QUOTE(T231H @ Dec 8 2017, 10:02 AM)

but i think he is a Platinum member...thus i will assume he knows about the basic of asset allocation, concentration risk and others....

FundSuperMart v18 (FSM) MY : Online UT Platform, UT DIY : Babystep to Investing :D

|

|

Dec 8 2017, 10:06 AM Dec 8 2017, 10:06 AM

Show posts by this member only | IPv6 | Post

#10641

|

All Stars

33,697 posts Joined: May 2008 |

QUOTE(T231H @ Dec 8 2017, 10:02 AM) but i think he is a Platinum member...thus i will assume he knows about the basic of asset allocation, concentration risk and others.... |

|

|

|

|

|

Dec 8 2017, 10:08 AM Dec 8 2017, 10:08 AM

|

Senior Member

1,177 posts Joined: Nov 2007 |

QUOTE(T231H @ Dec 8 2017, 10:02 AM) but i think he is a Platinum member...thus i will assume he knows about the basic of asset allocation, concentration risk and others.... Added together, these add up to about 25% of my current portfolio, so I think I'm okay. I'm actually holding more than that in bond and cash funds because I've been expecting a downturn for a while now. |

|

|

Dec 8 2017, 10:12 AM Dec 8 2017, 10:12 AM

Show posts by this member only | IPv6 | Post

#10643

|

All Stars

33,697 posts Joined: May 2008 |

QUOTE(wankongyew @ Dec 8 2017, 10:08 AM) I don't actually have any Greater China funds in my portfolio at the moment, though I do hold Affin Hwang Absolute Return Fund II, Affin Hwang Select Asia (Ex Japan) Quantum Fund and CIMB-Principal Asia Pacific Dynamic Income Fund - MYR. The first one I guess is the closest to a Greater China Fund. Cimb dynamic income has VERY substantial Greater China.Added together, these add up to about 25% of my current portfolio, so I think I'm okay. I'm actually holding more than that in bond and cash funds because I've been expecting a downturn for a while now. If AH absolute return II afffected in this recent correction ? |

|

|

Dec 8 2017, 10:12 AM Dec 8 2017, 10:12 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(puchongite @ Dec 8 2017, 10:06 AM) Maybe still can consider topping up down but profit taking some time latter. Right now the discount is too good to refuse ? |

|

|

Dec 8 2017, 10:15 AM Dec 8 2017, 10:15 AM

|

Senior Member

1,177 posts Joined: Nov 2007 |

QUOTE(puchongite @ Dec 8 2017, 10:12 AM) Cimb dynamic income has VERY substantial Greater China. Yeah, AH Absolute Return II absolutely cratered over the last month. But I'm still up on the year however. I would buy into it if I could but it's closed.If AH absolute return II afffected in this recent correction ? |

|

|

Dec 8 2017, 10:16 AM Dec 8 2017, 10:16 AM

|

Senior Member

1,638 posts Joined: Aug 2005 From: Vault 13 |

QUOTE(wankongyew @ Dec 8 2017, 10:08 AM) I don't actually have any Greater China funds in my portfolio at the moment, though I do hold Affin Hwang Absolute Return Fund II, Affin Hwang Select Asia (Ex Japan) Quantum Fund and CIMB-Principal Asia Pacific Dynamic Income Fund - MYR. The first one I guess is the closest to a Greater China Fund. For me it this is an easy choise. Ponzi 2 for sure. Price correcting + promo service charge 08%. Double happiness.Added together, these add up to about 25% of my current portfolio, so I think I'm okay. I'm actually holding more than that in bond and cash funds because I've been expecting a downturn for a while now. |

|

|

|

|

|

Dec 8 2017, 10:18 AM Dec 8 2017, 10:18 AM

Show posts by this member only | IPv6 | Post

#10647

|

All Stars

33,697 posts Joined: May 2008 |

QUOTE(wankongyew @ Dec 8 2017, 10:15 AM) Yeah, AH Absolute Return II absolutely cratered over the last month. But I'm still up on the year however. I would buy into it if I could but it's closed. The fund manager 'promises' that he will actively manage the fund. I am curious if he is active enough to be able to cash out right on time.This post has been edited by puchongite: Dec 8 2017, 10:19 AM |

|

|

Dec 8 2017, 10:18 AM Dec 8 2017, 10:18 AM

|

Senior Member

696 posts Joined: Feb 2008 |

|

|

|

Dec 8 2017, 10:18 AM Dec 8 2017, 10:18 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(wankongyew @ Dec 8 2017, 10:08 AM) I don't actually have any Greater China funds in my portfolio at the moment, though I do hold Affin Hwang Absolute Return Fund II, Affin Hwang Select Asia (Ex Japan) Quantum Fund and CIMB-Principal Asia Pacific Dynamic Income Fund - MYR. The first one I guess is the closest to a Greater China Fund. Added together, these add up to about 25% of my current portfolio, so I think I'm okay. I'm actually holding more than that in bond and cash funds because I've been expecting a downturn for a while now. or have already disposed of how many % of this "war chest "of bond and cash fund in this 2 weeks correction to try to take the possible potential? |

|

|

Dec 8 2017, 10:20 AM Dec 8 2017, 10:20 AM

Show posts by this member only | IPv6 | Post

#10650

|

All Stars

33,697 posts Joined: May 2008 |

|

|

|

Dec 8 2017, 10:22 AM Dec 8 2017, 10:22 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 8 2017, 10:22 AM Dec 8 2017, 10:22 AM

|

Senior Member

1,177 posts Joined: Nov 2007 |

QUOTE(T231H @ Dec 8 2017, 10:18 AM) or have already disposed of how many % of this "war chest "of bond and cash fund in this 2 weeks correction to try to take the possible potential? |

|

|

Dec 8 2017, 10:23 AM Dec 8 2017, 10:23 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(wankongyew @ Dec 8 2017, 10:22 AM) Looking to deploy some of this now but unlike seemingly most of you, I'm comfortable with maintaining a large proportion in bond funds over the long term. FSM classifies my portfolio as a balanced one and I rather like the stability this brings. |

|

|

|

|

|

Dec 8 2017, 10:25 AM Dec 8 2017, 10:25 AM

|

Senior Member

1,962 posts Joined: Nov 2011 |

QUOTE(wankongyew @ Dec 8 2017, 10:22 AM) Looking to deploy some of this now but unlike seemingly most of you, I'm comfortable with maintaining a large proportion in bond funds over the long term. FSM classifies my portfolio as a balanced one and I rather like the stability this brings. mind to share what type of bond fund? |

|

|

Dec 8 2017, 10:27 AM Dec 8 2017, 10:27 AM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(puchongite @ Dec 8 2017, 10:20 AM) QUOTE(T231H @ Dec 8 2017, 10:22 AM) Thank you |

|

|

Dec 8 2017, 10:29 AM Dec 8 2017, 10:29 AM

|

Senior Member

1,177 posts Joined: Nov 2007 |

|

|

|

Dec 8 2017, 11:39 AM Dec 8 2017, 11:39 AM

|

All Stars

10,859 posts Joined: Jan 2003 From: Sarawak |

|

|

|

Dec 8 2017, 11:41 AM Dec 8 2017, 11:41 AM

|

Senior Member

696 posts Joined: Feb 2008 |

QUOTE(ben3003 @ Dec 8 2017, 11:39 AM) no idea bro, assume kenanga benchmark KLCI main index, but very tanky, drop 1% only.. no wonder it is the top fund for long term investment. You can get what funds Interpac invested in here...:Interpac semi-annual report You guys never read fund's report?? |

|

|

Dec 8 2017, 11:55 AM Dec 8 2017, 11:55 AM

|

Junior Member

225 posts Joined: Jul 2017 |

Since last week, i've switched 5% of total portfolio from Affin Hwang FI to Affin Hwang EQ, using credit at FSM. When bonus come in by mid Dec, i will topup Affin Hwang FI, to go back original FI/EQ ratio. Hopefully, market rebound soon. |

|

|

Dec 8 2017, 12:50 PM Dec 8 2017, 12:50 PM

|

Junior Member

225 posts Joined: Jul 2017 |

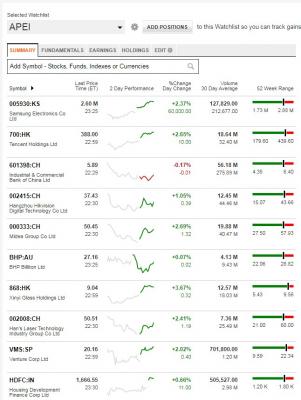

QUOTE(funnyface @ Dec 8 2017, 11:41 AM) You can get what funds Interpac invested in here...: Content in Annual/ Semi Annual Report is updated Every Year/ 6 months. By the time the report is published, at least 2 month had been passed. Interpac semi-annual report You guys never read fund's report?? That's y, a monthly updated factsheet is more useful to understand the holding, to forecast the up/down of NAV when doing purchase/ withdrawal. However, Inter-pac seems only update their factsheet every 3 months, not monthly. Moreover, they only list the top 3 holdings without stating the % of the holding. To who looking at index to guess the NAV of today. Actually, a better way is insert the top 10/ top 5 holding to watchlist of Bloomberg and cal the "weighted average" using excel, Like this : - Ponzi 2.

|

| Change to: |  0.0228sec 0.0228sec

0.48 0.48

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 02:09 AM |