QUOTE(guy3288 @ Jan 11 2016, 01:33 PM)

Why MBF is better than BSN with current deal?Credit Cards Balance Transfer (BT) Plans V3 - Banks Offer List

Credit Cards Balance Transfer (BT) Plans V3 - Banks Offer List

|

|

Jan 12 2016, 02:31 PM Jan 12 2016, 02:31 PM

Return to original view | Post

#1

|

Senior Member

721 posts Joined: Sep 2009 |

|

|

|

|

|

|

Jan 18 2016, 04:16 PM Jan 18 2016, 04:16 PM

Return to original view | Post

#2

|

Senior Member

721 posts Joined: Sep 2009 |

just went to AMbank asking about their BT promo... currently for new to bank customer.. they are offering 0% for 12months and upon received CC.. if you swipe 1300 within 2months we can get rm388 cash rebate. sounds like a good deal

This post has been edited by opjust: Jan 18 2016, 04:54 PM |

|

|

Jan 19 2016, 01:38 PM Jan 19 2016, 01:38 PM

Return to original view | Post

#3

|

Senior Member

721 posts Joined: Sep 2009 |

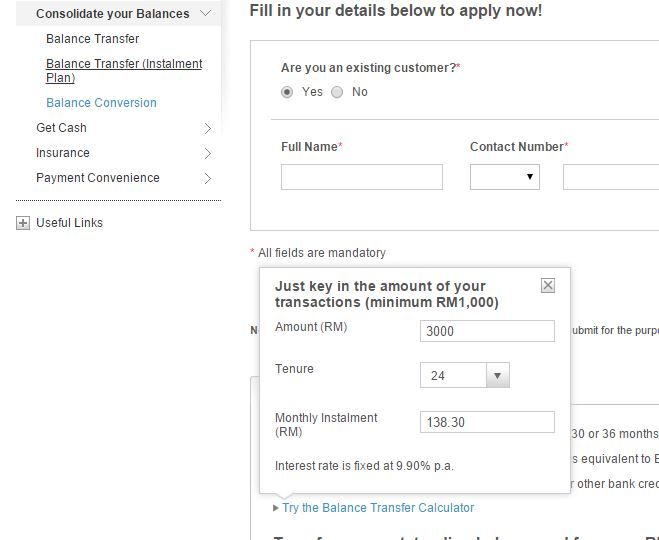

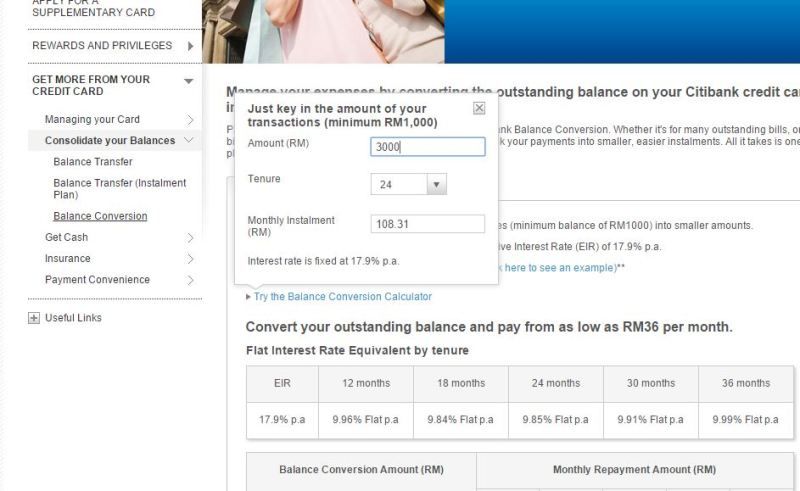

QUOTE(Prince of Andalus @ Jan 19 2016, 01:27 PM) Hi all, If i were you.. i'll keep my 5k somewhere else that can earn me money.. since you wanna cut down 1card.. let's just stick to your plan on settle one CC and BT another one. I wanna ask question. 1 got 2 credits card. 1 citibank, 1 cimb. Both got outstanding amount around RM 4k. Now, I got around RM 5k cash to settle the amount in my credit card. I want to terminate one CC and only use one CC. My plans are Plan A Pay all outstanding amount in Citibank CC and the remaining cash to CIMB CC. My total credit card outstanding amount is RM 3k (only in CIMB). I will balance transfer RM 3k to my Citibank and terminate my CIMB cc. Citibank balance transfer - Flat Interest Rate between 5.32% - 5.81% p.a. which is equivalent to Effective Interest Rate (EIR) of 9.9% p.a. Actually, I am not sure about difference between flat interest rate and effective interest rate.  I have to pay RM 138.30 Plan B Pay all outstanding amount in CIMB CC and the remaining cash to Citibank CC. My total credit card outstanding amount is RM 3k (only in Citibank). I will do balance conversion RM 3k to my Citibank and terminate my CIMB cc. Citibank balance conversion - Flat Interest Rate between 9.84 - 9.99% p.a. for Effective Interest Rate (EIR) of 17.9% p.a.  I have to pay RM 108.31 The interest rate is higher in plan B but why do i need to pay $ lower than plan A? The reason why i dont want to choose CIMB balance transfer is only max 12 month. Which plan should i choose? Or u guys got other better plans? Thank you for your help. for balance transfer since there's no good interest rate offered by your bank, why dont you find for 0% one... you can apply PB CC or AMbank CC... both of that you can straight do BT 0% for 12months... from your calculation, i think there is something wrong with that... if you were to BT 3k for 24months..with 0% you have to pay 125/month.... it can't be any lower than that. This post has been edited by opjust: Jan 19 2016, 01:42 PM |

|

|

Jan 21 2016, 10:38 AM Jan 21 2016, 10:38 AM

Return to original view | Post

#4

|

Senior Member

721 posts Joined: Sep 2009 |

|

|

|

Feb 18 2016, 03:21 PM Feb 18 2016, 03:21 PM

Return to original view | Post

#5

|

Senior Member

721 posts Joined: Sep 2009 |

|

|

|

Feb 28 2016, 01:26 AM Feb 28 2016, 01:26 AM

Return to original view | Post

#6

|

Senior Member

721 posts Joined: Sep 2009 |

I applied BT with BSN, since i dont have any bsn cc, applied one also... What surprised me is that, i haven't collect my card yet but the BT has been transfered to my account.

|

|

|

|

|

|

Feb 28 2016, 03:03 PM Feb 28 2016, 03:03 PM

Return to original view | Post

#7

|

Senior Member

721 posts Joined: Sep 2009 |

|

|

|

Feb 28 2016, 03:06 PM Feb 28 2016, 03:06 PM

Return to original view | Post

#8

|

Senior Member

721 posts Joined: Sep 2009 |

|

|

|

Feb 28 2016, 03:35 PM Feb 28 2016, 03:35 PM

Return to original view | Post

#9

|

Senior Member

721 posts Joined: Sep 2009 |

QUOTE(victorywp @ Feb 28 2016, 03:13 PM) Hmm... I haven't collected the card even till now. Very strange situation though.. I'm thinking what happened if i never collect the card, since the bank call me if i dont collect for more 2mnths i will be cancelled. Lol! |

|

|

Feb 28 2016, 06:39 PM Feb 28 2016, 06:39 PM

Return to original view | Post

#10

|

Senior Member

721 posts Joined: Sep 2009 |

|

|

|

Feb 29 2016, 10:39 AM Feb 29 2016, 10:39 AM

Return to original view | Post

#11

|

Senior Member

721 posts Joined: Sep 2009 |

QUOTE(nestahng @ Feb 29 2016, 06:42 AM) Hi bro, okay,below is what i understand Thanks for your time first of all. Let's say I'm interested in plan D, where the tenure is 12 months, and the interest rate is "0% for the first 6 months and subsequent months at 0.30%". Let's assume the amount I BT is RM 10,000. How much total in interest I will be paying if I repay to BSN using the following 2 payment patterns? A. Every month RM 850 for first eleven months and the remaining on the 12th month B. Every month RM 1500 for first six months, RM 150 from 7th month to 11th month and the remaining on 12th month I'm asking the above because from the Saving Table they provided in their website, it seems like they charge you interest based on the initial amount of BT(in example above it's RM 10,000), regardless of your outstanding balance from 6th month onwards(Since plan D stated that "0% for the first 6 months and subsequent months at 0.30%"). The following link is the Saving Table from their website. http://www.mybsn.com.my/content.xhtml?contentId=285 BT amount : 10 000 Plan : Plan D ( 0% for 1st 6months and 0.3% for the remaining 6months) Installment 1st 6months at 0% : 5000/6 = 833.33 Installment remaining 6months at 0.3% = 5000*1.03/6 = 858.33 Total interest for 12months = 150 make sense to you?? |

|

Topic ClosedOptions

|

| Change to: |  0.0455sec 0.0455sec

0.50 0.50

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 07:35 PM |