Original FD Thread

Fixed Deposit Rates in Malaysia V2

Fixed Deposits Rates in Malaysia V3

Fixed Deposit Rates in Malaysia V4

Fixed Deposits Rates in Malaysia V5

Fixed Deposits Rates in Malaysia V6.1

Note: Please refer to Post#2 for latest FD Promos by BoomChaCha

Notice / Disclaimer:-

Call & Visit the respective banks for confirmation & latest promotion.

We are not liable to any misinformation which might cause any financial or opportunity loss (which include FD rates & any others information).

Malaysia Major Commercial Banks and Foreign Banks Fixed Deposit / Time Deposit Rates as of 18 July 2014.

Bank - FD rates for 1 month, 3 months, 6 months and 12 months.

Affin Bank - 3.25%, 3.3%, 3.40% and 3.7% (Revised 18/7/14)

Alliance Bank - 3.15%, 3.2%, 3.25% and 3.3% (Revised 21/7/14). FD Gold 12 months 3.40% (Interest paid monthly).

AmBank - 3.15, 3.2%, 3.25% and 3.35% (Revised 18/7/14)

Citibank - 2.95%, 3.10%, 3.10% and 3.20% (Revised 17/7/14)

CIMB Bank - 3.15%, 3.2%, 3.25% and 3.30% (Revised down 7/10/14)

Hong Leong Bank - 3.05%, 3.1%, 3.2% and 3.30% (Revised 16/7/14)

HSBC Bank - 2.90%, 3.10%, 3.15% and 3.25% (Revised 16/7/14)

Maybank - 3.15%, 3.20%, 3.25% and 3.30% (Revised 16/7/14)

OCBC Bank - 2.75%, 2.85%, 2.9% and 3.05%

RHB Bank - 3.15%, 3.20%, 3.25% and 3.45% (Revised 18/7/14)

Public Bank - 3.15%, 3.20%, 3.30% and 3.35%. PB Golden 50 Plus 12 months 3.45% (Revised 16/7/14)

Standard Chartered Bank - 2.95%, 3.10%, 3.15% and 3.25% (Revised 23/7/14)

UOB Bank - 3.05%, 3.10%, 3.10% and 3.30% (Revised 18/7/14)

Fixed / Time Deposit and Savings Account Promotions 2014

Please call the nearest bank to reconfirm the rates (go to the bank website for bank contact number where you can also get the contact number of the branch nearest to you) before going to the bank to check if promotions are still valid.

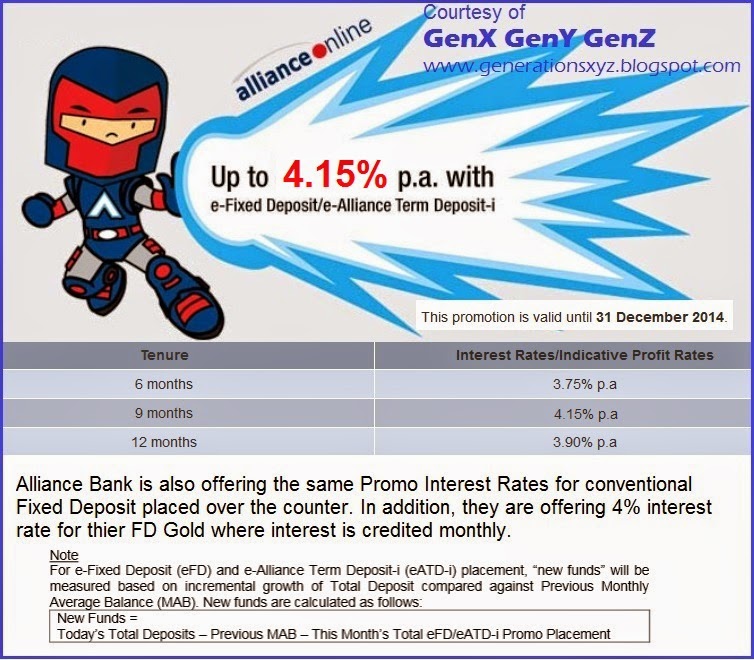

ALLIANCE BANK - valid until 31 December 2014.

For those of you above 40 years young, Alliance Bank is offering 4.1% for their FD Gold with minimum fresh fund RM30K.

Please note that the definition of Fresh Fund for Alliance eFD promo - contributed by kyenli

AFFIN BANK - contributed by Ramjade

QUOTE(Ramjade @ Nov 11 2014, 06:40 PM)

Affin bank CNY Promo min Rm10k until April 2015

1) 4.18% for 15 months casa 15% of money of FD

2) 4.28% for 18 months casa 10% of money of FD

3) 4.38% for 24 months no casa. Just normal account for them to deposit interest

(opening account Rm100)

*1) 4.18% for 15 months casa 15% of money of FD

2) 4.28% for 18 months casa 10% of money of FD

3) 4.38% for 24 months no casa. Just normal account for them to deposit interest

(opening account Rm100)

HONG LEONG BANK

4.08% for 12 months

HLB Junior FD - 4.15% for 24 Months Tenure

*

MACH by HLB - MACH 3.85% for their 12 Months FD online interest rates

OCBC BANK - Minimum RM10K. Promo until 31 March 2015.

3 mth 3.8%,

6 mth 4%

UOB BANK - Until 28 February 2015

No Stupid CASA Requirements, No Step Up Rubbish and No need to have Savings or Cuurent Account!

Minimum RM10K Fresh Fund

3 Months - 3.85%

12 Months 4.10%

Christmas FD Promo until 24 Dece 2014 - Minimum Fresh Fund RM50K

6 Months 4%

12 Months -4.2%

*

RHB BANK - 1st reported and subsequent revisions by bbgoat and top secret brochure/image by dagdag1

QUOTE(bbgoat @ Dec 16 2014, 10:16 AM)

Just received info from RHB Bank manager that HQ informed them that the 6/9 mth FD promotion min placement has been reduced from 50k to 10k. The rates are as before at 4%/4.15% respectively. It will end by end of Dec.

*

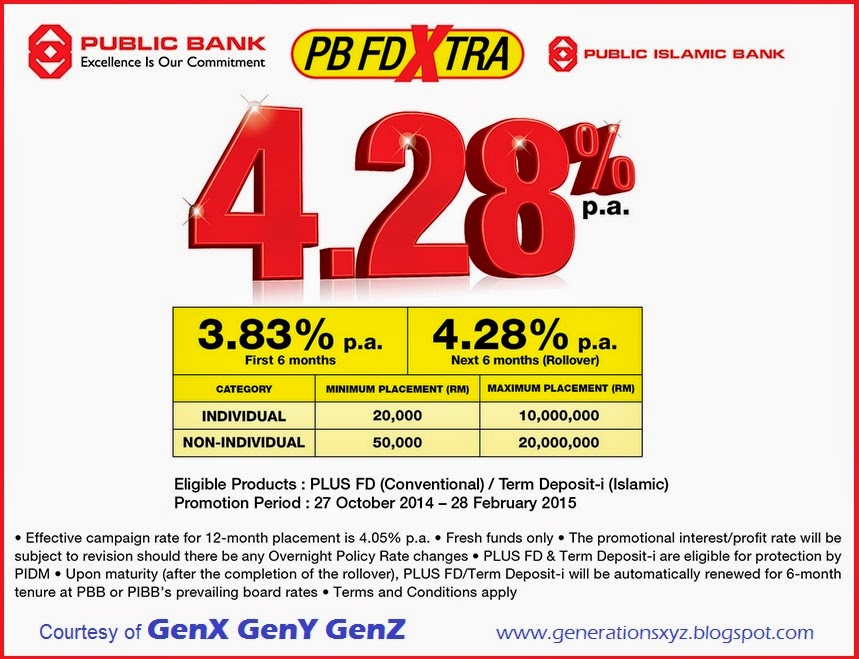

PUBLIC BANK - 12 Months Step Up FD. Effective 27 October 2014 until February 2015. - First reported by cklimm

*

BANK RAKYAT - NOT Eligible for PIDM

If you are willing to go deposit with a non PIDM member, then check out Bank Rakyat Deposit Account -i which is based on Islamic Principles and like all Islamic banks' products, the profit rate cannot be guaranteed.

Thanks to all members who highlighted that deposit more than RM5K with BR is now eligible for monthly dividend. However, please note that many members here reported that their monthly dividends were not be credited monthly but they have to call up BR staff to have it done manually every month!!!

Special thanks to bbgoat for reporting the tenure to be eligible for monthly dividend:

QUOTE(bbgoat @ Apr 16 2014, 06:45 PM)

**

For more Fixed Deposit Promotions and my comments on them, please click here to my FD Page.

If you are new to Fixed Deposit or even a serious FD fan, click here to my article Get More FREE MONEY With The Right Fixed Deposit Promotions.

FDMCGC - Fixed Deposit Musical Chair Gamers Club

» Click to show Spoiler - click again to hide... «

FRMONBWFDP - Freaking Rich Members Or Not Bothered With FD Promotions but contributors to FD Thread

» Click to show Spoiler - click again to hide... «

This post has been edited by Gen-X: Dec 16 2014, 11:09 AM

Sep 6 2014, 01:10 AM, updated 11y ago

Sep 6 2014, 01:10 AM, updated 11y ago

Quote

Quote

0.0646sec

0.0646sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled