QUOTE(Mavik @ Jan 26 2021, 10:08 PM)

Actually I just realised that I have a SG debit card, how do I enable Apple Pay on my iPhone? Do I need to set the region to Singapore in order for it to appear?

YesAPPLE PAY IN MALAYSIA, Official arrives in Malaysia! Aug 2022!

|

|

Jan 26 2021, 10:29 PM Jan 26 2021, 10:29 PM

|

Junior Member

62 posts Joined: Oct 2013 |

|

|

|

|

|

|

Jan 27 2021, 08:53 AM Jan 27 2021, 08:53 AM

Show posts by this member only | IPv6 | Post

#402

|

Junior Member

171 posts Joined: Jan 2013 |

used apple pay in malaysia for the first time. no one bats an eye..

but i do feel like a global citizen now. i feel like i finally catch up to the present instead of living in the past. everyone still living in stone age using qr code This post has been edited by taga: Jan 27 2021, 08:53 AM |

|

|

Jan 27 2021, 10:38 AM Jan 27 2021, 10:38 AM

Show posts by this member only | IPv6 | Post

#403

|

Junior Member

672 posts Joined: Jun 2018 |

QUOTE(taga @ Jan 27 2021, 08:53 AM) used apple pay in malaysia for the first time. no one bats an eye.. I afraid you could be misunderstood some logic.but i do feel like a global citizen now. i feel like i finally catch up to the present instead of living in the past. everyone still living in stone age using qr code We are using "stone-age" QR, because this is Apple's fault. This is the fault of Apple for not open its NFC feature to 3rd party. One of the reasons that QR is widely used, because of the huge amount of iPhone users and they have "No NFC feature" on their phone. Meanwhile, the bloody Apple is charging bank a handling fees for Apple Pay, this might be one of reasons we cant use Apple Pay in Malaysia. It's Apple fault, not us. We are paying the same price with Singapore iPhone users, but our iPhone have no Apple Pay, we should blame Apple, not the current QR situation due to selfish Apple. (P/s: I'm not an Apple hater, I just telling the truth) This post has been edited by lowkelvin: Jan 27 2021, 10:44 AM |

|

|

Jan 27 2021, 11:51 AM Jan 27 2021, 11:51 AM

Show posts by this member only | IPv6 | Post

#404

|

Senior Member

1,841 posts Joined: Feb 2018 |

QUOTE(lowkelvin @ Jan 27 2021, 10:38 AM) I afraid you could be misunderstood some logic. Another reason why Apple Pay is not being introduced here is because, with QR payment, all the merchant need to do is apply, and print your own QR and then stick on wherever you want. Simple. No need for extra equipment but for Apple Pay, merchants are required to get the terminal and this costs money as there's a "fee" for renting the terminal from banks. We are using "stone-age" QR, because this is Apple's fault. This is the fault of Apple for not open its NFC feature to 3rd party. One of the reasons that QR is widely used, because of the huge amount of iPhone users and they have "No NFC feature" on their phone. Meanwhile, the bloody Apple is charging bank a handling fees for Apple Pay, this might be one of reasons we cant use Apple Pay in Malaysia. It's Apple fault, not us. We are paying the same price with Singapore iPhone users, but our iPhone have no Apple Pay, we should blame Apple, not the current QR situation due to selfish Apple. (P/s: I'm not an Apple hater, I just telling the truth) I do hate QR Payments here and rather go with something like Apple Pay or Samsung Pay or so on. Why? Look at the steps to use QR payments. QR 1) Reload from CC to eWallet (most tedious part as it can trigger OTP on some eWallets) 2) Open eWallet and choose camera or QR option 3) Scan 4) Sometimes, can still trigger in app PIN to verify payment Apple/Samsung Pay 1) Tie your CC to the app (one time deal) 2) Place your phone near the terminal and let it trigger the Apple/Samsung Pay app. Do a biometric scan and that's it. See, the convienience for us is so much but Banks and Merchants don't want it. Plus, with QR, sometimes u can see SOME people wait until the cashier announce the price to the buyer, only the buyer starts to take out their phone, unlock, find their eWallet app, loading takes eternity on older phones, then dunno which option to choose, then only scan. Why can't these people get ready on the spot? Like right before reaching the counter, take out your phone, open the app and then lock your phone. allvin, SYAMiLLiON, and 1 other liked this post

|

|

|

Jan 27 2021, 01:39 PM Jan 27 2021, 01:39 PM

Show posts by this member only | IPv6 | Post

#405

|

Junior Member

171 posts Joined: Jan 2013 |

QUOTE(lowkelvin @ Jan 27 2021, 10:38 AM) I afraid you could be misunderstood some logic. It is not Apple's fault. I blame Malaysian Banks, even to certain extend the government.We are using "stone-age" QR, because this is Apple's fault. This is the fault of Apple for not open its NFC feature to 3rd party. One of the reasons that QR is widely used, because of the huge amount of iPhone users and they have "No NFC feature" on their phone. Meanwhile, the bloody Apple is charging bank a handling fees for Apple Pay, this might be one of reasons we cant use Apple Pay in Malaysia. It's Apple fault, not us. We are paying the same price with Singapore iPhone users, but our iPhone have no Apple Pay, we should blame Apple, not the current QR situation due to selfish Apple. (P/s: I'm not an Apple hater, I just telling the truth) Do you know even Kazakhstan has Apple Pay? We are more backward than Kazakhstan. If Kazakhstan bank can pay the "handling fees", why Malaysia cannot? It's a bullshit excuse from the banks and gov. The truth is banks and gov have their own agenda to push. Every industry player want to push their shit-tier system like grabpay, qrpay, tng ewallet, duitnow. Don't get me wrong, non-nfc payment has their own place in the payment space. But it is a shrinking pie. NFC payment is in many ways, more superior to QR payment. The sooner the banks realise this, the more likely Malaysia will move one step towards a developed nation. |

|

|

Jan 27 2021, 01:45 PM Jan 27 2021, 01:45 PM

Show posts by this member only | IPv6 | Post

#406

|

Junior Member

171 posts Joined: Jan 2013 |

QUOTE(PoisonSoul @ Jan 27 2021, 11:51 AM) Another reason why Apple Pay is not being introduced here is because, with QR payment, all the merchant need to do is apply, and print your own QR and then stick on wherever you want. Simple. No need for extra equipment but for Apple Pay, merchants are required to get the terminal and this costs money as there's a "fee" for renting the terminal from banks. The QR payment can be allow for those dirt poor merchant (e.g. roadside hawker) that barely can afford to print their merchant QR code cardboard.I do hate QR Payments here and rather go with something like Apple Pay or Samsung Pay or so on. Why? Look at the steps to use QR payments. QR 1) Reload from CC to eWallet (most tedious part as it can trigger OTP on some eWallets) 2) Open eWallet and choose camera or QR option 3) Scan 4) Sometimes, can still trigger in app PIN to verify payment Apple/Samsung Pay 1) Tie your CC to the app (one time deal) 2) Place your phone near the terminal and let it trigger the Apple/Samsung Pay app. Do a biometric scan and that's it. See, the convienience for us is so much but Banks and Merchants don't want it. Plus, with QR, sometimes u can see SOME people wait until the cashier announce the price to the buyer, only the buyer starts to take out their phone, unlock, find their eWallet app, loading takes eternity on older phones, then dunno which option to choose, then only scan. Why can't these people get ready on the spot? Like right before reaching the counter, take out your phone, open the app and then lock your phone. The rest of the businesses simply have no excuse not to get the terminal. Even some vending machine here have visa wave terminal integrated. Nobody likes to unlock their phone, wait.., open app, wait.., type in the amount, click click, type promo code, click, type pin number, then only pay! Like that I rather pay by card la, even cash is better. urgh... PoisonSoul liked this post

|

|

|

|

|

|

Jan 27 2021, 02:49 PM Jan 27 2021, 02:49 PM

|

Senior Member

1,841 posts Joined: Feb 2018 |

QUOTE(taga @ Jan 27 2021, 01:45 PM) The QR payment can be allow for those dirt poor merchant (e.g. roadside hawker) that barely can afford to print their merchant QR code cardboard. Exactly, sometimes I even give up on using eWallet as it requires data/wifi which at some places, has a weak network signal and that's it, we can't use it anymore but with A/S Pay or directly CC, are all capable of offline payments.The rest of the businesses simply have no excuse not to get the terminal. Even some vending machine here have visa wave terminal integrated. Nobody likes to unlock their phone, wait.., open app, wait.., type in the amount, click click, type promo code, click, type pin number, then only pay! Like that I rather pay by card la, even cash is better. urgh... Special words given from me to those ppl infront of me standing there, staring @ the cashier and not at least taking out their CC or launching their eWallet ready, and only when the cashier says the final total, only they start searching for their phone/cc, launching app, yada yada. I do wonder if the people behind me gratefully thank me in their hearts that I have prepared all these before hand, upon cashier telling me the final amount. taga liked this post

|

|

|

Jan 27 2021, 05:23 PM Jan 27 2021, 05:23 PM

|

All Stars

14,901 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

Do you guys know what's the signup cost to bear NFC Pay? You need the terminal + monthly fees + cc fees.

QR Pay? Just sign up through app, QR code print out cardboard and relatively low 1% fee. |

|

|

Jan 27 2021, 06:43 PM Jan 27 2021, 06:43 PM

|

Junior Member

24 posts Joined: Apr 2019 |

QUOTE(taga @ Jan 27 2021, 01:45 PM) The QR payment can be allow for those dirt poor merchant (e.g. roadside hawker) that barely can afford to print their merchant QR code cardboard. You using iPhone 4 is it? The long waiting part is probably due to the poor app optimization or your old phone. Wechat pay is quick. The rest of the businesses simply have no excuse not to get the terminal. Even some vending machine here have visa wave terminal integrated. Nobody likes to unlock their phone, wait.., open app, wait.., type in the amount, click click, type promo code, click, type pin number, then only pay! Like that I rather pay by card la, even cash is better. urgh... Either the merchant or the payer has to key in the amount so this part is unavoidable and all have to wait. Either case are so much better than using cash, which is considered trouble to keep and use by today’s standard |

|

|

Jan 27 2021, 07:01 PM Jan 27 2021, 07:01 PM

Show posts by this member only | IPv6 | Post

#410

|

Junior Member

171 posts Joined: Jan 2013 |

QUOTE(throwaway account @ Jan 27 2021, 06:43 PM) You using iPhone 4 is it? The long waiting part is probably due to the poor app optimization or your old phone. Wechat pay is quick. Im using 12 pro max, so most likely is poor app quality issue. Big company like grab also suffer from poor app quality. Either the merchant or the payer has to key in the amount so this part is unavoidable and all have to wait. Either case are so much better than using cash, which is considered trouble to keep and use by today’s standard Regardless, it does not take away the fact the plenty users are using few years old iphone. Another point to consider is that I do not have confidence with most of qr payment providers. Particularly wechat. No offence, but I would rather let the world biggest company (and privacy focused) than some CCP linked company or our local fossil banks cartel that fails to innovate to handle my wallet. Imagine a future where i wear a shirt, pants and an apple watch, and i can lock my house door, pay for mrt, unlock my car, buy coffee, all with my apple watch. Except the future is already here, just not in malaysia. This post has been edited by taga: Jan 27 2021, 07:01 PM PoisonSoul liked this post

|

|

|

Jan 29 2021, 08:03 PM Jan 29 2021, 08:03 PM

Show posts by this member only | IPv6 | Post

#411

|

Junior Member

45 posts Joined: Nov 2014 |

QUOTE(taga @ Jan 27 2021, 08:53 AM) used apple pay in malaysia for the first time. no one bats an eye.. Same. Especially at mamak. When using Apple Pay through Apple Watch, they’ll be like “wah itu macam ah? Sangat senang ar” and other customer wearing Apple Watch shown a curious face 🤨.but i do feel like a global citizen now. i feel like i finally catch up to the present instead of living in the past. everyone still living in stone age using qr code This post has been edited by syahmonteiro: Jan 29 2021, 08:06 PM PoisonSoul liked this post

