Wah, like this also called 'heated debate'? Sing song, tok cok also can say heated debate meh?

Universal truth like buy cheap, buy at basement price bargains also need to have mathematical proof to show advantage over friend? So high class one the discussions... 3 days long weekend no go holiday or jam the malls?

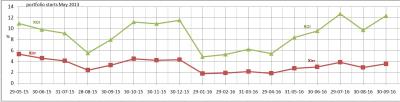

I top-up 2 weeks ago, so damn regret la... nav price drop 1% last Friday, should have waited till Friday.

If it drop again next 2-3 weeks another 8-9%, more regret la...

But ask me in 10 years time, what's the returns, hopefully I can boast "don't know la, maybe 110% or just above 120%... for sure more than 100."

In 10 years time, I would also forgot what's the NAV price I bought, and what's the 'rugi' I didn't buy at cheaper price. No luck... already buy, then price drop... buy somemore, price drop again.

Always no luck, so keep on buying...

Wait, dont' say no luck... don't talk like newbie... be more 'veteran' - "I'm using DCA method".

==============

QUOTE(dasecret @ Oct 4 2016, 05:50 PM)

Let me guess, public mutual agents? PM bond funds returns lose to FD one... how to sell

Besides, bond fund close to zero commission

Once on cari chinese forum an agent tell me off, say it's a disservice to the clients to sell them bond fund because of the lacklustre returns. Ahem, the problem is why the bond fund return so little right? Not because your bond fund sucks so you ask client to take more risk than they are supposed/ready to

Bond funds is for old folks without fresh funds... no risk, no thrill.

Oct 4 2016, 04:29 PM

Oct 4 2016, 04:29 PM

Quote

Quote

0.0270sec

0.0270sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled