QUOTE(hurtedheart @ Jan 16 2016, 10:40 PM)

the limit that is increased temporarily can't be utilised for bt.Credit Cards Balance Transfer (BT) Plans V3 - Banks Offer List

Credit Cards Balance Transfer (BT) Plans V3 - Banks Offer List

|

|

Jan 18 2016, 12:41 AM Jan 18 2016, 12:41 AM

|

All Stars

11,740 posts Joined: Oct 2013 From: Her Heart |

|

|

|

|

|

|

Jan 18 2016, 02:29 AM Jan 18 2016, 02:29 AM

|

Senior Member

854 posts Joined: Jun 2005 From: N9 |

for AEON BT, which is faster, email the bt form to them, or straight send to menara olympia ground floor their HQ customer service?

|

|

|

Jan 18 2016, 07:58 AM Jan 18 2016, 07:58 AM

|

Senior Member

843 posts Joined: Dec 2015 |

|

|

|

Jan 18 2016, 10:16 AM Jan 18 2016, 10:16 AM

|

Junior Member

565 posts Joined: Mar 2014 |

Regarding BT to Aeon Credit Card, can BT only the statement balance or the latest outstanding balance (i.e. statement balance plus charges subsequent to the statement balance)?

|

|

|

Jan 18 2016, 10:29 AM Jan 18 2016, 10:29 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

|

|

|

Jan 18 2016, 10:31 AM Jan 18 2016, 10:31 AM

|

Junior Member

565 posts Joined: Mar 2014 |

|

|

|

|

|

|

Jan 18 2016, 10:37 AM Jan 18 2016, 10:37 AM

|

Senior Member

2,392 posts Joined: Dec 2009 |

QUOTE(ytan053 @ Jan 18 2016, 10:31 AM) Thanks. How about the statement balance that already included some BT amount? if Bank B for that month has the monthly installment amount included in your balance statement, then you can request Bank C to pay that full amount |

|

|

Jan 18 2016, 10:38 AM Jan 18 2016, 10:38 AM

|

All Stars

11,740 posts Joined: Oct 2013 From: Her Heart |

|

|

|

Jan 18 2016, 11:00 AM Jan 18 2016, 11:00 AM

|

Senior Member

843 posts Joined: Dec 2015 |

|

|

|

Jan 18 2016, 11:28 AM Jan 18 2016, 11:28 AM

|

Junior Member

565 posts Joined: Mar 2014 |

|

|

|

Jan 18 2016, 04:16 PM Jan 18 2016, 04:16 PM

|

Senior Member

721 posts Joined: Sep 2009 |

just went to AMbank asking about their BT promo... currently for new to bank customer.. they are offering 0% for 12months and upon received CC.. if you swipe 1300 within 2months we can get rm388 cash rebate. sounds like a good deal

This post has been edited by opjust: Jan 18 2016, 04:54 PM |

|

|

Jan 18 2016, 04:58 PM Jan 18 2016, 04:58 PM

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

|

|

Jan 18 2016, 05:32 PM Jan 18 2016, 05:32 PM

|

Junior Member

565 posts Joined: Mar 2014 |

|

|

|

|

|

|

Jan 18 2016, 05:58 PM Jan 18 2016, 05:58 PM

|

Senior Member

2,065 posts Joined: Oct 2014 From: Ipoh,Perak |

|

|

|

Jan 18 2016, 11:07 PM Jan 18 2016, 11:07 PM

|

Senior Member

843 posts Joined: Dec 2015 |

QUOTE(opjust @ Jan 18 2016, 04:16 PM) just went to AMbank asking about their BT promo... currently for new to bank customer.. they are offering 0% for 12months and upon received CC.. if you swipe 1300 within 2months we can get rm388 cash rebate. sounds like a good deal last time i cancel their credit card because back to few years they 're doing merging and online system and their credit cards went crazy think now it's time to re-apply back |

|

|

Jan 19 2016, 12:56 PM Jan 19 2016, 12:56 PM

|

Senior Member

986 posts Joined: Sep 2011 |

Wow 1st time using AEON CC for 1 year that CS called me to offer me 0% 6 months BT. Previously all my BT is submit ownself and because now is 6 months once so mafan.

My last BT payment shown in statement on 18th Jan (yesterday), today straight call me to ask me apply for 0% BT. How I wish they call me halfway through my BT rather than wait until finish only call |

|

|

Jan 19 2016, 01:27 PM Jan 19 2016, 01:27 PM

|

Junior Member

365 posts Joined: Dec 2006 |

Hi all,

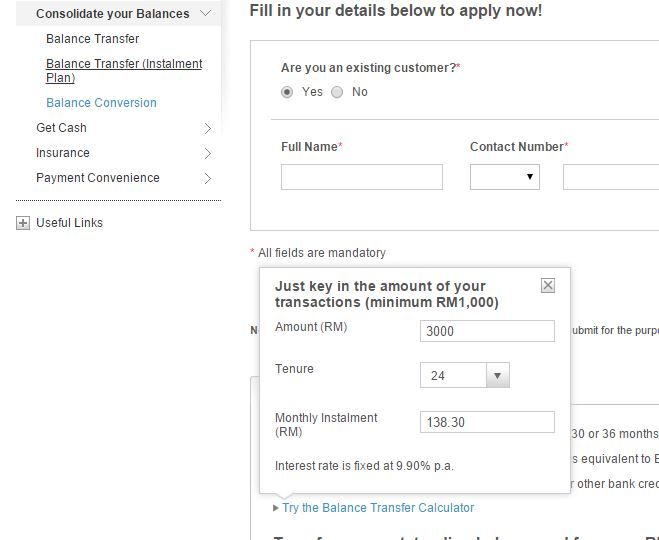

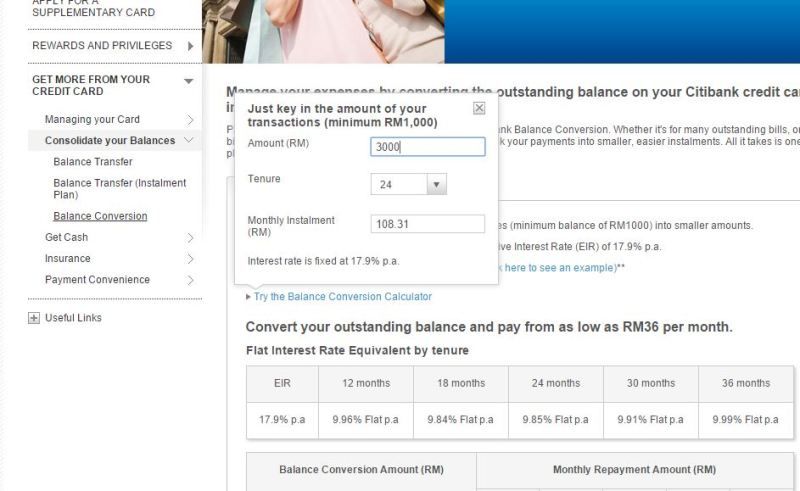

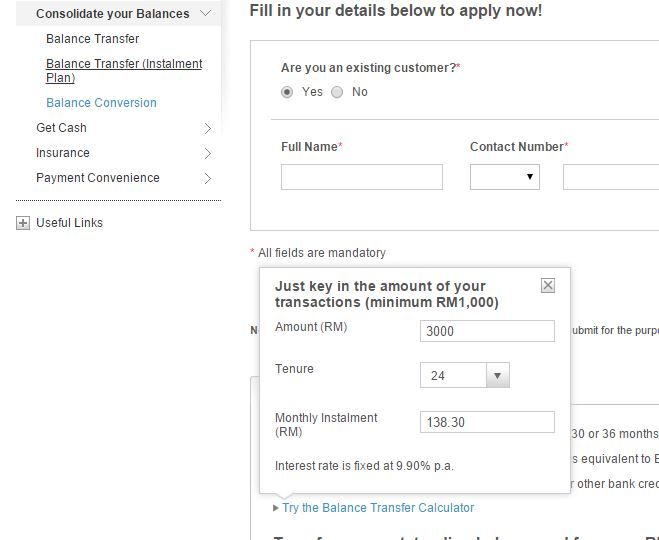

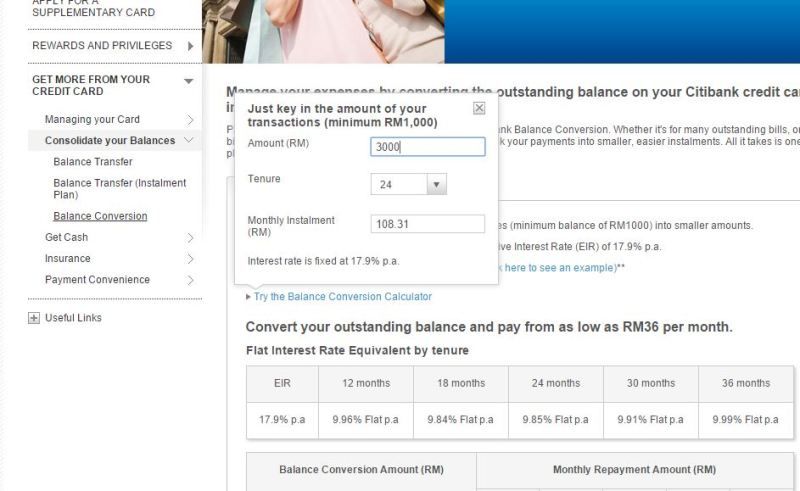

I wanna ask question. 1 got 2 credits card. 1 citibank, 1 cimb. Both got outstanding amount around RM 4k (total rm 8k). Now, I got around RM 5k cash to settle the amount in my credit card. I want to terminate one CC and only use one CC. My plans are Plan A Pay all outstanding amount in Citibank CC and the remaining cash to CIMB CC. My total credit card outstanding amount is RM 3k (only in CIMB). I will balance transfer RM 3k to my Citibank and terminate my CIMB cc. Citibank balance transfer - Flat Interest Rate between 5.32% - 5.81% p.a. which is equivalent to Effective Interest Rate (EIR) of 9.9% p.a. Actually, I am not sure about difference between flat interest rate and effective interest rate.  I have to pay RM 138.30 Plan B Pay all outstanding amount in CIMB CC and the remaining cash to Citibank CC. My total credit card outstanding amount is RM 3k (only in Citibank). I will do balance conversion RM 3k to my Citibank and terminate my CIMB cc. Citibank balance conversion - Flat Interest Rate between 9.84 - 9.99% p.a. for Effective Interest Rate (EIR) of 17.9% p.a.  I have to pay RM 108.31 The interest rate is higher in plan B but why do i need to pay $ lower than plan A? The reason why i dont want to choose CIMB balance transfer is only max 12 month. Which plan should i choose? Or u guys got other better plans? Thank you for your help. This post has been edited by Prince of Andalus: Jan 19 2016, 02:02 PM |

|

|

Jan 19 2016, 01:38 PM Jan 19 2016, 01:38 PM

|

Senior Member

721 posts Joined: Sep 2009 |

QUOTE(Prince of Andalus @ Jan 19 2016, 01:27 PM) Hi all, If i were you.. i'll keep my 5k somewhere else that can earn me money.. since you wanna cut down 1card.. let's just stick to your plan on settle one CC and BT another one. I wanna ask question. 1 got 2 credits card. 1 citibank, 1 cimb. Both got outstanding amount around RM 4k. Now, I got around RM 5k cash to settle the amount in my credit card. I want to terminate one CC and only use one CC. My plans are Plan A Pay all outstanding amount in Citibank CC and the remaining cash to CIMB CC. My total credit card outstanding amount is RM 3k (only in CIMB). I will balance transfer RM 3k to my Citibank and terminate my CIMB cc. Citibank balance transfer - Flat Interest Rate between 5.32% - 5.81% p.a. which is equivalent to Effective Interest Rate (EIR) of 9.9% p.a. Actually, I am not sure about difference between flat interest rate and effective interest rate.  