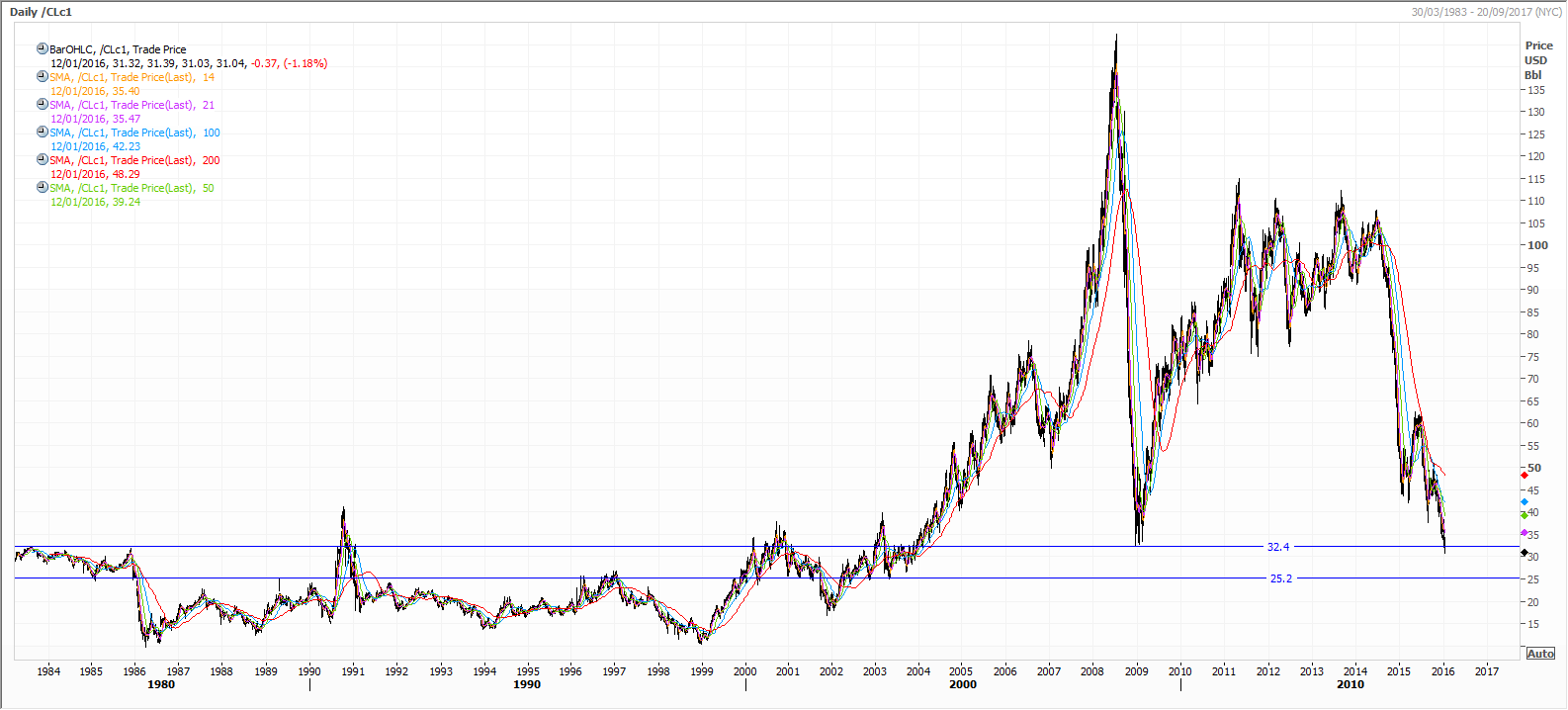

Oil Prices Tumble Below $30 a Barrel

U.S. crude posts lowest settlement since 2003

Oil prices settled below $30 a barrel on Friday for the first time in 12 years as turmoil in Chinese markets and the expected increase in Iranian crude exports added to concerns that a global glut will linger.

Light, sweet crude for February delivery settled down $1.78, or 5.7%, at $29.42 a barrel on the New York Mercantile Exchange, the lowest settlement since November 2003.

Brent, the global benchmark, fell $1.94, or 6.3%, to $28.94 a barrel on ICE Futures Europe, marking the lowest settlement level since February 2004.

After more than a year of collapse, this week saw some of oil prices’ biggest losses since the financial crisis. A glut of oil hasn’t caused producers to slow down and traders are worried that demand won’t grow enough to soak it up. That has pushed oil into a bear market, with both U.S. and global prices down more than 20% since the start of the year.

Dour economic signs have inflamed fears about demand in China, the world’s second-biggest oil consumer. Also, Iranian oil is expected to hit the market soon after long-standing international sanctions are lifted.

“This is a culmination of all those things,” said Michael Tran, commodity strategist at RBC Capital Markets. “It’s all causing a panic in the market where sentiment was already poor to begin with.”

U.S. oil declined 11% this week, marking its 12th losing week of the last 14 and its worst one-week percentage losses in more than a year.

Brent’s weekly percentage losses were the worst since December 2008 and marked its sixth losing week in the past seven.

“With the global economy, we could be in a serious crisis…which translates into a lack of demand for energy,” said Gene McGillian, an analyst at Tradition Energy.

http://www.wsj.com/articles/oil-prices-fal...rrel-1452853918

Jan 13 2016, 04:17 PM

Jan 13 2016, 04:17 PM

Quote

Quote

0.0962sec

0.0962sec

0.67

0.67

6 queries

6 queries

GZIP Disabled

GZIP Disabled