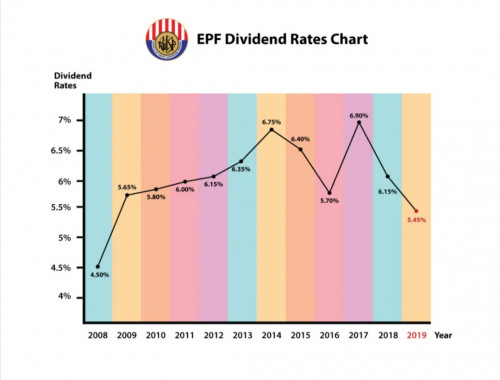

1. Maximize your Kwsp n ASNB FP investments. No point hoping for rates to go up to moon, if you ain't got lots of money in those 2 God-given financial instruments.

2. Prepare liquid cash to spaculate in Black Swan events... Cough! Cough! Fever! I think one's brewing now. Wealth changing hands events.

3. In event, the Fiat currency seems taking a bad turn for the worse n the ruling Govt seems lost... Diversify n use those dividends to buy hard assets, protect against inflation...love my precious biscuits, all courtesy from ASM123.

Jan 29 2020, 08:19 PM

Jan 29 2020, 08:19 PM

Quote

Quote

0.0413sec

0.0413sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled