Outline ·

[ Standard ] ·

Linear+

Fixed Deposit Rates in Malaysia V7, Please Read Post# 1 & 2

|

okuribito

|

Nov 7 2014, 02:08 PM Nov 7 2014, 02:08 PM

|

|

QUOTE(Gen-X @ Nov 7 2014, 10:58 AM) Bro, fantastic rates indeed. Actually too good to be true. I would appreciate if you could triple confirm with the RHB person that SMS you that there is no CASA requirement. Updated above to Post#1 and also added BR new rates. hehehe told my fren about the promo. straightaway he went & got it done, no casa bs. straight fresh fund fd  now i sitting with him at nasi kandar place waiting out the rain - he buy me lunch  |

|

|

|

|

|

bbgoat

|

Nov 7 2014, 02:09 PM Nov 7 2014, 02:09 PM

|

|

QUOTE(okuribito @ Nov 7 2014, 02:08 PM) hehehe told my fren about the promo. straightaway he went & got it done, no casa bs. straight fresh fund fd  now i sitting with him at nasi kandar place waiting out the rain - he buy me lunch  Nothing for me ?   |

|

|

|

|

|

aeiou228

|

Nov 7 2014, 02:49 PM Nov 7 2014, 02:49 PM

|

|

QUOTE(bbgoat @ Nov 6 2014, 08:30 PM) Received SMS from RHB manager. New FD promo until Dec 5. 6 mths 4%. 9 mths 4.15%. Min 50k. Note separate FD promo of 6 mths and 9 mths, not step up like previously. Rather good rate.  Both promo very good except min 50k required.  One of the best updates so far. Thank you  My RHB 15 mths Step up FD first Q (3.48%) due today. Thought want to switch over to this promo since RHB allow uplifting every 3 months without penalty. But after counting the remaining 4Q step up FD average yield (3.68+3.88+4.08+5.38), it is much higher at 4.255%. So tak jadi switch. From this experience, we can see how effective it is a step up FD hold back depositors with gradual rate increase towards the end of FD tenure even though withdrawal without penalty is allow every quarter. |

|

|

|

|

|

dEviLs

|

Nov 7 2014, 02:53 PM Nov 7 2014, 02:53 PM

|

|

QUOTE(okuribito @ Nov 7 2014, 02:01 PM) actually me no experience with it. one day a bit back was at bank & this uncle started chatting , told me about diversifying, how he got 7% pa. Got me curious & he led me to his H private banking mgr. hahaha gave me coffee & started talking about these auto-callable foreign currency equity index linked structured deposit - damn, that's a freaking mouthful for my simple mind la  Anyway, i ask what is auto-callable. Was told that if the idx went up beyond a certain threshold, the bank had the right to end your structured deposit ie give you your money back lah. So I asked, do we get to earn anything if the idx go up? Well, yes & no. Only little bit lah because beyond that threshold, they will call in your structured deposit. Long story short, you don't get to participate in the idx's upside & your deposit also finito like premature ejac before maturity. So I thot why so lousy one??? summore got foreign exchange risk. hahaha too complicated for me lah how about you? what they try to sell u? ya thats the whole idea that the rm trying to sell me, for me its like a medium (slightly skewed to high) risk investment, high risk return is usually those naked outright investment but again high risk high return i am ok with this risk appetite cos i sought to diversify my portfolio, its medium for me cos it offers higher than the convention return plus certain protection to a level, it is like a short straddle strategy that bring yields in lacklustre market but i give this a pass simply becos i dont fancy the underlying  |

|

|

|

|

|

TSGen-X

|

Nov 7 2014, 02:53 PM Nov 7 2014, 02:53 PM

|

Lifetime LYN Member

|

QUOTE(okuribito @ Nov 7 2014, 02:08 PM) hehehe told my fren about the promo. straightaway he went & got it done, no casa bs. straight fresh fund fd  now i sitting with him at nasi kandar place waiting out the rain - he buy me lunch  hahaha, reading this thread got side benefit also QUOTE(bbgoat @ Nov 7 2014, 02:09 PM) Nothing for me ?   Bro, sad to tell you we doing charity work to make other richer, hahahaha |

|

|

|

|

|

chintmy

|

Nov 7 2014, 03:03 PM Nov 7 2014, 03:03 PM

|

Getting Started

|

I went to RHB bank during lunch asking about the 4% for 6 months. No such offer...

