Outline ·

[ Standard ] ·

Linear+

Income Tax Issues v4, Scope: e-BE and eB only

|

dragonteoh

|

May 17 2020, 10:38 AM May 17 2020, 10:38 AM

|

|

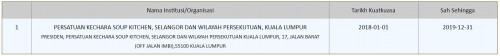

QUOTE(GrumpyNooby @ May 17 2020, 10:33 AM) If not listed, then not eligible for taxable income reduction. Normally because I do a donation, I check the background of the respective non-profit or charity organization. Those registered and eligible usually carry a registration number starts with PPM: For example: Malaysian Medical Relief Society (Reg. No: PPM-020-14-16091999) Ooo, is that mean, if their institution registration no come with the word PPM , then is eligible ? Then is consider eligible, however, not sure why LHDN site can't find their name in the list. This post has been edited by dragonteoh: May 17 2020, 10:41 AM |

|

|

|

|

|

GrumpyNooby

|

May 17 2020, 10:42 AM May 17 2020, 10:42 AM

|

|

QUOTE(dragonteoh @ May 17 2020, 10:38 AM) Ooo, is that mean, if their institution registration no come with the word PPM , then is eligible ? Usually not eligible. Best to counter check with list in the LHDN database, some may have expired.  This post has been edited by GrumpyNooby: May 17 2020, 10:43 AM This post has been edited by GrumpyNooby: May 17 2020, 10:43 AM |

|

|

|

|

|

dragonteoh

|

May 17 2020, 10:53 AM May 17 2020, 10:53 AM

|

|

QUOTE(GrumpyNooby @ May 17 2020, 10:42 AM) Usually not eligible. Best to counter check with list in the LHDN database, some may have expired.  Too bad, the name is totally not appear in the list, even they have PPM in their registration. |

|

|

|

|

|

StarPrimo

|

May 17 2020, 01:51 PM May 17 2020, 01:51 PM

|

|

QUOTE(dragonteoh @ May 17 2020, 10:23 AM) http://www.hasil.gov.my/bt_goindex.php?bt_...nit=8&bt_sequ=1from the list , i think many organization did not register their name. If the organisation is not registered, then it’s not eligible for deduction. Perhaps check with LHDN for eligibility. |

|

|

|

|

|

woodenpuppy

|

May 18 2020, 03:16 PM May 18 2020, 03:16 PM

|

New Member

|

I've been trying to apply for epin through their online feedback website but I'm not getting any response. https://maklumbalaspelanggan.hasil.gov.my/MaklumBalas/en-US/Their Hasil numbers all cant reach. Does anyone know if LHDN offices are open or how to get epin ? |

|

|

|

|

|

Salary

|

May 18 2020, 11:44 PM May 18 2020, 11:44 PM

|

|

QUOTE(woodenpuppy @ May 18 2020, 03:16 PM) I've been trying to apply for epin through their online feedback website but I'm not getting any response. https://maklumbalaspelanggan.hasil.gov.my/MaklumBalas/en-US/Their Hasil numbers all cant reach. Does anyone know if LHDN offices are open or how to get epin ? Yes, LHDN offices are now open, but if I’m correct, limited services are available. Call their care line tomorrow and check with them first. |

|

|

|

|

|

MUM

|

May 19 2020, 12:12 AM May 19 2020, 12:12 AM

|

|

|

|

|

|

|

|

woodenpuppy

|

May 19 2020, 11:57 AM May 19 2020, 11:57 AM

|

New Member

|

I've used exactly this. Theres no replies for the e-pin for almost 2 weeks

|

|

|

|

|

|

MUM

|

May 19 2020, 01:48 PM May 19 2020, 01:48 PM

|

|

QUOTE(ken_zie @ May 15 2020, 06:38 PM) Tried to submit the e-Filing since end of March but always failed to receive the TAC. Just a sharing for those who are having difficulty to receive TAC for submission and are not able to talk or chat with the customer service. You can file for a complaint here. They replied in an hour telling me they deactivated the TAC submission for my account. QUOTE(woodenpuppy @ May 19 2020, 11:57 AM) I've used exactly this. Theres no replies for the e-pin for almost 2 weeks read the above positive comment and tried the above link? |

|

|

|

|

|

nicholascwy

|

May 19 2020, 11:03 PM May 19 2020, 11:03 PM

|

New Member

|

Hi, could you guys share some insight for me?

In the past 3 years i have not declared my income, so far i have yet to be summon by LHDN and i decided not to risk it anymore and gonna be declaring soon for my 2019 income.

Question:

1- Will it be a clean break or will they audit my 2018/2017 as well?

my company do pay PCB for me.

