Anyone paying prudential insurance and may i know what's the MCC code ?

wanna called current auto billed bank but kept in loop waiting CS =.=

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

Credit Cards Standard Chartered Bank Credit Cards V4, Everything About SC Credit Cards

|

|

Jun 10 2019, 09:30 AM Jun 10 2019, 09:30 AM

|

Senior Member

6,643 posts Joined: Aug 2008 From: Malaysia |

Anyone paying prudential insurance and may i know what's the MCC code ?

wanna called current auto billed bank but kept in loop waiting CS =.= |

|

|

|

|

|

Jun 10 2019, 09:43 AM Jun 10 2019, 09:43 AM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(fruitie @ Jun 9 2019, 04:50 PM) No la. SCB used to easily giving out AF waiver to its users, however the customers base has grown rapidly in the past one year hence it may not be that easy anymore. QUOTE(TongCN @ Jun 9 2019, 07:25 PM) Try call cs after charged AF, they have been kind enough to waive my Worldmile mastercard for 6 years+ Hi, maybe your case is very similar to fruitie as per her statement below? By the way, may I know if you pay the full outstanding amount, statement amount or pay some random amount every month?I talked to SC sales team before, and they told me that my record is too clean in SC, so usually I will not receive any preferential service from the bank. I don't know if this would affect the AF waiver decision. QUOTE(darkterror15 @ Jun 10 2019, 09:18 AM) and i just got my card last 2 weeks and now come this, and i already want to cancel it. waiting for luggage and cashback rm 100 before cancel it You just applied and already paid the SST, so why don't you just use the card and terminate it closer to your anniversary? Then it won't be wasted.I don't know if what people telling me are real, that it will affect your credibility if you cancel a credit card too early. They said usually it would be better to terminate only after 6 months after your approval. Whatever it is, it does not hurt to use the card for another 6 months because you would've already paid whatever you were supposed to pay even if you terminate it early. Please correct me if I'm wrong. As for the luggage, it took them almost 3 months to deliver it to me (I believe it is due to the campaign period). They did mention that your spending will be monitored for the first 60 days, thus they will only verify your eligibility after the 60 days period. |

|

|

Jun 10 2019, 09:56 AM Jun 10 2019, 09:56 AM

|

Senior Member

6,643 posts Joined: Aug 2008 From: Malaysia |

QUOTE(Jordy @ Jun 10 2019, 09:43 AM) Hi, maybe your case is very similar to fruitie as per her statement below? By the way, may I know if you pay the full outstanding amount, statement amount or pay some random amount every month? I always called them after i saw AF charged on my statement (20 days before due)I talked to SC sales team before, and they told me that my record is too clean in SC, so usually I will not receive any preferential service from the bank. I don't know if this would affect the AF waiver decision. You just applied and already paid the SST, so why don't you just use the card and terminate it closer to your anniversary? Then it won't be wasted. I don't know if what people telling me are real, that it will affect your credibility if you cancel a credit card too early. They said usually it would be better to terminate only after 6 months after your approval. Whatever it is, it does not hurt to use the card for another 6 months because you would've already paid whatever you were supposed to pay even if you terminate it early. Please correct me if I'm wrong. As for the luggage, it took them almost 3 months to deliver it to me (I believe it is due to the campaign period). They did mention that your spending will be monitored for the first 60 days, thus they will only verify your eligibility after the 60 days period. They didn't question me anything and said I will see the amount credited back by next day. So, by the time i do my statement payment, i just paid outstanding without AF. |

|

|

Jun 10 2019, 09:58 AM Jun 10 2019, 09:58 AM

|

Junior Member

359 posts Joined: Jan 2015 |

QUOTE(Jordy @ Jun 10 2019, 09:43 AM) You just applied and already paid the SST, so why don't you just use the card and terminate it closer to your anniversary? Then it won't be wasted. I don't know if what people telling me are real, that it will affect your credibility if you cancel a credit card too early. They said usually it would be better to terminate only after 6 months after your approval. Whatever it is, it does not hurt to use the card for another 6 months because you would've already paid whatever you were supposed to pay even if you terminate it early. Please correct me if I'm wrong. As for the luggage, it took them almost 3 months to deliver it to me (I believe it is due to the campaign period). They did mention that your spending will be monitored for the first 60 days, thus they will only verify your eligibility after the 60 days period. |