|

|

|

|

|

|

dagdag1

|

Nov 7 2014, 03:23 PM Nov 7 2014, 03:23 PM

|

New Member

|

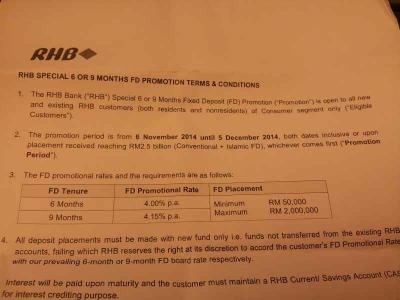

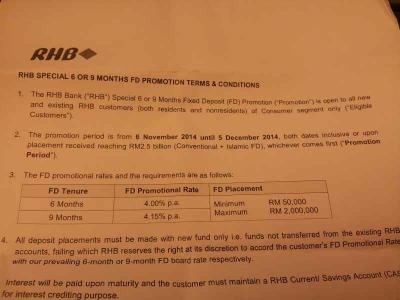

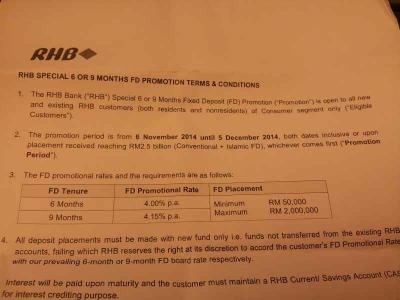

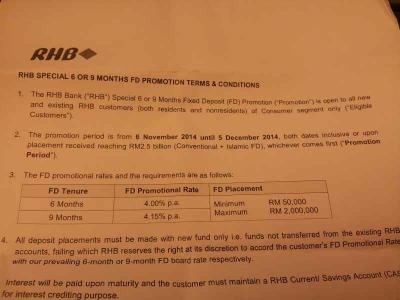

RHB 4% for 6 month ongoing.

|

|

|

|

|

|

dEviLs

|

Nov 7 2014, 03:38 PM Nov 7 2014, 03:38 PM

|

|

QUOTE(dagdag1 @ Nov 7 2014, 03:23 PM) RHB 4% for 6 month ongoing.

oh need to open casa for interest crediting  |

|

|

|

|

|

dagdag1

|

Nov 7 2014, 03:44 PM Nov 7 2014, 03:44 PM

|

New Member

|

no need, it pure FD

|

|

|

|

|

|

dEviLs

|

Nov 7 2014, 03:55 PM Nov 7 2014, 03:55 PM

|

|

QUOTE(dagdag1 @ Nov 7 2014, 03:44 PM) i know casa earmark is not required to qualify for the promo but need to hustle to open casa for interest crediting as i dont have any with them |

|

|

|

|

|

bbgoat

|

Nov 7 2014, 05:13 PM Nov 7 2014, 05:13 PM

|

|

QUOTE(aeiou228 @ Nov 7 2014, 02:49 PM) One of the best updates so far. Thank you  My RHB 15 mths Step up FD first Q (3.48%) due today. Thought want to switch over to this promo since RHB allow uplifting every 3 months without penalty. But after counting the remaining 4Q step up FD average yield (3.68+3.88+4.08+5.38), it is much higher at 4.255%. So tak jadi switch. From this experience, we can see how effective it is a step up FD hold back depositors with gradual rate increase towards the end of FD tenure even though withdrawal without penalty is allow every quarter. Ya. I also have fund tie up by this 3 mth step up of RHB. They lure us to keep it until final 3 mth of 5.38% !  QUOTE(Gen-X @ Nov 7 2014, 02:53 PM) Bro, sad to tell you we doing charity work to make other richer, hahahaha Ya lah. Before I post it, I even double checked with RHB manager as the deal is really sweet. The best so far for 6 and 9 mth FD deals !!   This post has been edited by bbgoat: Nov 7 2014, 05:14 PM This post has been edited by bbgoat: Nov 7 2014, 05:14 PM |

|

|

|

|

|

chintmy

|

Nov 7 2014, 05:46 PM Nov 7 2014, 05:46 PM

|

Getting Started

|

Will have to print this out and then go to the bank... I guess they didn't notify all their staffs on the promotions.