I have to pay RM 138.30 Plan B Pay all outstanding amount in CIMB CC and the remaining cash to Citibank CC. My total credit card outstanding amount is RM 3k (only in Citibank). I will do balance conversion RM 3k to my Citibank and terminate my CIMB cc. Citibank balance conversion - Flat Interest Rate between 9.84 - 9.99% p.a. for Effective Interest Rate (EIR) of 17.9% p.a.  I have to pay RM 108.31 The interest rate is higher in plan B but why do i need to pay $ lower than plan A? The reason why i dont want to choose CIMB balance transfer is only max 12 month. Which plan should i choose? Or u guys got other better plans? Thank you for your help. for balance transfer since there's no good interest rate offered by your bank, why dont you find for 0% one... you can apply PB CC or AMbank CC... both of that you can straight do BT 0% for 12months... from your calculation, i think there is something wrong with that... if you were to BT 3k for 24months..with 0% you have to pay 125/month.... it can't be any lower than that. This post has been edited by opjust: Jan 19 2016, 01:42 PM |

|

|

Jan 19 2016, 01:59 PM Jan 19 2016, 01:59 PM

|

Junior Member

365 posts Joined: Dec 2006 |

QUOTE(opjust @ Jan 19 2016, 01:38 PM) If i were you.. i'll keep my 5k somewhere else that can earn me money.. since you wanna cut down 1card.. let's just stick to your plan on settle one CC and BT another one. That's why. I think something wrong with the citibank balance conversion calculator.for balance transfer since there's no good interest rate offered by your bank, why dont you find for 0% one... you can apply PB CC or AMbank CC... both of that you can straight do BT 0% for 12months... from your calculation, i think there is something wrong with that... if you were to BT 3k for 24months..with 0% you have to pay 125/month.... it can't be any lower than that. I can earn more money using my 5k? In stock market? I actually want to avoid cc interest rate 18% annually. I quite noob actually in manipulating bank. Edited: Do u guys know balance transfer offer with good vouchers or rebate? Last time i heard imoney offer balance transfer with lazada voucher if im not mistaken. This post has been edited by Prince of Andalus: Jan 19 2016, 02:01 PM |

|

|

Jan 19 2016, 03:19 PM Jan 19 2016, 03:19 PM

Show posts by this member only | IPv6 | Post

#2460

|

Junior Member

285 posts Joined: Oct 2011 |

maybank still had 0% balance transfer? i thaught still had 3.88 % one time payment.

|

|

Topic ClosedOptions

|

| Change to: |  0.0271sec 0.0271sec

0.31 0.31

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 06:42 AM |