|

|

Jun 10 2019, 10:20 AM Jun 10 2019, 10:20 AM

|

Senior Member

3,902 posts Joined: Jul 2007 |

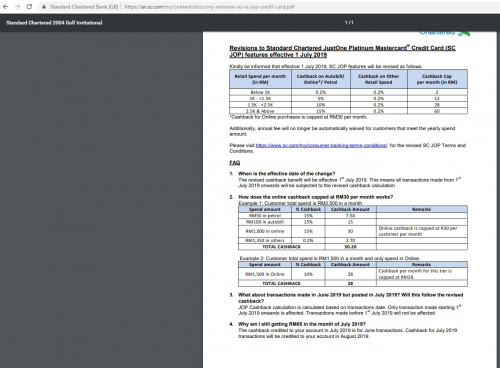

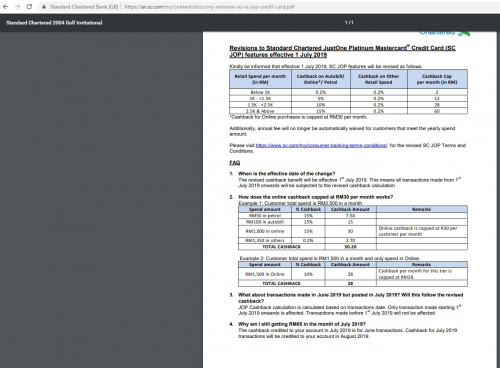

Revisions to Standard Chartered JustOne Platinum Mastercard® Credit Card (SC

JOP) features effective 1 July 2019 https://av.sc.com/my/content/docs/my-revisi...credit-card.pdf  |

|

|

Jun 10 2019, 10:24 AM Jun 10 2019, 10:24 AM

|

|

Staff

72,806 posts Joined: Sep 2005 From: KUL |

QUOTE(lamode @ Jun 10 2019, 10:20 AM) Revisions to Standard Chartered JustOne Platinum Mastercard® Credit Card (SC JOP) features effective 1 July 2019 https://av.sc.com/my/content/docs/my-revisi...credit-card.pdf  Anyway, it is still a worth keeping card. I will assess based on my needs as my anniversary is also in July but I think last year AF was only charged in August. |

|

|

|

|

|

Jun 10 2019, 10:32 AM Jun 10 2019, 10:32 AM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(TongCN @ Jun 10 2019, 09:56 AM) I always called them after i saw AF charged on my statement (20 days before due) Thanks for your confirmation bro They didn't question me anything and said I will see the amount credited back by next day. So, by the time i do my statement payment, i just paid outstanding without AF. But then yeah, I am not a risk taker in this situation. RM250 is a bit too much for me to gamble on when my current cumulative cashback is only RM800+. So it would be better for me to cash out that amount to offset whatever balance I am going to use for this month. QUOTE(darkterror15 @ Jun 10 2019, 09:58 AM) actually i will just hold but not use because the restriction and rate is very bad actually. I did that for few cards already, HSBC, Citibank, i hold them because that time they got promo for lazada/11street rm 500 voucher Yeah, I myself have been applying a few credit cards for the gifts too, but I will only apply those cards that I would be using for the next few months.For JOP, usually SC will require you to use RM1k in 60 days, so yeah might as well just use another RM1.5k to be eligible for the full RM85 cashback while it is still valid, so in total you will get a luggage bag and RM100 + RM85 cash back |

|

|

Jun 10 2019, 10:37 AM Jun 10 2019, 10:37 AM

|

Junior Member

576 posts Joined: Oct 2011 |

QUOTE(beebee1314 @ Jun 8 2019, 03:29 PM) do you know what's FPX? bigpay don't go through internet banking. it uses other payment gateways. so how can be FPX? I dont really care BigPay goes through what type of payment, ultimately I just want to know whether I get the CB or not. There is a discussion on this and there are a lot of people saying that BP falls under FPX. Whether they are right or wrong, I also dont know. So the best thing is just to try it out next month. |

|

|

Jun 10 2019, 10:38 AM Jun 10 2019, 10:38 AM

|

|

Staff

72,806 posts Joined: Sep 2005 From: KUL |

QUOTE(x-frame @ Jun 10 2019, 10:37 AM) I dont really care BigPay goes through what type of payment, ultimately I just want to know whether I get the CB or not. There is a discussion on this and there are a lot of people saying that BP falls under FPX. Whether they are right or wrong, I also dont know. So the best thing is just to try it out next month. It is not FPX since day 1, I'm not sure where you read it. |

|

|

Jun 10 2019, 10:38 AM Jun 10 2019, 10:38 AM

|

|||||||||||||||

Senior Member

3,902 posts Joined: Jul 2007 |

QUOTE(fruitie @ Jun 10 2019, 10:24 AM) Anyway, it is still a worth keeping card. I will assess based on my needs as my anniversary is also in July but I think last year AF was only charged in August.

