Outline ·

[ Standard ] ·

Linear+

Public Mutual Funds, version 0.0

|

engyr

|

Sep 29 2019, 09:33 AM Sep 29 2019, 09:33 AM

|

|

QUOTE(smwah @ Sep 29 2019, 08:07 AM) My in law want to support his relative, and instend buy ut for my child. So I no idea which public fund to go. Prob is the relative still new. My in law plan is just monthly rm200 for maybe 5 years. So any sifu suggestion. Can consider bond fund or money market fund. Bond fund 1% sales charge, money market fund 0% sales charges. Equity fund sales charge 5.5%. Not easy to earn after deduct 5.5% sales charge. Whether you earn or lost money, your agent will earn. I was so regret to buy equity fund. |

|

|

|

|

|

smwah

|

Sep 29 2019, 01:58 PM Sep 29 2019, 01:58 PM

|

Glad to be Here

|

QUOTE(engyr @ Sep 29 2019, 09:33 AM) Can consider bond fund or money market fund. Bond fund 1% sales charge, money market fund 0% sales charges. Equity fund sales charge 5.5%. Not easy to earn after deduct 5.5% sales charge. Whether you earn or lost money, your agent will earn. I was so regret to buy equity fund. So any product recomend for bond, money market or equity. The amount investniw not big, monthly purcha se aroudn 200 for maybe 10 years. |

|

|

|

|

|

engyr

|

Sep 29 2019, 07:35 PM Sep 29 2019, 07:35 PM

|

|

QUOTE(smwah @ Sep 29 2019, 01:58 PM) So any product recomend for bond, money market or equity. The amount investniw not big, monthly purcha se aroudn 200 for maybe 10 years. Only invest at the things that you know well. Since you are making favour for your relative, you can ask him for product prospectus & annual report. |

|

|

|

|

|

coolbuddha91

|

Oct 4 2019, 07:02 PM Oct 4 2019, 07:02 PM

|

Getting Started

|

HI, would like to know what 'distribution is in the form of cash' means? Does it mean once distribution date come, it will bank in the dividend/interest directly to my bank account? i saw this type of distribution in bond fund. Thanks.

|

|

|

|

|

|

MUM

|

Oct 4 2019, 07:42 PM Oct 4 2019, 07:42 PM

|

|

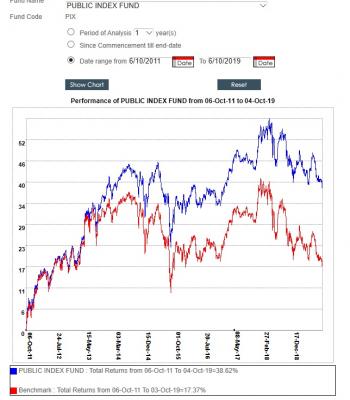

QUOTE(coolbuddha91 @ Oct 4 2019, 07:02 PM) HI, would like to know what 'distribution is in the form of cash' means? Does it mean once distribution date come, it will bank in the dividend/interest directly to my bank account? i saw this type of distribution in bond fund. Thanks. read this while you wait for responses? hope you could get some info from it while you wait https://www.publicmutual.com.my/LinkClick.a...A%3d&portalid=0 Attached thumbnail(s)

|

|

|

|

|

|

boldsouljah

|

Oct 6 2019, 09:11 PM Oct 6 2019, 09:11 PM

|

Getting Started

|

Anyone invested in Public Index Fund ? Mine shows -6k. Scary. Should I withdraw it ?

|

|

|

|

|

|

MUM

|

Oct 6 2019, 09:14 PM Oct 6 2019, 09:14 PM

|

|

QUOTE(boldsouljah @ Oct 6 2019, 09:11 PM) Anyone invested in Public Index Fund ? Mine shows -6k. Scary. Should I withdraw it ? how much have you invested to be able to lose RM6k? |

|

|

|

|

|

boldsouljah

|

Oct 6 2019, 09:28 PM Oct 6 2019, 09:28 PM

|

Getting Started

|

QUOTE(MUM @ Oct 6 2019, 09:14 PM) how much have you invested to be able to lose RM6k? RM74k |

|

|

|

|

|

MUM

|

Oct 6 2019, 09:36 PM Oct 6 2019, 09:36 PM

|

|

QUOTE(boldsouljah @ Oct 6 2019, 09:28 PM)  invested 74k now is 68K losing 6k that is about 8.1% if MINUS 5.5% SC....loses is about 2.6%? |

|

|

|

|

|

tometoto

|

Oct 6 2019, 09:37 PM Oct 6 2019, 09:37 PM

|

Getting Started

|

Better pun in sspn. Around 4 ++ interest plus income taxes decision rm6k

|

|

|

|

|

|

boldsouljah

|

Oct 6 2019, 09:47 PM Oct 6 2019, 09:47 PM

|

Getting Started

|

QUOTE(MUM @ Oct 6 2019, 09:36 PM)  invested 74k now is 68K losing 6k that is about 8.1% if MINUS 5.5% SC....loses is about 2.6%? Sorry, mine is the EPF scheme. I have been putting money into PM from my EPF for the past 7 years, So now i have around 74k, and it shows Total Returns : -RM6454 |

|

|

|

|

|

engyr

|

Oct 6 2019, 09:56 PM Oct 6 2019, 09:56 PM

|

|

QUOTE(boldsouljah @ Oct 6 2019, 09:47 PM) Sorry, mine is the EPF scheme. I have been putting money into PM from my EPF for the past 7 years, So now i have around 74k, and it shows Total Returns : -RM6454 Epf annual return range from 5.7-6.9%. Here you lost 8.7%. Wait for klse goes up then shift back to epf. This post has been edited by engyr: Oct 6 2019, 09:57 PM |

|

|

|

|

|

MUM

|

Oct 6 2019, 09:57 PM Oct 6 2019, 09:57 PM

|

|

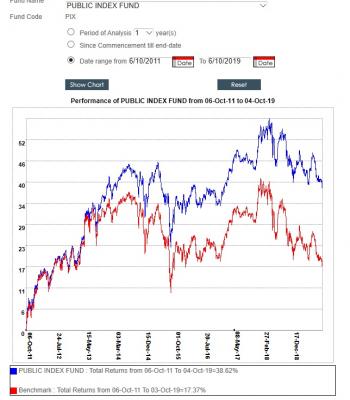

QUOTE(boldsouljah @ Oct 6 2019, 09:47 PM) Sorry, mine is the EPF scheme. I have been putting money into PM from my EPF for the past 7 years, So now i have around 74k, and it shows Total Returns : -RM6454  Sales charge for EPF is 3%..... past 7 yrs doing periodic reinvestment.... with minus 8% ROI......It will be a tough nut to beat if were to includes the cumulation of the yearly 6% opportunity cost may I suggest you stop the reinvestment but invest into some other fund or just stop taking out the money from EPF to earn 6% btw, did you do the calculation of profit/losses by yourself? This post has been edited by MUM: Oct 6 2019, 09:59 PM Attached thumbnail(s)

|

|

|

|

|

|

boldsouljah

|

Oct 6 2019, 10:17 PM Oct 6 2019, 10:17 PM

|

Getting Started

|

QUOTE(MUM @ Oct 6 2019, 09:57 PM)  Sales charge for EPF is 3%..... past 7 yrs doing periodic reinvestment.... with minus 8% ROI......It will be a tough nut to beat if were to includes the cumulation of the yearly 6% opportunity cost may I suggest you stop the reinvestment but invest into some other fund or just stop taking out the money from EPF to earn 6% btw, did you do the calculation of profit/losses by yourself? Using the latets KWSP's Investment portal it says this : Unrealised Profit/Loss (%) MYR - 5625.91(-4.99%) Total : 107k. |

|

|

|

|

|

MUM

|

Oct 6 2019, 10:30 PM Oct 6 2019, 10:30 PM

|

|

QUOTE(boldsouljah @ Oct 6 2019, 10:17 PM) Using the latets KWSP's Investment portal it says this : Unrealised Profit/Loss (%) MYR - 5625.91(-4.99%) Total : 107k. I am not sure about the display from KWSP.... you mentioned total about 74K...here it shows 107K wondering why??  ...if you have opened a PMOnline registration....goto PMO website to login and check the status? |

|

|

|

|

|

boldsouljah

|

Oct 6 2019, 10:36 PM Oct 6 2019, 10:36 PM

|

Getting Started

|

QUOTE(MUM @ Oct 6 2019, 10:30 PM) I am not sure about the display from KWSP.... you mentioned total about 74K...here it shows 107K wondering why??  ...if you have opened a PMOnline registration....goto PMO website to login and check the status? 76k is just from Public Index Fund, i have more $$ in few other funds (Public Global,etc). So the total is 107k from EPF, Public Index Fund has the highest $$ with 76k. |

|

|

|

|

|

MUM

|

Oct 6 2019, 10:42 PM Oct 6 2019, 10:42 PM

|

|

QUOTE(boldsouljah @ Oct 6 2019, 10:36 PM) 76k is just from Public Index Fund, i have more $$ in few other funds (Public Global,etc). So the total is 107k from EPF, Public Index Fund has the highest $$ with 76k. so that 6k losses is/maybe most probably from that few other funds too (Public Global, etc, etc funds)? This post has been edited by MUM: Oct 6 2019, 10:49 PM |

|

|

|

|

|

howszat

|

Oct 6 2019, 11:00 PM Oct 6 2019, 11:00 PM

|

|

QUOTE(boldsouljah @ Oct 6 2019, 09:11 PM) Anyone invested in Public Index Fund ? Mine shows -6k. Scary. Should I withdraw it ? The fund mandate is too inflexible, and fund value has not gone up since 2013. Terrible fund. Yes, dump. |

|

|

|

|

|

boldsouljah

|

Oct 6 2019, 11:08 PM Oct 6 2019, 11:08 PM

|

Getting Started

|

QUOTE(MUM @ Oct 6 2019, 10:42 PM) so that 6k losses is/maybe most probably from that few other funds too (Public Global, etc, etc funds)? Not really.. Fund 1 (Public Index Fund) Lost RM6.7k Fund 2 Made RM50 Fund 3 Made RM1.1k Fund 4 Lost RM127. So in total lost of around 5.5k |

|

|

|

|

|

boldsouljah

|

Oct 6 2019, 11:09 PM Oct 6 2019, 11:09 PM

|

Getting Started

|

QUOTE(howszat @ Oct 6 2019, 11:00 PM) The fund mandate is too inflexible, and fund value has not gone up since 2013. Terrible fund. Yes, dump. When you say dump, you mean bring back the cash to EPF and lose RM6.7k. No chance for this value to go up at all? (For Public Index Fund) ? |

|

|

|

|

Sep 29 2019, 09:33 AM

Sep 29 2019, 09:33 AM

Quote

Quote

0.1288sec

0.1288sec

0.74

0.74

6 queries

6 queries

GZIP Disabled

GZIP Disabled