QUOTE(ChenHo123 @ May 31 2020, 10:19 PM)

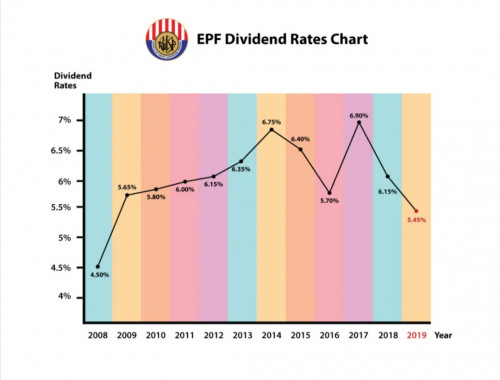

You have a point. But EPF currently gives out interest rate between 5.5%-8% the the past 10 years. Considering capital is Guaranteed (Super save risk), its hard to find alternate investment which can beat it.

You don't have to beat EPF rate, its ok to be slightly lower than EPF because EPF is locked until 55 years old. EPF with 5.5% compared to let's say ASM which gives ~4.5%, ASM will still be better because you can redeem it anytime and is as good as cash.

Another way will be to invest in property. Let's say if you found a good deal in the market but all of your money is invested in EPF, you'll miss out on the deal.

Of course, EPF is important for your retirement savings. There's where the compulsory EPF contribution comes in. You can just leave it inside and let it grow as your retirement savings.

May 31 2020, 10:26 PM

May 31 2020, 10:26 PM

Quote

Quote

0.0295sec

0.0295sec

0.55

0.55

6 queries

6 queries

GZIP Disabled

GZIP Disabled