Outline ·

[ Standard ] ·

Linear+

Maybank eGIA-i 3.45% p.a., Rojak of SA + FD + MMF

|

cempedaklife

|

Mar 1 2019, 06:37 AM Mar 1 2019, 06:37 AM

|

|

QUOTE(epie @ Jan 7 2019, 12:46 PM) Gia only good if u want to park the money less than 1month Other than that..better find other fd Do you park that amount less than 1 month all the time? Just to share. One thing I did previously is, I place 1k 2 months fd each month, by the end of several months,. I would have a few placement of fd of 1k to take out as it mature at different timing. That was before I know eGIA, but after that since my house loan is full flexi I just dump into house loan. |

|

|

|

|

|

epie

|

Mar 1 2019, 03:06 PM Mar 1 2019, 03:06 PM

|

|

QUOTE(cempedaklife @ Mar 1 2019, 06:37 AM) Do you park that amount less than 1 month all the time? Just to share. One thing I did previously is, I place 1k 2 months fd each month, by the end of several months,. I would have a few placement of fd of 1k to take out as it mature at different timing. That was before I know eGIA, but after that since my house loan is full flexi I just dump into house loan. Yea...i only park my money in gia if it is less than 1month If more than 1 month..i have a better place to park i.e asb/th etc |

|

|

|

|

|

cybpsych

|

Mar 6 2019, 08:27 PM Mar 6 2019, 08:27 PM

|

|

MBB MBB | T&CsThis promotion is applicable for Conventional Fixed Deposit (FD) or Islamic Fixed Deposit (IFD-i) or General Investment Account-i (GIA-i) with 6 months tenure. The campaign period is valid from 1 March 2019 to 15 March 2019 or upon reaching the campaign limit, whichever is earlier.  *Should there be an Overnight Policy Rate (OPR) change, the offered rates may be revised. *Should there be an Overnight Policy Rate (OPR) change, the offered rates may be revised. |

|

|

|

|

|

rivetindigo

|

Mar 23 2019, 04:44 PM Mar 23 2019, 04:44 PM

|

Getting Started

|

Hi, is it true that i still can earn interest eventho i park my money here into GIA for about a week? Need to park about rm30k for about a week.

|

|

|

|

|

|

epie

|

Mar 24 2019, 07:22 AM Mar 24 2019, 07:22 AM

|

|

QUOTE(rivetindigo @ Mar 23 2019, 04:44 PM) Hi, is it true that i still can earn interest eventho i park my money here into GIA for about a week? Need to park about rm30k for about a week. Yes..make sure you choose 1month tenure |

|

|

|

|

|

rivetindigo

|

Mar 24 2019, 03:06 PM Mar 24 2019, 03:06 PM

|

Getting Started

|

QUOTE(epie @ Mar 24 2019, 07:22 AM) Yes..make sure you choose 1month tenure Oraite thank u |

|

|

|

|

|

ktek

|

May 17 2019, 02:12 PM May 17 2019, 02:12 PM

|

|

many rate affected, even normal fd decreased. not sure gia still can hold 2.5% rate monthly fall to 2.3% but 2month onwards 3.1% still good. 6month onwards 3.2% where 12month 3.4% https://www.maybank2u.com.my/maybank2u/mala..._account_i.page? This post has been edited by ktek: May 17 2019, 02:20 PM |

|

|

|

|

|

fairylord

|

May 17 2019, 08:33 PM May 17 2019, 08:33 PM

|

|

QUOTE(ktek @ May 17 2019, 02:12 PM) many rate affected, even normal fd decreased. not sure gia still can hold 2.5% rate monthly fall to 2.3% but 2month onwards 3.1% still good. 6month onwards 3.2% where 12month 3.4% https://www.maybank2u.com.my/maybank2u/mala..._account_i.page? Haiz.. As expected but still have to sigh.. |

|

|

|

|

|

AskarPerang

|

Jun 23 2019, 12:46 PM Jun 23 2019, 12:46 PM

|

|

Just to check whether this GIA award treatpoints?

