Senior Member

2,175 posts Joined: Mar 2016 |

|

| Change to: |  0.0393sec 0.0393sec

0.53 0.53

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 15th December 2025 - 03:11 AM |