Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

sunnieyck P

|

May 4 2020, 05:12 PM May 4 2020, 05:12 PM

|

New Member

|

Hi guys, may i know how do you guys find out the details/ T&C of the tax relief?

for example, I can only see RM3000 relief for parents (RM1500 for one father and RM1500 for one mother)

how to you guys find out the T&C such as the parents must be 60 years old and annual income <24k etc

Any idea where can I find such information in LHDN official website?

|

|

|

|

|

|

MUM

|

May 4 2020, 05:25 PM May 4 2020, 05:25 PM

|

|

QUOTE(sunnieyck @ May 4 2020, 05:12 PM) Hi guys, may i know how do you guys find out the details/ T&C of the tax relief? for example, I can only see RM3000 relief for parents (RM1500 for one father and RM1500 for one mother) how to you guys find out the T&C such as the parents must be 60 years old and annual income <24k etc Any idea where can I find such information in LHDN official website? perhaps in page 12 of this http://lampiran1.hasil.gov.my/pdf/pdfam/Ex...es_BE2019_2.pdffrom http://www.hasil.gov.my/bt_goindex.php?bt_...1&Submit=Search |

|

|

|

|

|

jiaen0509

|

May 5 2020, 12:32 AM May 5 2020, 12:32 AM

|

|

I do the freelancer at home. Payment via Paypal.

Declare Borang BE in the past. If June I go and register SSM.

How to declare efilling next year? Since I register SSM half way(starts June 2020).

BE - Jan to May

B - June to Dec?

Hope sifus here can help to answer. Decide to register SSM so later when come to apply any credit facilities will smooth.

|

|

|

|

|

|

MUM

|

May 5 2020, 12:36 AM May 5 2020, 12:36 AM

|

|

QUOTE(jiaen0509 @ May 5 2020, 12:32 AM) I do the freelancer at home. Payment via Paypal. Declare Borang BE in the past. If June I go and register SSM. How to declare efilling next year? Since I register SSM half way(starts June 2020). BE - Jan to May B - June to Dec? Hope sifus here can help to answer. Decide to register SSM so later when come to apply any credit facilities will smooth. this looks similar.... S13: Pada awal tahun pendapatan saya hanyalah daripada gaji sahaja, namun pada pertengahan tahun saya mula berniaga secara kecil-kecilan. Adakah saya perlu mengisi kedua-dua Borang B dan BE? J13: Anda hanya perlu mengisi Borang B sahaja jika anda mempunyai pendapatan perniagaan dan juga anda perlu mengembalikan Borang B selewat–lewatnya pada 30 Jun. Sila isikan pendapatan penggajian anda dalam borang B yang sama. http://lampiran1.hasil.gov.my/pdf/pdfam/FA..._27012015_1.pdf |

|

|

|

|

|

playboy88

|

May 5 2020, 10:14 PM May 5 2020, 10:14 PM

|

Getting Started

|

hi all,

i am salary earner with an solo proprietor business.

my salary is my main income, while for business account only with very little transation.

business register seen last year March. but for year 2019 transaction is less then 10k. profit are around +/-3k

this case do i still need to submit tax for my business?

|

|

|

|

|

|

MUM

|

May 5 2020, 10:40 PM May 5 2020, 10:40 PM

|

|

QUOTE(playboy88 @ May 5 2020, 10:14 PM) hi all, i am salary earner with an solo proprietor business. my salary is my main income, while for business account only with very little transation. business register seen last year March. but for year 2019 transaction is less then 10k. profit are around +/-3k this case do i still need to submit tax for my business? check this simple and easy to read info.... http://lampiran1.hasil.gov.my/pdf/pdfam/R0...AN_INDIVIDU.pdf Attached thumbnail(s)

|

|

|

|

|

|

iamkid

|

May 6 2020, 03:35 PM May 6 2020, 03:35 PM

|

|

Hi, I would like to clarify is the 50% discount on rental income still valid? Coz i see some article and investor said the discount was only for 2018. Last known is 2018-2020, but I might be not aware of any news on the change. cant find much info online too |

|

|

|

|

|

MrB9

|

May 7 2020, 02:00 PM May 7 2020, 02:00 PM

|

Getting Started

|

Hi sifus/ pros,

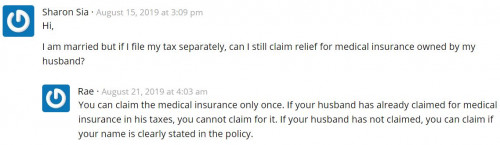

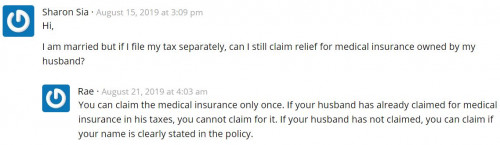

Can I know if I can tax relief my wife's medical insurance?

|

|

|

|

|

|

MrB9

|

May 7 2020, 02:00 PM May 7 2020, 02:00 PM

|

Getting Started

|

Hi sifus/ pros,

Can I know if I can tax relief my wife's medical insurance?

|

|

|

|

|

|

MUM

|

May 7 2020, 02:05 PM May 7 2020, 02:05 PM

|

|

QUOTE(MrB9 @ May 7 2020, 02:00 PM) Hi sifus/ pros, Can I know if I can tax relief my wife's medical insurance? try page 21 under F17.... http://lampiran1.hasil.gov.my/pdf/pdfam/Ex...es_BE2019_2.pdfhope that guidelines is applicable to you... |

|

|

|

|

|

jepakazoid_82

|

May 7 2020, 02:16 PM May 7 2020, 02:16 PM

|

|

Hi guys, I just submitted my tax return last weekend. How long is the typical wait ya for the refund? TQ.

|

|

|

|

|

|

MUM

|

May 7 2020, 02:18 PM May 7 2020, 02:18 PM

|

|

QUOTE(jepakazoid_82 @ May 7 2020, 02:16 PM) Hi guys, I just submitted my tax return last weekend. How long is the typical wait ya for the refund? TQ. in March before MCO, there had been postings about receiving it in 2~3 weeks |

|

|

|

|

|

MrB9

|

May 7 2020, 02:40 PM May 7 2020, 02:40 PM

|

Getting Started

|

Hi Sir/Ms, thank you for the info. Because I heard confusion if I claim my wife's medical insurance must be under joint assessment. however I don find any clause / statement. Thank you. QUOTE(MUM @ May 7 2020, 02:05 PM) try page 21 under F17.... http://lampiran1.hasil.gov.my/pdf/pdfam/Ex...es_BE2019_2.pdfhope that guidelines is applicable to you... |

|

|

|

|

|

rapple

|

May 7 2020, 02:57 PM May 7 2020, 02:57 PM

|

|

QUOTE(MrB9 @ May 7 2020, 02:00 PM) Hi sifus/ pros, Can I know if I can tax relief my wife's medical insurance? You only can claim if your are the Policy Owner. |

|

|

|

|

|

MrB9

|

May 7 2020, 03:04 PM May 7 2020, 03:04 PM

|

Getting Started

|

QUOTE(rapple @ May 7 2020, 02:57 PM) You only can claim if your are the Policy Owner. Hi...Can I know where to get that particular info? |

|

|

|

|

|

rapple

|

May 7 2020, 04:04 PM May 7 2020, 04:04 PM

|

|

QUOTE(MrB9 @ May 7 2020, 03:04 PM) Hi...Can I know where to get that particular info? It's printed on the Life Insurance Premium Statement. Or refer to your insurance policy, it's written there if you are the owner. This post has been edited by rapple: May 7 2020, 04:05 PM |

|

|

|

|

|

MrB9

|

May 7 2020, 07:16 PM May 7 2020, 07:16 PM

|

Getting Started

|

I see. I could not claim tax relief if I pay for my wife medical insurance policy under her name ? We are doing separate assessment. QUOTE(rapple @ May 7 2020, 04:04 PM) It's printed on the Life Insurance Premium Statement. Or refer to your insurance policy, it's written there if you are the owner. |

|

|

|

|

|

GrumpyNooby

|

May 7 2020, 07:28 PM May 7 2020, 07:28 PM

|

|

Proposal for tax relief measures in 2021 budgetWhile drafting the 2021 Budget, it is hoped that our leaders will feel the people’s pulse and take into consideration the challenges we are facing, especially the ever-increasing cost of living during the pandemic. To reduce the severity of the impact of the pandemic, we appeal for additional tax relief measures to be considered, especially a “ Covid-19 tax relief” of RM5,000 and RM500 for fees to test for Covid-19 under medical expenses in the year of assessment (YA) 2020 for individual taxpayers. https://www.thestar.com.my/opinion/letters/...-in-2021-budgetI welcome this proposal!  But maybe I'm dreaming too early.

|

|

|

|

|

|

MrB9

|

May 7 2020, 09:22 PM May 7 2020, 09:22 PM

|

Getting Started

|

Hi boss, does it mean that I can claim for my spouse / wife medical insurance under her name? Any other sifus can advise my situation please, we are filing for separate assessment. Can I claim my wife's medical insurance under my tax relief? QUOTE(MUM @ May 7 2020, 02:05 PM) try page 21 under F17.... http://lampiran1.hasil.gov.my/pdf/pdfam/Ex...es_BE2019_2.pdfhope that guidelines is applicable to you... |

|

|

|

|

|

GrumpyNooby

|

May 7 2020, 09:36 PM May 7 2020, 09:36 PM

|

|

QUOTE(MrB9 @ May 7 2020, 09:22 PM) Hi boss, does it mean that I can claim for my spouse / wife medical insurance under her name? Any other sifus can advise my situation please, we are filing for separate assessment. Can I claim my wife's medical insurance under my tax relief? has actually answered your questions and he has taxation background. I dig extra for you:  https://www.ibanding.my/want-maximize-tax-r...insurance-read/ https://www.ibanding.my/want-maximize-tax-r...insurance-read/Technically only policy owner can claim for tax relief. The same applies for medical and/or education bought by you (under your name as policy owner) and your child name as the beneficiary. Another article under The Most Overlooked Malaysian Income Tax Relief You Can Miss Out: https://howtofinancemoney.com/malaysian-income-tax-reliefThis post has been edited by GrumpyNooby: May 7 2020, 09:45 PM |

|

|

|

|

May 4 2020, 05:12 PM

May 4 2020, 05:12 PM

Quote

Quote

0.0215sec

0.0215sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled