QUOTE(mohdyakup @ Jan 11 2016, 10:29 PM)

Not to be a naysayer, but these added value courses aint cheap... CSWIP, API training...

Its my dream to pursue CIPS/MCIPS/PMP a while ago but with the current commitment that I have need to hold that intent for a while...

Pretty much every "established" training course in the industry is insanely expensive. I guess it's a matter of saving your bullets and choosing those or THE one course which would be the most relevant. But surely the training providers themselves would be aware of the state of the industry and should be giving better rates.

QUOTE(kuli2sahaja @ Jan 11 2016, 11:21 PM)

If you are financially able why not?

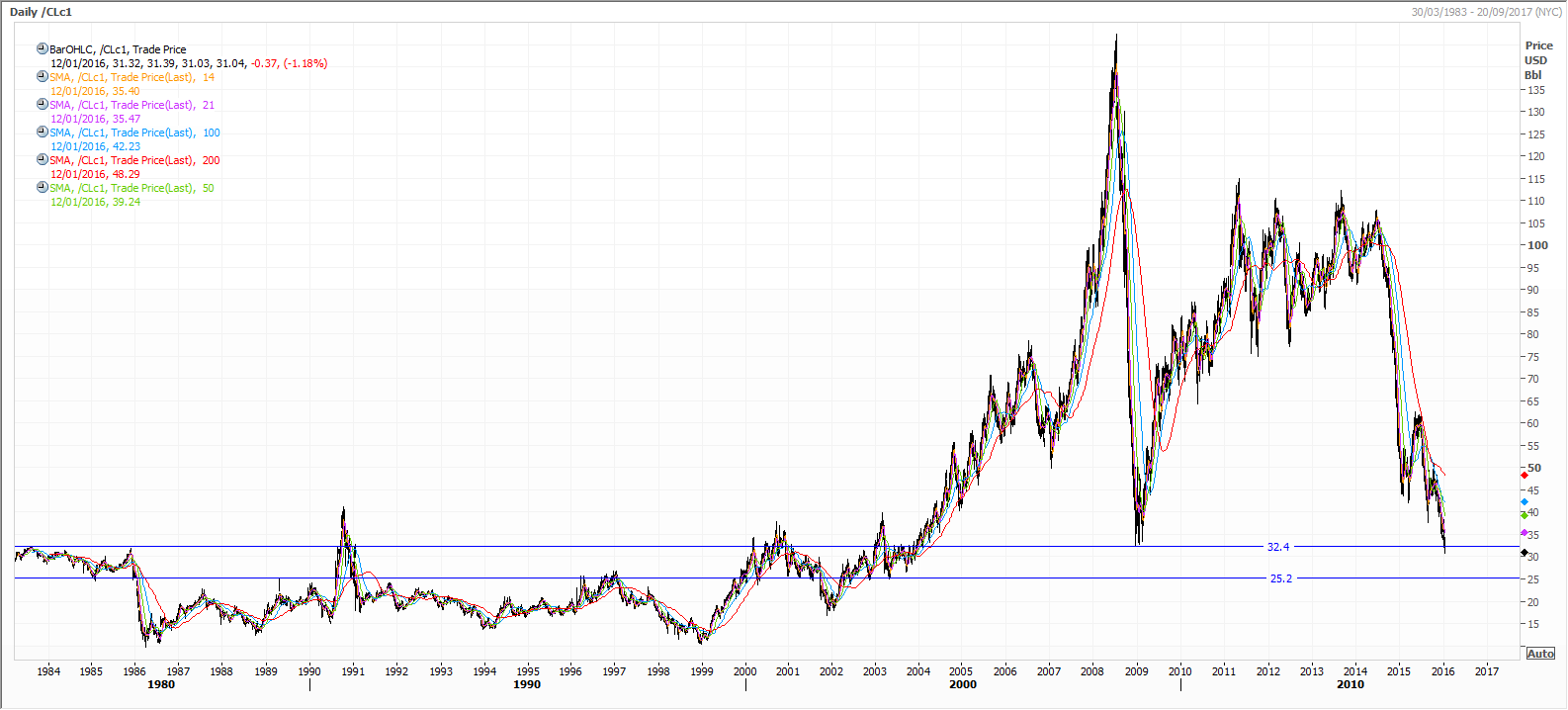

One year to wait out the oil price i think not.

From all the news and forecasts imo it will take a very long time for the industry to recover.

Maybe other sifus can enlighten their opinion more on this topic and hopefully none of the sarcastic remarks.

There are alot of people affected and the number continues to grow, last week a few of my friends got the axe again.

Sadly, I think you might be right about the 1 year duration.

I suppose if someone really wanted to play it safe, then they could choose a course which would be relevant across industries ? This should be easier for Facilities folks. Subsurface people might find it a little more challenging I suppose.

I hate to say this but a "Plan C" would be to take a course to re-orientate towards another field altogether. But damn I wish I never have to make this choice.

Jan 12 2016, 01:37 PM

Jan 12 2016, 01:37 PM

Quote

Quote

0.0377sec

0.0377sec

0.34

0.34

6 queries

6 queries

GZIP Disabled

GZIP Disabled