Has anyone done any purchases throught EPF i-akaun?

I have registered into EPF i-Akaun today.

You can get the temporary user id from a epf kiosk... located in banks like UOB or Bank Rakyat instead of going to a epf branch office.

Make sure epf has your correct mobile number, as the temporary password will be sms to you. (The sms is quite slow, I have to wait about 2-3 minutes before receiving it.)

Then you need to activate it using the temporary id and password... at this webpage

https://secure.kwsp.gov.my/employer/employe...untactivation?0After activation, where you change the id and password and fill in a phrase word... you login into i-akaun

https://secure.kwsp.gov.my/member/member/loginYou would be asked to comfirm your mobile number by requesting a tac to be send to you.

Inside i-akuan, there are several tabs... one of them is "Investment". It will bring you to another site.

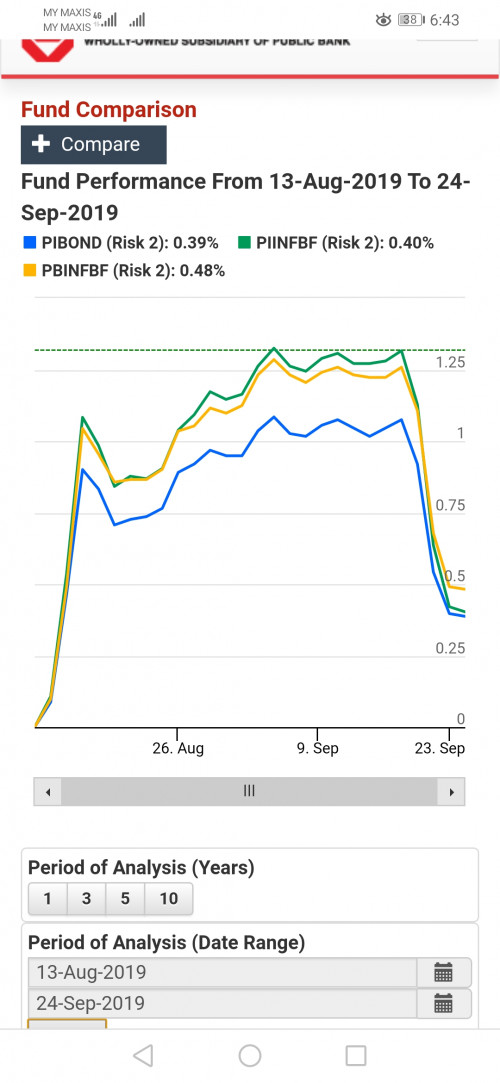

I have only explore it a bit... there is a fund selector, group by fund houses... and yes, the service charge is 0.5%.

Did not go all the way through in completing the "buy"...

=========

I would presume that if say a new fund is purchased from Fund House A, you will have an account with Fund House A.

If Fund House A has online service as like Public Mutual Online, you would then register into the online service to keep track of the fund and to switch to another fund or sell it. Switching and redemption fees will be applied as normal to that fund house.

If several fund houses are selected and the purchases were done and completed, you will have individual accounts with each fund house.

In Public Mutual, it would be safe to assume that any purchases done by epf i-akaun, if the fund is an existing fund you already have, a new account number will be created for that fund. Hence, same fund, 2 separate accounts to indicate who is the agent.

Aug 28 2019, 04:44 PM

Aug 28 2019, 04:44 PM

Quote

Quote

0.0202sec

0.0202sec

0.49

0.49

6 queries

6 queries

GZIP Disabled

GZIP Disabled