under new structure, if just use for online (topup), then just spend RM1530 to get max of RM30 CB... This post has been edited by lamode: Jun 10 2019, 10:42 AM |

|||||||||||||||

|

|

Jun 10 2019, 10:41 AM Jun 10 2019, 10:41 AM

|

|

Staff

72,806 posts Joined: Sep 2005 From: KUL |

QUOTE(cybpsych @ Jun 7 2019, 02:05 PM) Revisions to Standard Chartered JustOne Platinum Mastercard® Credit Card (SC JOP) features effective 1 July 2019 [ SCB | Updated T&Cs ] Official Announcement & FAQ  QUOTE(lamode @ Jun 10 2019, 10:38 AM) ya i thought no details was given until today? Err.. You sure? Amount CB % CB Amount 999 0.2 1.998 499 5 24.95 32 10 3.2 1530 30.148 under new structure, if just use for online (topup), then just spend RM1530 to get max of RM30 CB... Just use it for auto bill and online, you still can get RM 60. |

|

|

Jun 10 2019, 10:46 AM Jun 10 2019, 10:46 AM

|

Senior Member

3,902 posts Joined: Jul 2007 |

|

|

|

Jun 10 2019, 11:12 AM Jun 10 2019, 11:12 AM

|

Junior Member

262 posts Joined: Aug 2018 |

May I know statement out only will receive cashback or got a specified date for it?

|

|

|

|

|

|

Jun 10 2019, 11:14 AM Jun 10 2019, 11:14 AM

|

All Stars

65,286 posts Joined: Jan 2003 |

QUOTE(fruitie @ Jun 10 2019, 01:44 AM) For SCB CB, you will need to redeem it from Rewards 360. It will not appear automatically and will be ready for redemption latest by end of following month. However, it is usually ready by mid of following month and fellow forummers will let us know if ready to be redeemed. So look out for this thread when it's ready to redeem for May cash back. QUOTE(zinze36 @ Jun 10 2019, 11:12 AM) |

|

|

Jun 10 2019, 11:14 AM Jun 10 2019, 11:14 AM

|

|

Staff

72,806 posts Joined: Sep 2005 From: KUL |

QUOTE(fruitie @ Jun 10 2019, 01:44 AM) For SCB CB, you will need to redeem it from Rewards 360. It will not appear automatically and will be ready for redemption latest by end of following month. However, it is usually ready by mid of following month and fellow forummers will let us know if ready to be redeemed. So look out for this thread when it's ready to redeem for May cash back. QUOTE(zinze36 @ Jun 10 2019, 11:12 AM) As above. |

|

|

Jun 10 2019, 11:15 AM Jun 10 2019, 11:15 AM

|

|||||||||||||||

Senior Member

2,965 posts Joined: Jul 2014 |

QUOTE(lamode @ Jun 10 2019, 10:38 AM) ya i thought no details was given until today? spend just RM1530 wont get u RM30 cb ehh.. please read back sifu2 posts previously or SC t&c for new cb structure.

|

|||||||||||||||

|

|

Jun 10 2019, 11:24 AM Jun 10 2019, 11:24 AM

|

Senior Member

3,902 posts Joined: Jul 2007 |

|

|

|

Jun 10 2019, 11:56 AM Jun 10 2019, 11:56 AM

|

Senior Member

1,683 posts Joined: Sep 2018 |

QUOTE(x-frame @ Jun 10 2019, 10:37 AM) I dont really care BigPay goes through what type of payment, ultimately I just want to know whether I get the CB or not. There is a discussion on this and there are a lot of people saying that BP falls under FPX. Whether they are right or wrong, I also dont know. So the best thing is just to try it out next month. Hahaha. This is crucial |

|

|

Jun 10 2019, 12:11 PM Jun 10 2019, 12:11 PM

|

Senior Member

6,643 posts Joined: Aug 2008 From: Malaysia |

QUOTE(avinlim @ Jun 10 2019, 11:15 AM) spend just RM1530 wont get u RM30 cb ehh.. please read back sifu2 posts previously or SC t&c for new cb structure. QUOTE(lamode @ Jun 10 2019, 11:24 AM) Actually it's quite true from the pic ,hmmon tier 3 (1.5 <> 2.5) you get 10% which can get max RM28 ? So confuse as it's monday blue XD |

|

|

Jun 10 2019, 12:41 PM Jun 10 2019, 12:41 PM

|

Junior Member

273 posts Joined: Jul 2014 |

Saw this from ringgitplus for JOP

So, no auto waive, but still possible to waive if spend above 20k. // On top of that, StanChart also stated that the card’s annual fee is no longer automatically waived when cardholders spend above RM20,000 per year. This means cardholders will need to contact the bank to waive the RM250 annual fee if they have spent more than RM20,000 with the card. // https://ringgitplus.com/en/blog/Cash-Back-C...tm_medium=email |

| Change to: |  0.0230sec 0.0230sec

0.43 0.43

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 6th December 2025 - 12:30 PM |