|

|

|

|

|

|

kyenli

|

Nov 7 2014, 07:39 PM Nov 7 2014, 07:39 PM

|

Getting Started

|

For fresh fund purpose, would bank accept if the cheque is under someone else's name? Or must the cheque name and fd account holder name be the same?

|

|

|

|

|

|

SUSDavid83

|

Nov 7 2014, 08:02 PM Nov 7 2014, 08:02 PM

|

|

QUOTE(kyenli @ Nov 7 2014, 07:39 PM) For fresh fund purpose, would bank accept if the cheque is under someone else's name? Or must the cheque name and fd account holder name be the same? Of course, the name must be same. Otherwise, how to "cash" the cheque to your FD account which is under your name? |

|

|

|

|

|

aeiou228

|

Nov 7 2014, 08:24 PM Nov 7 2014, 08:24 PM

|

|

QUOTE(kyenli @ Nov 7 2014, 07:39 PM) For fresh fund purpose, would bank accept if the cheque is under someone else's name? Or must the cheque name and fd account holder name be the same? Someone else name also can, just open a joint FD account with that someone else. |

|

|

|

|

|

TSGen-X

|

Nov 7 2014, 09:18 PM Nov 7 2014, 09:18 PM

|

Lifetime LYN Member

|

QUOTE(dagdag1 @ Nov 7 2014, 03:23 PM) RHB 4% for 6 month ongoing.

Thank you. You are now officially a Committee Member of FDMCGC  Will update Post#1 with photo. dagdag1 - can I use your image for my FD Page at my blog and will give you credit - "Posted by dagdag1 at LYN". This post has been edited by Gen-X: Nov 7 2014, 09:23 PM |

|

|

|

|

|

SUSDavid83

|

Nov 7 2014, 09:25 PM Nov 7 2014, 09:25 PM

|

|

QUOTE(Gen-X @ Nov 7 2014, 09:18 PM) Thank you. You are now officially a Committee Member of FDMCGC  Will update Post#1 with photo. dagdag1 - can I use your image for my FD Page at my blog and will give you credit - "Posted by dagdag1 at LYN". What does FDMCGC stand for? |

|

|

|

|

|

kyenli

|

Nov 7 2014, 09:36 PM Nov 7 2014, 09:36 PM

|

Getting Started

|

QUOTE(David83 @ Nov 7 2014, 08:02 PM) Of course, the name must be same. Otherwise, how to "cash" the cheque to your FD account which is under your name? What I meant was the cheque is not issued by myself, but maybe a friend. |

|

|

|

|

|

SUSDavid83

|

Nov 7 2014, 09:40 PM Nov 7 2014, 09:40 PM

|

|

QUOTE(kyenli @ Nov 7 2014, 09:36 PM) What I meant was the cheque is not issued by myself, but maybe a friend. As long as the name of the cheque is you, doesn't matter who is the issuer. The issuer could be a bank in the case of banker's cheque. |

|

|

|

|

|

nubJeff

|

Nov 7 2014, 09:47 PM Nov 7 2014, 09:47 PM

|

|

Hi all, Just an update for UOB Fixed Deposits under COMPANY level, 3 months 3.80% P.A~ Do PM me if you need more informations  |

|

|

|

|

Nov 7 2014, 02:08 PM

Nov 7 2014, 02:08 PM

Quote

Quote

0.0300sec

0.0300sec

0.40

0.40

6 queries

6 queries

GZIP Disabled

GZIP Disabled