QUOTE(ProxMatoR @ Dec 2 2018, 11:03 PM)

the link doesn't work for me after the long maintenance yesterday Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

Fixed Deposit Rates In Malaysia V. No.15, Strictly for FD Discussion Only

|

|

Dec 3 2018, 07:33 AM Dec 3 2018, 07:33 AM

Return to original view | Post

#1

|

Junior Member

233 posts Joined: Mar 2007 |

|

|

|

|

|

|

Dec 22 2018, 10:23 AM Dec 22 2018, 10:23 AM

Return to original view | Post

#2

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(supi @ Dec 21 2018, 10:45 PM) https://www.cimbclicks.com.my/content/eFD2018.html Page cannot be reachedClick the link inside.. to make placement for special rates 4.5%. "Click here to make your placement." We are unable to reach to the page you have requested for at the moment. Please try again later. Lol.. can't even properly implement their eFD... |

|

|

Dec 22 2018, 10:40 AM Dec 22 2018, 10:40 AM

Return to original view | Post

#3

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(bbgoat @ Dec 22 2018, 10:28 AM) oh, for those who gets Page Not Found error when clicked "Here", there is a small window when it shows the login page, time and click your cursor on Username column before it changes to Page Not Found then poof u're done.Question: For eFD, how do i withdraw on maturity? I don't want it to renew into 3.x%, please help thanks |

|

|

Dec 22 2018, 11:19 AM Dec 22 2018, 11:19 AM

Return to original view | Post

#4

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(adbacc @ Dec 22 2018, 11:05 AM) CIMB eFD will auto-renew at board rates. I've only seen other banks like Maybank having the option of uplifting into SA upon maturity. From FD slip:3. All fixed deposits not withdrawn upon maturity shall be automatically renewed for the same tenor with the interest rate that is prevailing at the time of renewal. 4. Upliftment of eFD can only be done a day after maturity date to facilitate interest calculation and crediting. Interest will not be calculated for upliftment before the eFD maturity date. My eFD matured on 22nd June 2019 (Saturday), so I need to withdraw it on Sunday, right? |

|

|

Jul 2 2019, 04:58 PM Jul 2 2019, 04:58 PM

Return to original view | Post

#5

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(Wong Kit yew @ Jul 2 2019, 04:02 PM) RHB eFD Promotion Thanks, but i don't really get the t&c, does it mean max can deposit 30k only for this 3 months promo?3 months 3.5% Minimum 5k Until 30 September 2019 https://www.rhbgroup.com/400/index.html |

|

|

Jul 17 2021, 05:46 PM Jul 17 2021, 05:46 PM

Return to original view | Post

#6

|

Junior Member

233 posts Joined: Mar 2007 |

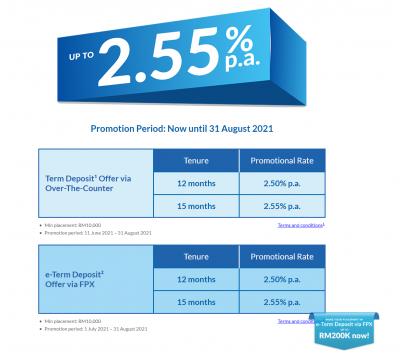

RHB promo:

https://www.rhbgroup.com/255/index.html?utm...tm_campaign=255

This post has been edited by shuin1986: Jul 17 2021, 06:35 PM |

|

|

|

|

|

Jul 17 2021, 06:35 PM Jul 17 2021, 06:35 PM

Return to original view | Post

#7

|

Junior Member

233 posts Joined: Mar 2007 |

|

|

|

Feb 19 2022, 01:17 PM Feb 19 2022, 01:17 PM

Return to original view | Post

#8

|

Junior Member

233 posts Joined: Mar 2007 |

seems like only Affin, HLB and RHB has gooding rates this pandemic

|

|

|

Nov 13 2025, 10:36 AM Nov 13 2025, 10:36 AM

Return to original view | IPv6 | Post

#9

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(fartbrat @ Nov 13 2025, 09:26 AM) Yes, u transfer money into ur HLB account, click the birthday promo banner, lock ur money, done... but the interest is given within 1-3 months upon maturity, not immediate fartbrat liked this post

|

|

|

Nov 14 2025, 04:02 PM Nov 14 2025, 04:02 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

233 posts Joined: Mar 2007 |

QUOTE(fartbrat @ Nov 14 2025, 12:21 PM) Ya i just aware that multiple placement is possible. I heard the interest will be given upon 3 months, so meaning the fund is available to use (like move to other fd) after 45 days but interest need to wait? Yes, after 45 days you are free to use the deposit, only the interest will be delayed for up to 3 months, means u can get it a month later, or 2 months later, or max 3 months. Unless the interest is too imporant or life threatening until u cannot wait, then i dont see any problem lol |

| Change to: |  0.0706sec 0.0706sec

0.87 0.87

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 12:00 PM |