Outline ·

[ Standard ] ·

Linear+

EPF DIVIDEND, EPF

|

Wedchar2912

|

May 26 2020, 02:34 PM May 26 2020, 02:34 PM

|

|

QUOTE(Unkerpanjang @ May 26 2020, 01:15 PM) Based on your last paragraph, most readers wud have immediately categorised you as T20% or even T10%. (last Kwsp report suggests only 0.5% active contributors hit above the $1mil savings mark)...Congrats! haha... that is the beauty of my wild proposal. The condition is that the bonus dividend must be spent, and so everyone can take the bonus dividend and spend... via e-wallets??? Then again, you are right. For those super high T20 (I call them T01) say some CEO or former CEO of a bank (hint hint), if they have say 10 million ringgit in EPF and the bonus dividend is 3%, they will get 300K ringgit to spend. Headache for them... a cheap beemer is too "low class" for them to buy.  |

|

|

|

|

|

lyc1982

|

May 26 2020, 11:01 PM May 26 2020, 11:01 PM

|

|

QUOTE(GrumpyNooby @ May 26 2020, 10:27 AM) What is the dividend rate that you guys expecting for this year? 5%? whatever number it is...i hope it's higher than sspn's This post has been edited by lyc1982: May 26 2020, 11:01 PM |

|

|

|

|

|

wongmunkeong

|

May 27 2020, 09:54 PM May 27 2020, 09:54 PM

|

Barista FIRE

|

QUOTE(lyc1982 @ May 26 2020, 11:01 PM) whatever number it is...i hope it's higher than sspn's bwhaha that would be epic (if SSPN % > EPF %) sh.. maybe ada ppl collaborate to adjust SSPN % to be a smidgen shy of EPF's % <insert THE MAN's aluminium hat scenarios here>  |

|

|

|

|

|

kochin

|

May 28 2020, 02:29 PM May 28 2020, 02:29 PM

|

|

top up is only via cheque/cash (not more than RM500)/ bank draft?

Any other methods?

and how does one change/update their correspondence address with epf?

thanks.

|

|

|

|

|

|

GrumpyNooby

|

May 28 2020, 02:35 PM May 28 2020, 02:35 PM

|

|

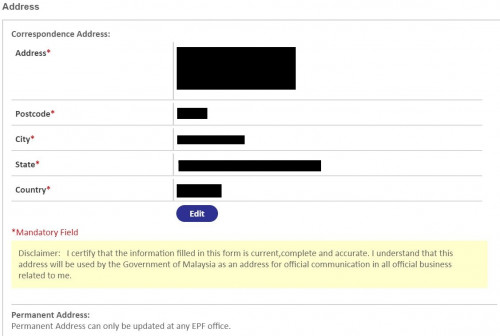

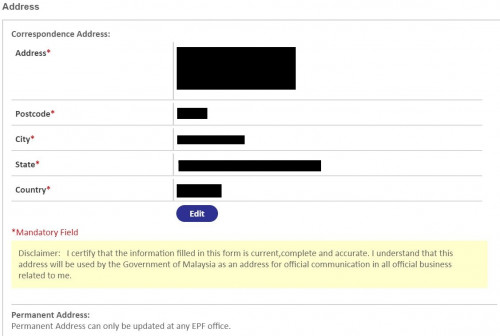

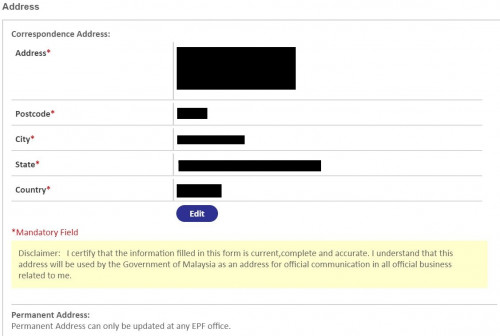

QUOTE(kochin @ May 28 2020, 02:29 PM) top up is only via cheque/cash (not more than RM500)/ bank draft? Any other methods? and how does one change/update their correspondence address with epf? thanks. Topup cannot do online? Correspondence address can be updated in iAkaun:  |

|

|

|

|

|

kochin

|

May 28 2020, 02:43 PM May 28 2020, 02:43 PM

|

|

QUOTE(GrumpyNooby @ May 28 2020, 02:35 PM) Topup cannot do online? Correspondence address can be updated in iAkaun:  thanks. just did it through my mobile phone via the app. so convenient unlike banks. thanks again. now to figure out the top up contribution besides physically attending the branches |

|

|

|

|

|

prophetjul

|

May 28 2020, 03:00 PM May 28 2020, 03:00 PM

|

|

Can one just dump in Rm60k at a go?