Stupid me for the mess im in and i wanna be mentally prepared.

|

|

|

|

|

|

Salary

|

May 19 2020, 11:22 PM May 19 2020, 11:22 PM

|

|

QUOTE(nicholascwy @ May 19 2020, 11:03 PM) Hi, could you guys share some insight for me? In the past 3 years i have not declared my income, so far i have yet to be summon by LHDN and i decided not to risk it anymore and gonna be declaring soon for my 2019 income. Question: 1- Will it be a clean break or will they audit my 2018/2017 as well? my company do pay PCB for me. Stupid me for the mess im in and i wanna be mentally prepared. If your company do pay PCB for you, it will not be a clean break for you. That also means you Have missed out on tax returns. There is an option in the e-Filing that allows you to declare your income for preceding years. Just make sure you fill that in and keep your EA forms just in case you’re audited. |

|

|

|

|

|

nicholascwy

|

May 20 2020, 12:09 AM May 20 2020, 12:09 AM

|

New Member

|

QUOTE(Salary @ May 19 2020, 11:22 PM) If your company do pay PCB for you, it will not be a clean break for you. That also means you Have missed out on tax returns. There is an option in the e-Filing that allows you to declare your income for preceding years. Just make sure you fill that in and keep your EA forms just in case you’re audited. Thank you for the input. i think at this point, the tax return isnt really on my head. I'm just worried of being fined like 300%  |

|

|

|

|

|

Salary

|

May 20 2020, 12:18 AM May 20 2020, 12:18 AM

|

|

QUOTE(nicholascwy @ May 20 2020, 12:09 AM) Thank you for the input. i think at this point, the tax return isnt really on my head. I'm just worried of being fined like 300%  No problem. As long as your company has been paying your PCB, you’ll not be fined. You’ll only be fined for undeclared, unpaid taxes. |

|

|

|

|

|

Tobyby P

|

May 20 2020, 02:48 PM May 20 2020, 02:48 PM

|

New Member

|

Want to ask, My pcb were normally deducted monthly from my salary and company will pay to lhdn. But in 2019 my employment was switch to contract-based ( contract for services, like a freelance ) started Oct to December (3 months), Jan to Sept remained same as before (company pay to lhdn). So the first 9 months I will be doing my tax submission - Efilling e-be as before, what about the 3 months of contract for services which company no deduct pcb part from my salary? I wanna know if I have to register another account or do some other procedure to contribute the 3 months myself? and Do I have to do together with the e-be of the 9 months?

|

|

|

|

|

|

MUM

|

May 20 2020, 03:31 PM May 20 2020, 03:31 PM

|

|

QUOTE(Tobyby @ May 20 2020, 02:48 PM) Want to ask, My pcb were normally deducted monthly from my salary and company will pay to lhdn. But in 2019 my employment was switch to contract-based ( contract for services, like a freelance ) started Oct to December (3 months), Jan to Sept remained same as before (company pay to lhdn). So the first 9 months I will be doing my tax submission - Efilling e-be as before, what about the 3 months of contract for services which company no deduct pcb part from my salary? I wanna know if I have to register another account or do some other procedure to contribute the 3 months myself? and Do I have to do together with the e-be of the 9 months? while waiting for responses, you can try this for some added info.... How To File Your Income Tax When You’re Freelancing https://ringgitplus.com/en/blog/income-tax/...reelancing.html |

|

|

|

|

|

Tobyby P

|

May 20 2020, 11:26 PM May 20 2020, 11:26 PM

|

New Member

|

QUOTE(MUM @ May 20 2020, 03:31 PM) while waiting for responses, you can try this for some added info.... How To File Your Income Tax When You’re Freelancing https://ringgitplus.com/en/blog/income-tax/...reelancing.htmlFrom the article, it said "If you have not registered your freelance work as a business, then you can use Form BE – for individuals not carrying on a business. However, if you have registered a business, you will need to file your taxes with Form B." So the form BE will be the same e-be form that i used to submit in e-filling as an employee? where to fill in the freelance part? Wanna ask, registered or not registered as a business, is the pcb to be paid same amount? or better to register? |

|

|

|

|

|

T231H

|

May 20 2020, 11:41 PM May 20 2020, 11:41 PM

|

|

QUOTE(Tobyby @ May 20 2020, 11:26 PM) From the article, it said "If you have not registered your freelance work as a business, then you can use Form BE – for individuals not carrying on a business. However, if you have registered a business, you will need to file your taxes with Form B." So the form BE will be the same e-be form that i used to submit in e-filling as an employee? where to fill in the freelance part?

Wanna ask, registered or not registered as a business, is the pcb to be paid same amount? or better to register? add in the amount earned as a freelancer to the amount you earned from that company as an employee (from EA form)... |

|

|

|

|

|

queeniec3388 P

|

May 21 2020, 01:04 AM May 21 2020, 01:04 AM

|

New Member

|

Submitted 30 Apr

Taksiran May 2

Until now no news yet, is it because of raya approaching?

|

|

|

|

|

|

ming24

|

May 21 2020, 11:45 AM May 21 2020, 11:45 AM

|

Getting Started

|

Have submitted e-Filing using BE forms. How long will it be before LHDN notifies my previous employer?

My previous employer has submitted the CP22A form to LHDN as well. I need tax clearance to be completed before my previous employer releases my last paycheck.

|

|

|

|

|

|

GrumpyNooby

|

May 21 2020, 02:34 PM May 21 2020, 02:34 PM

|

|

QUOTE(PurpleRain1990 @ May 21 2020, 02:33 PM) Hi all, My company already terminated my contract (1 year) last month. I have yet to receive my April salary. I e-mailed them regarding this matter and they said they are still waiting for Surat Penyelesaian Cukai from LHDN. Will I ever get my salary? Should I file for tax declaration as well when I am already jobless since May? The current year filing is for last year income till December 2019. It has nothing to do with your current unemployed status. |

|

|

|

|

May 17 2020, 10:38 AM

May 17 2020, 10:38 AM

Quote

Quote

0.0222sec

0.0222sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled