https://forum.lowyat.net/topic/3730638

For account opening FAQs - https://secure.fundsupermart.com/main/acl/r...terAccount1.tpl

For Singapore bank account opening - https://forum.lowyat.net/index.php?showtopi...aving+singapore

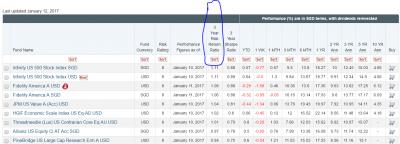

I'm hoping we can discuss unit trusts available on FSM SG, or other products on FSM such as retail bonds

"Great to hear that, I also received PM as well from forummer asking about FSM SG.

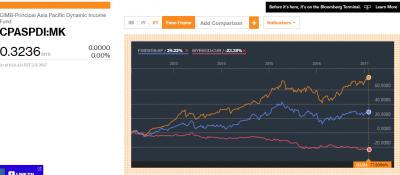

My favorite Asia ex japan fund goes to First State Dividen Advantage which give me quite decent of return IRR @ 13.08% for more than 2 and half years. But still lose abit to my Ponzi 2.0 performance la.. tongue.gif

https://secure.fundsupermart.com/main/fundi...olnumber=FSDVAD

Or you might start a thread focus about FSM SG and do not mix with long go version here, later make ppl lagi pening kepala."

I'm really bad at this... so please forgive me as the lousiest thread starter ever

I started with Dividend Advantage too... since it looked like Ponzi 2.0. But I guess I started at the wrong time, in March when India and China was at its highest... so until now I'm only breaking even...

FSM SG's bond funds are not as predictable as the msia's also, the short term SGD bond funds can lose money

And with the limited funds I have, I didn't construct a proper portfolio seeing how high the mature markets are already... but that also means it's not diversified

So boss.... what is your core portfolio? I tried looking at sui jau's, it makes me more

This post has been edited by dasecret: Oct 28 2015, 10:21 AM

Oct 28 2015, 01:34 AM, updated 4y ago

Oct 28 2015, 01:34 AM, updated 4y ago

Quote

Quote

0.4473sec

0.4473sec

0.53

0.53

6 queries

6 queries

GZIP Disabled

GZIP Disabled