QUOTE(i1899 @ Dec 8 2017, 12:50 PM)

Content in Annual/ Semi Annual Report is updated Every Year/ 6 months. By the time the report is published, at least 2 month had been passed.

That's y, a monthly updated factsheet is more useful to understand the holding, to forecast the up/down of NAV when doing purchase/ withdrawal.

However, Inter-pac seems only update their factsheet every 3 months, not monthly. Moreover, they only list the top 3 holdings without stating the % of the holding.

To who looking at index to guess the NAV of today. Actually, a better way is insert the top 10/ top 5 holding to watchlist of Bloomberg and cal the "weighted average" using excel,

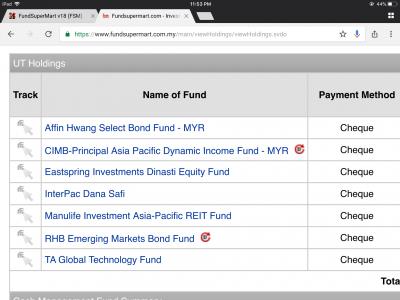

Like this : - Ponzi 2.

[attachmentid=9413535]

Try read page 33 in the report.....That's y, a monthly updated factsheet is more useful to understand the holding, to forecast the up/down of NAV when doing purchase/ withdrawal.

However, Inter-pac seems only update their factsheet every 3 months, not monthly. Moreover, they only list the top 3 holdings without stating the % of the holding.

To who looking at index to guess the NAV of today. Actually, a better way is insert the top 10/ top 5 holding to watchlist of Bloomberg and cal the "weighted average" using excel,

Like this : - Ponzi 2.

[attachmentid=9413535]

But i think 3 months factsheet is good enough, many funds there also have quarterly factsheet update.

Dec 8 2017, 01:14 PM

Dec 8 2017, 01:14 PM

Quote

Quote

0.0261sec

0.0261sec

0.79

0.79

6 queries

6 queries

GZIP Disabled

GZIP Disabled