Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

MrB9

|

Apr 12 2020, 09:13 PM Apr 12 2020, 09:13 PM

|

Getting Started

|

Hi all, would like to seek advise, in my EA form for example Section B:

(a) gaji kasar RM100,000

© tip kasar, perkuisit penerimaan sagu hati & elaun lain RM30,000

When I submit my income tax income declare as RM100k or 130k?

I have travel allowances included at ©, can I exempt 6k from total salary?

Seek for advise. Thank you.

This post has been edited by MrB9: Apr 12 2020, 09:20 PM

|

|

|

|

|

|

MrB9

|

Apr 12 2020, 09:19 PM Apr 12 2020, 09:19 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ Apr 12 2020, 09:15 PM) When I submit my income tax income declare as RM100k or 130k? The grand total of Section (B). Noted, thanks. I study there is tax deduction for travel allowance RM6000. Do I directly deduct from my section (b) value? for eg. Rm130k-6k= RM124k in B1? |

|

|

|

|

|

MrB9

|

Apr 12 2020, 09:24 PM Apr 12 2020, 09:24 PM

|

Getting Started

|

QUOTE(GrumpyNooby @ Apr 12 2020, 09:21 PM) Your HR/accounting/payroll/reimbursement team need to put that amount under Section F to be tax exempted; otherwise it's taxable. Surprisingly my HR did not declare that at section (F)...Do i refer back to my HR? |

|

|

|

|

|

MrB9

|

May 7 2020, 02:00 PM May 7 2020, 02:00 PM

|

Getting Started

|

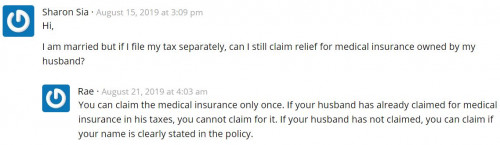

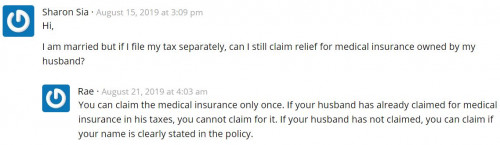

Hi sifus/ pros,

Can I know if I can tax relief my wife's medical insurance?

|

|

|

|

|

|

MrB9

|

May 7 2020, 02:00 PM May 7 2020, 02:00 PM

|

Getting Started

|

Hi sifus/ pros,

Can I know if I can tax relief my wife's medical insurance?

|

|

|

|

|

|

MrB9

|

May 7 2020, 02:40 PM May 7 2020, 02:40 PM

|

Getting Started

|

Hi Sir/Ms, thank you for the info. Because I heard confusion if I claim my wife's medical insurance must be under joint assessment. however I don find any clause / statement. Thank you. QUOTE(MUM @ May 7 2020, 02:05 PM) try page 21 under F17.... http://lampiran1.hasil.gov.my/pdf/pdfam/Ex...es_BE2019_2.pdfhope that guidelines is applicable to you... |

|

|

|

|

|

MrB9

|

May 7 2020, 03:04 PM May 7 2020, 03:04 PM

|

Getting Started

|

QUOTE(rapple @ May 7 2020, 02:57 PM) You only can claim if your are the Policy Owner. Hi...Can I know where to get that particular info? |

|

|

|

|

|

MrB9

|

May 7 2020, 07:16 PM May 7 2020, 07:16 PM

|

Getting Started

|

I see. I could not claim tax relief if I pay for my wife medical insurance policy under her name ? We are doing separate assessment. QUOTE(rapple @ May 7 2020, 04:04 PM) It's printed on the Life Insurance Premium Statement. Or refer to your insurance policy, it's written there if you are the owner. |

|

|

|

|

|

MrB9

|

May 7 2020, 09:22 PM May 7 2020, 09:22 PM

|

Getting Started

|

Hi boss, does it mean that I can claim for my spouse / wife medical insurance under her name? Any other sifus can advise my situation please, we are filing for separate assessment. Can I claim my wife's medical insurance under my tax relief? QUOTE(MUM @ May 7 2020, 02:05 PM) try page 21 under F17.... http://lampiran1.hasil.gov.my/pdf/pdfam/Ex...es_BE2019_2.pdfhope that guidelines is applicable to you... |

|

|

|

|

|

MrB9

|

May 11 2020, 11:26 PM May 11 2020, 11:26 PM

|

Getting Started

|

Thank you very much for your kind reply & information shared, appreciate it. I am just confused of tax relief for insurance as not mentioned clearly in the requirement, typically just self, spouse or children. QUOTE(GrumpyNooby @ May 7 2020, 09:36 PM) rapple has actually answered your questions and he has taxation background. I dig extra for you:  https://www.ibanding.my/want-maximize-tax-r...insurance-read/ https://www.ibanding.my/want-maximize-tax-r...insurance-read/Technically only policy owner can claim for tax relief. The same applies for medical and/or education bought by you (under your name as policy owner) and your child name as the beneficiary. Another article under The Most Overlooked Malaysian Income Tax Relief You Can Miss Out: https://howtofinancemoney.com/malaysian-income-tax-relief |

|

|

|

|

Apr 12 2020, 09:13 PM

Apr 12 2020, 09:13 PM

Quote

Quote

0.2101sec

0.2101sec

0.09

0.09

7 queries

7 queries

GZIP Disabled

GZIP Disabled