Thanks

yklooi. That’s good to know. It gives us some tome to incorporate changes to accommodate the new site. I’ll discuss with

polarzbearz to see if we can make this transition as smooth as possible for everyone using the spreadsheet.

-- EDIT --As of 8:30PM, we can no longer get NAV prices from the old link at

https://www.fundsupermart.com.my/main/fundi....tpl?id=MYKNGGF This means that if you're using the old Windows or Mac versions of this spreadsheet, it will no longer retrieve the latest prices since that page is no longer there.

-- EDIT2 --I have a working solution ready for

Windows. If you're feeling adventurous or impatient, below are the steps to modify your own copy of the Excel Spreadsheet to cater for changes in the new FSMOne site. By doing this yourself, you won't have to deal with migrating your existing data into a new updated file. It's pretty straightforward:

MAKE A COPY OF YOUR FILE BEFORE YOU DO THIS! Just in case...

» Click to show Spoiler - click again to hide... «

Instructions

- Right click on the "Update Current Fund Price" button, and choose "Assign Macro"

- Select the macro with the name "GetFundPrices" and click on "Edit"

- Click on the "Tools" menu and choose "References"

- Find the entry that says "Microsoft VBScript Regular Expressions 5.5", put a checkmark on it, and click "OK"

- On the main screen you'll see the subroutine that says "GetFundPrices"

- This subroutine goes all the way down here

- Now select all the lines of code that is in this subroutine. (Select until the line.)

- Press the "Backspace" key or "Delete" key on your keyboard

- Copy the code in the Spoiler section below, and paste it here

Code in here vvvv

» Click to show Spoiler - click again to hide... «

CODE

Sub GetFundPrices()

' ORIGINALLY CREATED BY idyllrain @ Lowyat.net

' ORIGINAL SOURCE(S):

' - https://forum.lowyat.net/index.php?showtopic=3633445&view=findpost&p=75357733

' - https://forum.lowyat.net/index.php?showtopic=3633445&view=findpost&p=75383114

' UPDATED BY polarzbearz @ Lowyat.net - 16 September 2015

' UPDATED BY idyllrain @ Lowyat.net - 23 December 2015

' Get current state of various Excel settings

screenUpdateState = Application.ScreenUpdating

statusBarState = Application.DisplayStatusBar

eventsState = Application.EnableEvents

displayPageBreakState = ActiveSheet.DisplayPageBreaks 'note this is a sheet-level setting

' Turn off some Excel functionality temporarily to speed up the macro

Application.ScreenUpdating = False

Application.DisplayStatusBar = False

Application.EnableEvents = False

ActiveSheet.DisplayPageBreaks = False 'note this is a sheet-level setting

Set ws = Worksheets("Investment Details")

Set Connection = CreateObject("winhttp.winhttprequest.5.1") 'Added on v2.1

'Connection.Option(WinHttpRequestOption_SecureProtocols) = 2048

Dim i As Long

Dim lastRow As Long: lastRow = ws.Range("A:A").Find(What:="0", After:=ws.Cells(1, 1), LookIn:=xlFormulas, LookAt:= _

xlPart, SearchOrder:=xlByColumns, SearchDirection:=xlPrevious, MatchCase:=False).Row

'Executing logs placeholder

Dim logs As String

logs = "Fund update has been successfully executed!" & vbNewLine & "Please refer to the status logs below:" & vbNewLine & vbNewLine

logs = logs & vbTab & "LINE" & vbTab & "FSM CODE" & vbTab & "STATUS"

'Set a Number of Updates counter, starting from zero before going into the loop

Dim successfulUpdate As Long

Dim totalUpdate As Long

sucessfulUpdate = 0

totalUpdate = 0

' Regular Expression setup (For Windows only)

Dim regEx As New RegExp

regEx.Global = False

regEx.MultiLine = True

regEx.IgnoreCase = False

Dim xsrfPattern As String: xsrfPattern = "message.{3}(.{36})"

Dim priceDatePattern As String: priceDatePattern = "latestNavPrice.+?showDate.:(\d+).+?bidPrice.:([0-9.]+)"