Recently received additional TP into my account as the Banking Treatpoints. No idea come from where. Only possible is from e-GIA placement and payout?

|

|

|

|

|

|

ktek

|

Jul 24 2019, 10:21 AM Jul 24 2019, 10:21 AM

|

|

gia one month further reduce to 2.25% pa

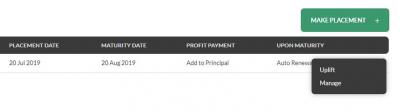

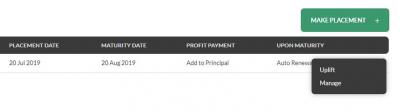

then today he dont allow me uplift withdraw from old m2u & new website

|

|

|

|

|

|

cybpsych

|

Jul 24 2019, 11:26 AM Jul 24 2019, 11:26 AM

|

|

QUOTE(ktek @ Jul 24 2019, 10:21 AM) gia one month further reduce to 2.25% pa then today he dont allow me uplift withdraw from old m2u & new website 2.25% already some time dy. no issue to uplift. you cannot uplift on same day you make the placement. |

|

|

|

|

|

ktek

|

Jul 24 2019, 01:12 PM Jul 24 2019, 01:12 PM

|

|

QUOTE(cybpsych @ Jul 24 2019, 11:26 AM) 2.25% already some time dy. no issue to uplift. you cannot uplift on same day you make the placement. i was entry early this month. kira few weeks ady. he redirect me to new site, ask me to wait 30 days  no uplift allowed |

|

|

|

|

|

cybpsych

|

Jul 24 2019, 02:23 PM Jul 24 2019, 02:23 PM

|

|

QUOTE(ktek @ Jul 24 2019, 01:12 PM) i was entry early this month. kira few weeks ady. he redirect me to new site, ask me to wait 30 days  no uplift allowed try again later and see. |

|

|

|

|

|

akping_1

|

Jul 24 2019, 02:28 PM Jul 24 2019, 02:28 PM

|

|

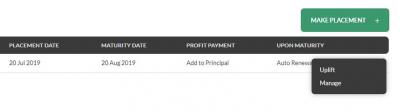

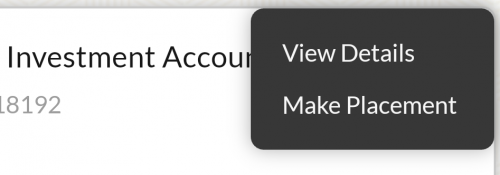

QUOTE(ktek @ Jul 24 2019, 01:12 PM) i was entry early this month. kira few weeks ady. he redirect me to new site, ask me to wait 30 days  no uplift allowed u click the view detail, then it will direct you to another page where u can uplift from there  This post has been edited by akping_1: Jul 24 2019, 02:30 PM

This post has been edited by akping_1: Jul 24 2019, 02:30 PM |

|

|

|

|

|

ktek

|

Jul 24 2019, 02:39 PM Jul 24 2019, 02:39 PM

|

|

QUOTE(akping_1 @ Jul 24 2019, 02:28 PM) u click the view detail, then it will direct you to another page where u can uplift from there

ok i was scared. let me try now thanks yo |

|

|

|

|

|

kart

|

Jul 27 2019, 10:52 PM Jul 27 2019, 10:52 PM

|

|

I cannot uplift eGIA-i on the old Maybank2u website. It is because the old Maybank2u website provides only the link to be redirected to the new Maybank2u website, to uplift eGIA-i.

Does anyone else face the same issue as me?

|

|

|

|

|

|

heavensea

|

Jul 30 2019, 06:38 AM Jul 30 2019, 06:38 AM

|

|

QUOTE(kart @ Jul 27 2019, 10:52 PM) I cannot uplift eGIA-i on the old Maybank2u website. It is because the old Maybank2u website provides only the link to be redirected to the new Maybank2u website, to uplift eGIA-i. Does anyone else face the same issue as me? Can uplift on new website. Do according as above instructions. |

|

|

|

|

|

kart

|

Aug 3 2019, 10:49 PM Aug 3 2019, 10:49 PM

|

|

heavensea

Yeah, it seems that at present, uplifting e-GIA in the new website is the only way.

As it stands, Maybank is slowly reducing the features of the old Maybank2u website, to encourage the migration to the new Maybank2u website.

|

|

|

|

|

|

kit2

|

Aug 13 2019, 09:27 PM Aug 13 2019, 09:27 PM

|

|

-deleted-

found the answer..

This post has been edited by kit2: Aug 13 2019, 09:28 PM

|

|

|

|

|

|

raulxiver

|

Aug 16 2019, 04:42 PM Aug 16 2019, 04:42 PM

|

|

hi all, im new to GIA and want to clarify something, called their cs but they seem dont know anything why cant i view the GIA fd in new m2u? only can view in classic web i will only know the psr upon maturity? any past record of psr this yr i can refer ? what does it mean by the sharing ratio? let say consumer:bank ratio is 60:40 / psr 3.2% means i will only get 60% of the 3.2% psr? kindly enlighten  |

|

|

|

|

Mar 1 2019, 06:37 AM

Mar 1 2019, 06:37 AM

Quote

Quote

0.0566sec

0.0566sec

0.96

0.96

6 queries

6 queries

GZIP Disabled

GZIP Disabled