|

|

|

|

|

|

lyc1982

|

May 28 2020, 03:03 PM May 28 2020, 03:03 PM

|

|

QUOTE(prophetjul @ May 28 2020, 03:00 PM) Can one just dump in Rm60k at a go? maybe over counter...? |

|

|

|

|

|

prophetjul

|

May 28 2020, 03:05 PM May 28 2020, 03:05 PM

|

|

QUOTE(lyc1982 @ May 28 2020, 03:03 PM) Yeah. JUst wondering if I can dump Rm60k into my wife's account since she's not working anymore. |

|

|

|

|

|

Unkerpanjang

|

May 28 2020, 04:02 PM May 28 2020, 04:02 PM

|

|

QUOTE(prophetjul @ May 28 2020, 03:05 PM) Yeah. JUst wondering if I can dump Rm60k into my wife's account since she's not working anymore. Can, Lao Da. M2u, Hlb, etc... Just go to settings n update as Fav. Per Calander year. |

|

|

|

|

|

prophetjul

|

May 28 2020, 04:15 PM May 28 2020, 04:15 PM

|

|

QUOTE(Unkerpanjang @ May 28 2020, 04:02 PM) Can, Lao Da. M2u, Hlb, etc... Just go to settings n update as Fav. Per Calander year. Thank You |

|

|

|

|

|

KIP21

|

May 30 2020, 09:49 AM May 30 2020, 09:49 AM

|

Getting Started

|

QUOTE(romuluz777 @ May 24 2020, 11:42 PM) I wish the govt would raise the $60K annual limit for self-cuntribution, up to $100K at least would be nice. If you already have extra 40k per year, i think can fill up form form epf of from your HR to deduct your monthly salary more than 11%, say push it to 20%.. provided you are salaried and .. well, i didnt explore on whats the max personal can contribute monthly via monthly salary. |

|

|

|

|

|

KIP21

|

May 30 2020, 10:04 AM May 30 2020, 10:04 AM

|

Getting Started

|

QUOTE(Wedchar2912 @ May 26 2020, 02:31 PM) In the interest (pun intended  ), in order to stimulate the economy, one cannot keep the money in EPF account but must spend the bonus dividend. Maybe throw the money into respective contributor's e-wallets run by companies that Epf has a stake in, and put restrictions that the money must be spent on certain purchases, medicine, or donations to charities. It is purely to stimulate the economy. You have my vote as the finance minister. Clear cut thinking instead of some dodgy supposed RM100 give pack to the poor but endup on RM35 on actual goods whereas RM65 maybe on logistic dunno to who handle n benifit. The e wallet thing is the going forward clear on all transactions. I remembered that time they had this RM30 to e wallet n must spend within a time period. Government want to pump money, should pump it this way to excite the spending. |

|

|

|

|

|

KIP21

|

May 30 2020, 10:06 AM May 30 2020, 10:06 AM

|

Getting Started

|

QUOTE(prophetjul @ May 28 2020, 03:05 PM) Yeah. JUst wondering if I can dump Rm60k into my wife's account since she's not working anymore. If you have say RM1.5mil in your EPF, you can even transfer RM400k direct to your wife EPF account from yours instead of RM60k yearly. If both already more than rm1mil category then nothing much to figure out. |

|

|

|

|

|

Unkerpanjang

|

May 30 2020, 10:33 AM May 30 2020, 10:33 AM

|

|

QUOTE(KIP21 @ May 30 2020, 10:06 AM) If you have say RM1.5mil in your EPF, you can even transfer RM400k direct to your wife EPF account from yours instead of RM60k yearly. If both already more than rm1mil category then nothing much to figure out. Lao Da wealth situation exactly as you described in last sentence. I imagine, Only challenge, $60k move in n out of the account, is too small to detect. This post has been edited by Unkerpanjang: May 30 2020, 10:34 AM |

|

|

|

|

|

prophetjul

|

May 30 2020, 02:36 PM May 30 2020, 02:36 PM

|

|

QUOTE(KIP21 @ May 30 2020, 10:06 AM) If you have say RM1.5mil in your EPF, you can even transfer RM400k direct to your wife EPF account from yours instead of RM60k yearly. If both already more than rm1mil category then nothing much to figure out. Was thinking that EPF should be better than FD in the near future.  So just dump it into wife's account. |

|

|

|

|

|

romuluz777

|

May 30 2020, 03:40 PM May 30 2020, 03:40 PM

|

|

QUOTE(KIP21 @ May 30 2020, 11:06 AM) If you have say RM1.5mil in your EPF, you can even transfer RM400k direct to your wife EPF account from yours instead of RM60k yearly. If both already more than rm1mil category then nothing much to figure out. If you do that, make sure she stays your wife until the end. Otherwise all gone  |

|

|

|

|

|

Unkerpanjang

|

May 30 2020, 04:18 PM May 30 2020, 04:18 PM

|

|

QUOTE(romuluz777 @ May 30 2020, 03:40 PM) If you do that, make sure she stays your wife until the end. Otherwise all gone  ... Written in poor taste! Not encourage in forum thread. This post has been edited by Unkerpanjang: May 30 2020, 06:27 PM |

|

|

|

|

|

Mijac

|

May 30 2020, 06:16 PM May 30 2020, 06:16 PM

|

|

QUOTE(prophetjul @ May 30 2020, 02:36 PM) Was thinking that EPF should be better than FD in the near future.  So just dump it into wife's account.  |

|

|

|

|

|

SUSChenHo123

|

May 31 2020, 01:17 PM May 31 2020, 01:17 PM

|

Getting Started

|

Recently my epf contribution have been reduced to 7%. I went to KWSP to increase it back to 11%. Now i am contemplating to increase it to the max as epf interest rate is decent and guaranteed. Should i do it?

This post has been edited by ChenHo123: May 31 2020, 01:49 PM

|

|

|

|

|

May 26 2020, 02:34 PM

May 26 2020, 02:34 PM

Quote

Quote

0.0211sec

0.0211sec

0.79

0.79

6 queries

6 queries

GZIP Disabled

GZIP Disabled