Dim regmatches As Object

' Get XSRF Token

Dim xsrf_token As String: xsrf_token = ""

Connection.Open "POST", "https://www.fundsupermart.com.my/fsmone/rest/csrf/get-new-csrf-token"

Connection.Send

If Connection.Status = 200 Then

With regEx

.pattern = xsrfPattern

If regEx.Test(Connection.ResponseText) Then

Set regmatches = regEx.Execute(Connection.ResponseText)

End If

xsrf_token = regmatches(0).SubMatches(0)

End With

End If

' Process each row that starts with a first cell value of "1"

For i = 1 To lastRow

If ws.Cells(i, 1).Value = "1" Then

totalUpdate = totalUpdate + 1

Dim fundName As String

fundName = ws.Cells(i, 3).Value

Connection.Open "POST", "https://www.fundsupermart.com.my/fsmone/rest/fund/get-factsheet?paramSedolnumber=" & fundName, False

Connection.SetRequestHeader "X-XSRF-TOKEN", xsrf_token

On Error GoTo EndHandler: ' terminate if error in connecting

Connection.Send

If Connection.Status = 200 Then

With regEx

.pattern = priceDatePattern

If regEx.Test(Connection.ResponseText) Then

Set regmatches = regEx.Execute(Connection.ResponseText)

ws.Cells(i, 4).Value = ((regmatches(0).SubMatches(0) + 28800000) / 86400000) + 25569 'Update date value'

ws.Cells(i, 9).Value = regmatches(0).SubMatches(1) 'Update NAV'

successfulUpdate = successfulUpdate + 1

logs = logs & vbNewLine & vbTab & i & vbTab & Left(fundName & Space(15), 15) & vbTab & "OK!"

Else

logs = logs & vbNewLine & vbTab & i & vbTab & Left(fundName & Space(15), 15) & vbTab & "ERROR!"

ws.Cells(i, 4).Value = "=TODAY()"

End If

End With

End If

End If

Next i

' Restore Excel state

Application.ScreenUpdating = screenUpdateState

Application.DisplayStatusBar = statusBarState

Application.EnableEvents = eventsState

ActiveSheet.DisplayPageBreaks = displayPageBreaksState 'note this is a sheet-level setting

' Add final line to logs and display to user

logs = logs & vbNewLine & vbNewLine & "If there are errors in updating the Fund Price, please double check on the FSM Codes and try again."

MsgBox logs

WS.Range("portfolioLastUpdate").Value = Date

Exit Sub

EndHandler:

MsgBox ("Unable to connect to FSM website. Please try again later.")

End Sub

- Finally, go to the "File" menu, "Save" and then choose "Close and Return to Excel"

Attached is an updated base file for Excel 2016 for Windows. Note that this file does not contain functionality that

polarzbearz added when she published her beta version a while ago. This is merely the previous spreadsheet with the FSM retrieval code updated. If you do not want to start afresh, I would recommend following the instructions above to update your own file.

[attachmentid=10144384]

-- EDIT3 --Instructions for

Mac version are available here:

https://forum.lowyat.net/index.php?showtopi...post&p=91308800-- EDIT4 --I updated the instructions and base file above.

Changes- Switched to using a different date value in the API response.

- Fixed timezone issues in date calculation

- Optimized regular expressions

- Removed TLS1.2 connection setting

Thanks to

yklooi for discovering these issues. I should've been more careful. Those who followed my instructions above will have to redo them again. I'm terribly sorry for the trouble; please forgive me.

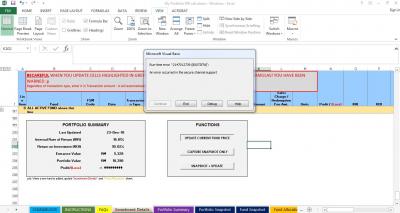

When I tried download the new spreadsheet and without doing anything, click on the button, same thing happens. Any idea?

Jan 25 2019, 09:28 AM

Jan 25 2019, 09:28 AM

Quote

Quote

0.0265sec

0.0265sec

0.46

0.46

6 queries

6 queries

GZIP Disabled

GZIP Disabled