QUOTE(xuzen @ Oct 3 2016, 04:26 PM)

After a couple of pages dedicated to the topic buying at Lower NAV pawns those who bought at higher NAV, so what usable info can we derive from this new and profound information?

How can we add value as investors to our portfolio?

Buy at lower NAV?

Xuzen

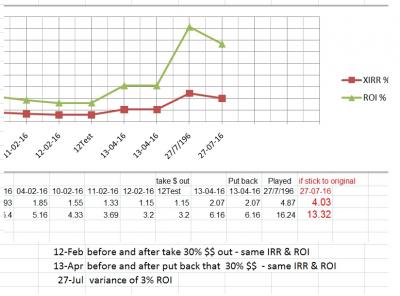

This is what I "see"..."YES and NO"

buy at lower NAV?

YES,.....if I am focusing on just

1 fund that I wanted to buy.....

BUT this lower NAV cannot be used as a fixed comparison benchmark over a longer term of (1 year as most distribution are annually)

usually the NAVs moves in a range band width....after distribution it goes down then "normally" it moves up again..

thus if one were to buy lower and compared it to another that bought at higher NAV, it does not mean that the lower price time of entry is the winner.....if he did not take distribution in it.

well that is for the effect of distribution....thus cannot use longer termed historical NAV price movement as the "timing" of entry.

BUT,....if for occasional dips, YES those who bought at that time is at an advantage of "cheaper NAV"...as mathematically proven to be correct...

buy at lower NAV?

NO,...if I were looking at fund

sas explained in post# 961 by Idyllrain and also in

FSM's article "Don't Let The High Fund Price Deter You "

https://www.fundsupermart.com.my/main/resea...-Apr-2012--2288well, that is what i "see", but for many time, what i saw had been proven to be "mistakes" too

OT:

Idyllrain...very long time no see your post,...welcome back...nice to drop by.

Sep 20 2016, 08:54 PM

Sep 20 2016, 08:54 PM

Quote

Quote

0.0834sec

0.0834sec

0.28

0.28

7 queries

7 queries

GZIP Disabled

GZIP Disabled