Anyone invested in Public Index Fund ? Mine shows -6k. Scary. Should I withdraw it ?

Public Mutual Funds, version 0.0

Public Mutual Funds, version 0.0

|

|

Oct 6 2019, 09:11 PM Oct 6 2019, 09:11 PM

Return to original view | IPv6 | Post

#1

|

Junior Member

50 posts Joined: Mar 2008 |

Anyone invested in Public Index Fund ? Mine shows -6k. Scary. Should I withdraw it ?

|

|

|

|

|

|

Oct 6 2019, 09:28 PM Oct 6 2019, 09:28 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

50 posts Joined: Mar 2008 |

|

|

|

Oct 6 2019, 09:47 PM Oct 6 2019, 09:47 PM

Return to original view | IPv6 | Post

#3

|

Junior Member

50 posts Joined: Mar 2008 |

|

|

|

Oct 6 2019, 10:17 PM Oct 6 2019, 10:17 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

50 posts Joined: Mar 2008 |

QUOTE(MUM @ Oct 6 2019, 09:57 PM) past 7 yrs doing periodic reinvestment.... with minus 8% ROI......It will be a tough nut to beat if were to includes the cumulation of the yearly 6% opportunity cost may I suggest you stop the reinvestment but invest into some other fund or just stop taking out the money from EPF to earn 6% btw, did you do the calculation of profit/losses by yourself? Unrealised Profit/Loss (%) MYR - 5625.91(-4.99%) Total : 107k. |

|

|

Oct 6 2019, 10:36 PM Oct 6 2019, 10:36 PM

Return to original view | IPv6 | Post

#5

|

Junior Member

50 posts Joined: Mar 2008 |

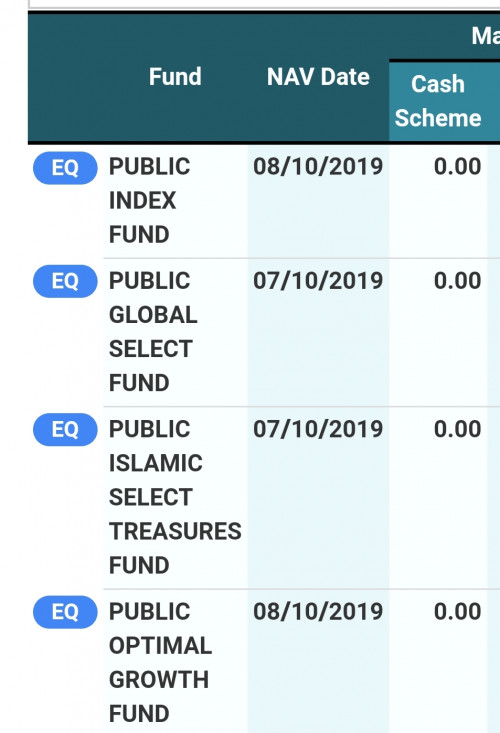

QUOTE(MUM @ Oct 6 2019, 10:30 PM) I am not sure about the display from KWSP.... 76k is just from Public Index Fund, i have more $$ in few other funds (Public Global,etc). So the total is 107k from EPF, Public Index Fund has the highest $$ with 76k.you mentioned total about 74K...here it shows 107K wondering why?? ...if you have opened a PMOnline registration....goto PMO website to login and check the status? |

|

|

Oct 6 2019, 11:08 PM Oct 6 2019, 11:08 PM

Return to original view | IPv6 | Post

#6

|

Junior Member

50 posts Joined: Mar 2008 |

|

|

|

|

|

|

Oct 6 2019, 11:09 PM Oct 6 2019, 11:09 PM

Return to original view | IPv6 | Post

#7

|

Junior Member

50 posts Joined: Mar 2008 |

|

|

|

Oct 7 2019, 12:09 AM Oct 7 2019, 12:09 AM

Return to original view | IPv6 | Post

#8

|

Junior Member

50 posts Joined: Mar 2008 |

QUOTE(howszat @ Oct 7 2019, 12:04 AM) I think it is very unlikely it will go up in the next few years, and it is most likely that it will not go up more than EPF. Thanks for the advice!. CheersIf you look at the performance chart, it is now at the same profit level since 2013. In other words, no profit since 2013. With EPF, you would got 6years x6% = 36% since then. You would have done better with even FD. To be fair, the mandate is too narrow. PM funds are under-performing with over-priced service charge so they can pay the agents to go and A cut-loss decision should not be based on how much you have already lost, but on future potential. If no potential, your loss would be even higher because you need to also consider opportunity costs. That's only my opinion, of course. What you actually do with your money, you have to decide. |

|

|

Oct 7 2019, 08:59 AM Oct 7 2019, 08:59 AM

Return to original view | IPv6 | Post

#9

|

Junior Member

50 posts Joined: Mar 2008 |

|

|

|

Oct 8 2019, 03:11 PM Oct 8 2019, 03:11 PM

Return to original view | IPv6 | Post

#10

|

Junior Member

50 posts Joined: Mar 2008 |

|

|

|

Oct 8 2019, 11:44 PM Oct 8 2019, 11:44 PM

Return to original view | IPv6 | Post

#11

|

Junior Member

50 posts Joined: Mar 2008 |

QUOTE(MUM @ Oct 8 2019, 03:15 PM) usually I heard was to keep on pumping into the losing fund to lower the earlier purchased average cost so now not to average the cost but to buy another EQ fund...that is why you had 4 funds.... could you tell which other 3 funds you had? Hopefully they are not correlated....  |

|

|

Jan 10 2021, 07:22 PM Jan 10 2021, 07:22 PM

Return to original view | IPv6 | Post

#12

|

Junior Member

50 posts Joined: Mar 2008 |

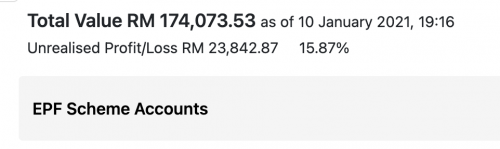

Hey guys, just a quick to PM sifus here.

I have been investing my EPF $$ for about 5-7years now (some funds are 7 years old, some are 5). The agent is very much helpful and we did some switching last year due to low performing fund called Public Index Fund. Below is my return.  So basically I invested RM 150,231 and got back RM23,842 profit. My question is, would it have been better if I just left it in EPF? How can I calculate how much I would have gotten if I left it in EPF? |

|

|

Jan 10 2021, 08:47 PM Jan 10 2021, 08:47 PM

Return to original view | Post

#13

|

Junior Member

50 posts Joined: Mar 2008 |

Thank you for the calculation.

May I know how you did the calculation. It's not like 1 day 7 years ago I deposited RN150k into PB. It was a gradual deposit according to how much EPF allows us. I remember when I started I was only depositing around 2 to 3k every 3 months. As time goes as my salary increases I deposit around 8k every 3 months (epf only allows certain amount of % to be moved to Unit trust every 3 months) QUOTE(ironman16 @ Jan 10 2021, 07:57 PM) https://ringgitplus.com/en/blog/personal-fi...dend-rates.html pass year EPF dividend 2014 =6.75 2015 =6.4 2016 =5.7 2017 =6.9 2018 =6.15 2019 =5.45 i did a simple calculation , if u left in EPF, should b around RM215818 u get salah jgn tembak saya, saya bukan pro punya.....just simple mathematic aje.....should b more than this value..... i would said better just left in EPF....... |

| Change to: |  0.0229sec 0.0229sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 11:55 PM |