Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

brandonkl

|

Nov 11 2025, 04:31 PM Nov 11 2025, 04:31 PM

|

|

QUOTE(cybpsych @ Nov 11 2025, 03:34 PM) previously also can, iirc, their TD-i Booster promo can be placed via online. now this "feature" is permanent? Yeah, I think is permanent with the campaign period. Current 3.66% - 12 mths is until 31 Dec 2025. I did try in the MBSB app. I selected 12 mths and it does show 3.66%. Not sure if previously was possible. Since I started placing FD with MBSB in October last year and renewals this year, it always has to be over the counter for the promotion FD rates. |

|

|

|

|

|

cybpsych

|

Nov 11 2025, 04:52 PM Nov 11 2025, 04:52 PM

|

|

QUOTE(brandonkl @ Nov 11 2025, 04:31 PM) Yeah, I think is permanent with the campaign period. Current 3.66% - 12 mths is until 31 Dec 2025. I did try in the MBSB app. I selected 12 mths and it does show 3.66%. Not sure if previously was possible. Since I started placing FD with MBSB in October last year and renewals this year, it always has to be over the counter for the promotion FD rates. it was mbsb web portal. they can selectively enable the promo for e-placement this one, web portal cannot work. must use mbsb app. iinm, even affinalwaysX (app) can now do e-placement for FD/TD. |

|

|

|

|

|

rahsk

|

Nov 11 2025, 06:20 PM Nov 11 2025, 06:20 PM

|

Getting Started

|

Ihsbc has new account promo of 4.28

If I close my current HSBC account,open new ones, can I get the offer or 4.28%?

|

|

|

|

|

|

paramdav

|

Nov 11 2025, 07:53 PM Nov 11 2025, 07:53 PM

|

Getting Started

|

QUOTE(rahsk @ Nov 11 2025, 06:20 PM) Ihsbc has new account promo of 4.28 If I close my current HSBC account,open new ones, can I get the offer or 4.28%? HSBC is a bit strict on this, In my case my account was closed abt 4 years ago they still had to check with HQ and alot of drama and finally agreed for the 4.28% FD you can check with them |

|

|

|

|

|

paramdav

|

Nov 11 2025, 07:58 PM Nov 11 2025, 07:58 PM

|

Getting Started

|

QUOTE(Chonloo13 @ Nov 10 2025, 07:19 PM) Anyone place HSBC premier offer with 6 months 4.28% FD rates? I checked with banker this is pure FD and have to place 300k, going to open account and place it next month, attractive offer , i just worry is there any hidden terms or this is related to investment products etc… I did mine last mth, its pure fd only catch is you should not have closed a saving / current HSCB acct - Not sure of the period mine was like 4 yrs ago i had closed a HSBC acct and they had to get approval from HQ |

|

|

|

|

|

paramdav

|

Nov 12 2025, 01:05 PM Nov 12 2025, 01:05 PM

|

Getting Started

|

hi Bros, where can I park abt 70k for 1 mth with daily interest returns, besides TnG, most banks the fd is 3 mths

|

|

|

|

|

|

wadafak

|

Nov 12 2025, 01:30 PM Nov 12 2025, 01:30 PM

|

New Member

|

QUOTE(paramdav @ Nov 12 2025, 01:05 PM) hi Bros, where can I park abt 70k for 1 mth with daily interest returns, besides TnG, most banks the fd is 3 mths kdi.. 1st 50k 4%, left over 3.5%. 1-2 working days for withdrawal. non pidm compliant |

|

|

|

|

|

drbone

|

Nov 12 2025, 02:19 PM Nov 12 2025, 02:19 PM

|

|

QUOTE(wadafak @ Nov 12 2025, 01:30 PM) kdi.. 1st 50k 4%, left over 3.5%. 1-2 working days for withdrawal. non pidm compliant If you have a Maybank account and withdrawal request is before 11am , you receive the funds by late evening on the same day. |

|

|

|

|

|

ClarenceT

|

Nov 12 2025, 05:10 PM Nov 12 2025, 05:10 PM

|

|

QUOTE(paramdav @ Nov 12 2025, 01:05 PM) hi Bros, where can I park abt 70k for 1 mth with daily interest returns, besides TnG, most banks the fd is 3 mths Saving Pocket/Jar/Pot GX Bank (2% p a.), Boost Bank (3% p.a.), Aeon Bank (3% p.a.) This post has been edited by ClarenceT: Nov 12 2025, 05:13 PM |

|

|

|

|

|

brandonkl

|

Nov 12 2025, 08:09 PM Nov 12 2025, 08:09 PM

|

|

QUOTE(ClarenceT @ Nov 12 2025, 05:10 PM) Saving Pocket/Jar/Pot GX Bank (2% p a.), Boost Bank (3% p.a.), Aeon Bank (3% p.a.) Boost Bank is 3.3% in the Unlimited Jar. |

|

|

|

|

|

fartbrat

|

Nov 13 2025, 09:26 AM Nov 13 2025, 09:26 AM

|

New Member

|

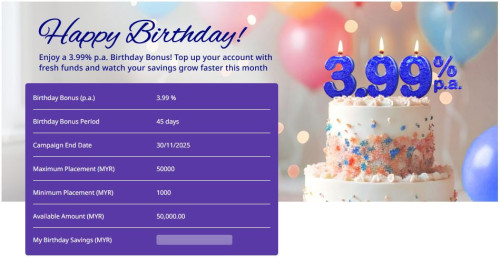

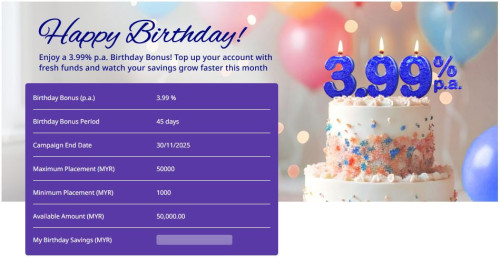

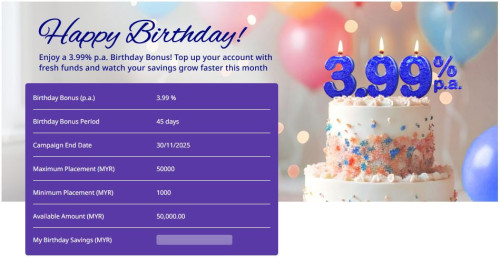

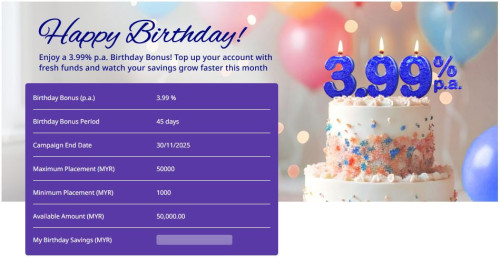

any senpai care to explain how this promo works? is it like an fd but only 45 days? |

|

|

|

|

|

shuin1986

|

Nov 13 2025, 10:36 AM Nov 13 2025, 10:36 AM

|

Getting Started

|

QUOTE(fartbrat @ Nov 13 2025, 09:26 AM)  any senpai care to explain how this promo works? is it like an fd but only 45 days? Yes, u transfer money into ur HLB account, click the birthday promo banner, lock ur money, done... but the interest is given within 1-3 months upon maturity, not immediate |

|

|

|

|

|

Afterburner1.0

|

Nov 13 2025, 11:00 AM Nov 13 2025, 11:00 AM

|

|

QUOTE(bbgoat @ Nov 6 2025, 11:34 AM) Withdraw from Muamalat matured FD. Was offered 3.85% but no mthly interest. Still withdraw out with BC. Their BC was rather fast compared with other banks taking some time to issue BC. Went to BR for 3.83% with 1k lock in. Found out the 1k is in investment account! Anyway already proceeded with the FD with mthly interest. Subsequently no need the 1k lock in. The investment acct takes sometime to create. Which BR branch did u go to for the mthly interest? also got FD in BM maturing soon.... |

|

|

|

|

|

fartbrat

|

Nov 13 2025, 06:45 PM Nov 13 2025, 06:45 PM

|

New Member

|

QUOTE(shuin1986 @ Nov 13 2025, 10:36 AM) Yes, u transfer money into ur HLB account, click the birthday promo banner, lock ur money, done... but the interest is given within 1-3 months upon maturity, not immediate I just called, it's actually not worth it lol. Better put 3-month fd. |

|

|

|

|

|

bbgoat

|

Nov 13 2025, 10:40 PM Nov 13 2025, 10:40 PM

|

|

QUOTE(Afterburner1.0 @ Nov 13 2025, 11:00 AM) Which BR branch did u go to for the mthly interest? also got FD in BM maturing soon.... Not branch specific, your choice of profit at maturity or mthly profit. |

|

|

|

|

|

fartbrat

|

Nov 14 2025, 11:42 AM Nov 14 2025, 11:42 AM

|

New Member

|

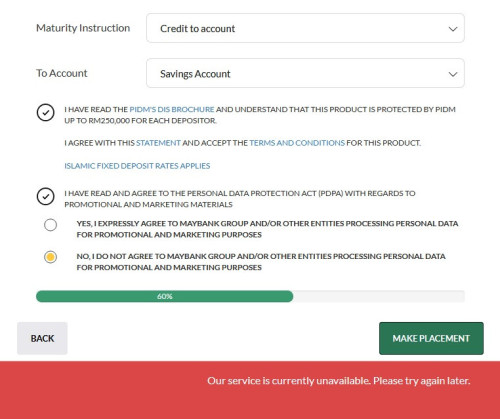

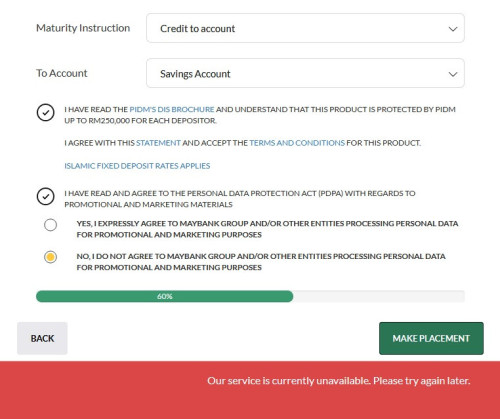

why does maybank suck so much? |

|

|

|

|

|

babysotong

|

Nov 14 2025, 11:46 AM Nov 14 2025, 11:46 AM

|

Getting Started

|

QUOTE(fartbrat @ Nov 13 2025, 06:45 PM) I just called, it's actually not worth it lol. Better put 3-month fd. Why not worth it? Interest rate at 3.99% pa, though the period of placement is 45 days. The 3.99% pa interest rate is higher than all FD and digital banks rate |

|

|

|

|

|

ericlaiys

|

Nov 14 2025, 12:06 PM Nov 14 2025, 12:06 PM

|

|

QUOTE(fartbrat @ Nov 13 2025, 09:26 AM)  any senpai care to explain how this promo works? is it like an fd but only 45 days? transfer new fresh $$$ into saving. then that $$$ can lock 45 days. u can do multiple times/date for that BD month. all will 45 days lock[follow date placement]. quite good deal |

|

|

|

|

|

fartbrat

|

Nov 14 2025, 12:21 PM Nov 14 2025, 12:21 PM

|

New Member

|

QUOTE(ericlaiys @ Nov 14 2025, 12:06 PM) transfer new fresh $$$ into saving. then that $$$ can lock 45 days. u can do multiple times/date for that BD month. all will 45 days lock[follow date placement]. quite good deal Ya i just aware that multiple placement is possible. I heard the interest will be given upon 3 months, so meaning the fund is available to use (like move to other fd) after 45 days but interest need to wait? |

|

|

|

|

|

kyleen

|

Nov 14 2025, 01:59 PM Nov 14 2025, 01:59 PM

|

Getting Started

|

QUOTE(babysotong @ Nov 14 2025, 11:46 AM) Why not worth it? Interest rate at 3.99% pa, though the period of placement is 45 days. The 3.99% pa interest rate is higher than all FD and digital banks rate 50k at 3.99 for 45 days only nets extra rm80 (compared to the usual 3.60%). On top of that have to wait 1-3 months for the interest. Waiting so long for interest is already a big no. Wait 45 days + 3 months for extra RM80 ?! Correct me if I'm wrong though. |

|

|

|

|

Nov 11 2025, 04:31 PM

Nov 11 2025, 04:31 PM

Quote

Quote

0.0266sec

0.0266sec

0.82

0.82

6 queries

6 queries

GZIP Disabled

GZIP Disabled