|

|

|

Jan 30 2021, 09:58 AM Jan 30 2021, 09:58 AM

|

|

Elite

7,826 posts Joined: Jan 2003 |

QUOTE(taga @ Jan 27 2021, 01:45 PM) The QR payment can be allow for those dirt poor merchant (e.g. roadside hawker) that barely can afford to print their merchant QR code cardboard. Those merchants who really want to optimise operations and also look at the big picture will go for the credit card terminals which today banks offer and these terminals can even accept ewallet payments as well. The rest of the businesses simply have no excuse not to get the terminal. Even some vending machine here have visa wave terminal integrated. Nobody likes to unlock their phone, wait.., open app, wait.., type in the amount, click click, type promo code, click, type pin number, then only pay! Like that I rather pay by card la, even cash is better. urgh... And then there are merchants who don't want their exact revenue to be recorded in some form so that they can declare less for less tax. Hence why you see the tax man standing outside popular restaurants counting the number of plates sold |

|

|

Jan 30 2021, 10:01 AM Jan 30 2021, 10:01 AM

|

|

Elite

7,826 posts Joined: Jan 2003 |

QUOTE(Icehart @ Jan 27 2021, 05:23 PM) Do you guys know what's the signup cost to bear NFC Pay? You need the terminal + monthly fees + cc fees. Depending on your provider the rental of the terminal can be free (based on your transaction volume - both in $ amount and frequency)QR Pay? Just sign up through app, QR code print out cardboard and relatively low 1% fee. The CC fees or the terminology used is called MDR rate (Merchant Discount Rate). Debit card <1% Credit card =>1%-1.5% (Master/Visa is lower compared to AMEX, not sure how much the UnionPay network charges) eWallet Grab = 1% Boost, TnG = ??? |

|

|

|

|

|

Jan 30 2021, 10:36 AM Jan 30 2021, 10:36 AM

|

Junior Member

153 posts Joined: Mar 2016 |

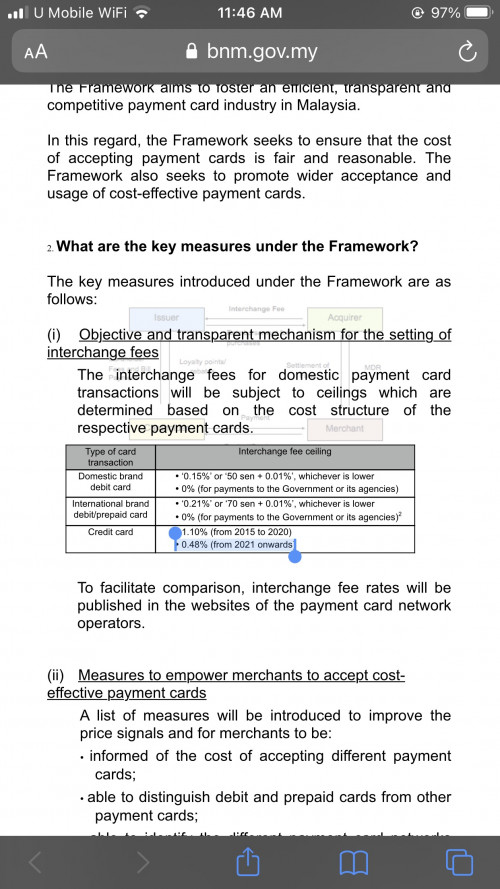

QUOTE(PoisonSoul @ Dec 26 2020, 11:47 AM)  Possible? Afterall, they drop the interchange fee, maybe then Banks are more willing to adopt Apple Pay? Link to PDF |

|

|

Jan 30 2021, 11:28 AM Jan 30 2021, 11:28 AM

|

|

Elite

7,826 posts Joined: Jan 2003 |

|

|

|

Jan 30 2021, 01:28 PM Jan 30 2021, 01:28 PM

Show posts by this member only | IPv6 | Post

#416

|

Senior Member

1,841 posts Joined: Feb 2018 |

|

|

|

Jan 30 2021, 03:49 PM Jan 30 2021, 03:49 PM

Show posts by this member only | IPv6 | Post

#417

|

Junior Member

41 posts Joined: Nov 2012 |

Pathetic Malaysia. It’s not Apple fault , it’s depend our banks and gov nothing else. Why our neighbour country can support Apple Pay so quickly but but we can’t ? Local banks here just want to push their own system which is not work very well , they just failed to admit it. Another thing is our beloved gov don’t know all these kind advance technology instead they prefer traditional way and baby step for qrpays wjleong15 liked this post

|

|

|

Jan 30 2021, 10:38 PM Jan 30 2021, 10:38 PM

Show posts by this member only | IPv6 | Post

#418

|

Senior Member

1,841 posts Joined: Feb 2018 |

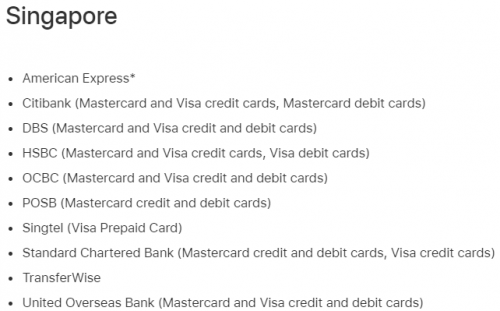

QUOTE(Ericbau @ Jan 30 2021, 03:49 PM) Pathetic Malaysia. Let's look at major banks.It’s not Apple fault , it’s depend our banks and gov nothing else. Why our neighbour country can support Apple Pay so quickly but but we can’t ? Local banks here just want to push their own system which is not work very well , they just failed to admit it. Another thing is our beloved gov don’t know all these kind advance technology instead they prefer traditional way and baby step for qrpays Maybank -> Owns 30% share of Grab CIMB -> Own's TnG which own's TnG eWallet @ 51% vs Ant Financial @ 49%. Who owns TnG eWallet? Who owns TnG? Boost -> Axiata which is owned by Khazanah and it's own by MoF which I think they don't care. With the 2 major eWallet players in MY competing + gov's initiative of QRPay + Maybank's QRPay, do you think that the major banks in Malaysia will cave in into something that will eat their cut even more? Let's just assume there are banks that support AP and my best guess would be the non-local banks like 1) Citi 2) HSBC 3) OCBC 4) UOB etc etc. These banks @ overseas support AP. Look at CIMB and Maybank @ our neighbour SG, they don't even want to implement it.  So you think AP will see the light of day here? Maybe when everyone realise where eWallet is a god damn hassle and ditch eWallet indefinitely and prefer something like AP or SP(Samsung), baru those higher up ppl in the banks will give green light. |

|

|

Jan 31 2021, 02:28 AM Jan 31 2021, 02:28 AM

Show posts by this member only | IPv6 | Post

#419

|

Junior Member

171 posts Joined: Jan 2013 |

QUOTE(PoisonSoul @ Jan 30 2021, 10:38 PM) Let's look at major banks. The day malaysia banks start offering AP is the day when everyone stop using their stupid proprietary payment system.Maybank -> Owns 30% share of Grab CIMB -> Own's TnG which own's TnG eWallet @ 51% vs Ant Financial @ 49%. Who owns TnG eWallet? Who owns TnG? Boost -> Axiata which is owned by Khazanah and it's own by MoF which I think they don't care. With the 2 major eWallet players in MY competing + gov's initiative of QRPay + Maybank's QRPay, do you think that the major banks in Malaysia will cave in into something that will eat their cut even more? Let's just assume there are banks that support AP and my best guess would be the non-local banks like 1) Citi 2) HSBC 3) OCBC 4) UOB etc etc. These banks @ overseas support AP. Look at CIMB and Maybank @ our neighbour SG, they don't even want to implement it.  So you think AP will see the light of day here? Maybe when everyone realise where eWallet is a god damn hassle and ditch eWallet indefinitely and prefer something like AP or SP(Samsung), baru those higher up ppl in the banks will give green light. PoisonSoul liked this post

|

|

|

Jan 31 2021, 09:57 PM Jan 31 2021, 09:57 PM

|

|

Elite

7,826 posts Joined: Jan 2003 |

QUOTE(Ericbau @ Jan 30 2021, 03:49 PM) Pathetic Malaysia. For a market with less than 5% iOS market share especially for banks, the ROI to setup Apple Pay isn't there at all.It’s not Apple fault , it’s depend our banks and gov nothing else. Why our neighbour country can support Apple Pay so quickly but but we can’t ? Local banks here just want to push their own system which is not work very well , they just failed to admit it. Another thing is our beloved gov don’t know all these kind advance technology instead they prefer traditional way and baby step for qrpays |

| Change to: |  0.0307sec 0.0307sec

0.68 0.68

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 20th December 2025 - 12:41 AM |