QUOTE(nexona88 @ May 19 2016, 01:05 PM)

Haha.. i kinda agree ;pFund Investment Corner v3, Funds101

Fund Investment Corner v3, Funds101

|

|

May 19 2016, 07:09 PM May 19 2016, 07:09 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

|

|

|

May 21 2016, 05:44 PM May 21 2016, 05:44 PM

|

Junior Member

194 posts Joined: Mar 2016 |

hi can i just ask, if the sales charge is 2% and gst is 6%

lets say i buy rm10k worth of units, the fee would be 200 and rm600 for gst? or am i calculating wrong. sorry newbie. |

|

|

May 21 2016, 05:54 PM May 21 2016, 05:54 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

|

|

|

May 21 2016, 06:55 PM May 21 2016, 06:55 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(blackseed202 @ May 21 2016, 05:44 PM) hi can i just ask, if the sales charge is 2% and gst is 6% try see the answers and calculation in here for understanding.....lets say i buy rm10k worth of units, the fee would be 200 and rm600 for gst? or am i calculating wrong. sorry newbie. http://www.fundsupermart.com.my/main/faq/1...es-Tax-GST--393 |

|

|

May 22 2016, 02:36 AM May 22 2016, 02:36 AM

|

Junior Member

194 posts Joined: Mar 2016 |

QUOTE(T231H @ May 21 2016, 06:55 PM) try see the answers and calculation in here for understanding..... thanks for the link!http://www.fundsupermart.com.my/main/faq/1...es-Tax-GST--393 that means if i want to get a profit, i should target like more than 2.12% yield or else i wont get any profit right? and the YTD like 1m/6m at the website, does that minus the sales fee or not? like for example 1y yield is 7% does that mean my net profit is 7-2.12%= 4.88%?? and that is like 1-2% more than fixed deposit in most major banks right? that doesnt look very worth it? please advise. thanks! |

|

|

May 22 2016, 09:04 AM May 22 2016, 09:04 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(blackseed202 @ May 22 2016, 02:36 AM) thanks for the link! use the Fund Return tools in the FSM page to see the returns over a period of specified time period.that means if i want to get a profit, i should target like more than 2.12% yield or else i wont get any profit right? and the YTD like 1m/6m at the website, does that minus the sales fee or not? like for example 1y yield is 7% does that mean my net profit is 7-2.12%= 4.88%?? and that is like 1-2% more than fixed deposit in most major banks right? that doesnt look very worth it? please advise. thanks! FSM MY main page >> FUNDS INFO>>>FUND RETURN then click FUNDS INFO>>>FUND PRICES ...this will shows the price of particular date. compare the data from the 2 tools to see how the returns are calculated? does the RETURN shown excludes the Sales Charges or inclusive? I may be wrong...but my monitored ROI data is almost similar to FSM. and my data are comparing the NAVs...and NAV is already net (after minus Sales charges and other charges). that doesnt look very worth it?" in mind.....(nothing wrong with what you think...most people are doing that). Hope you had not stepped into UTs investing......for one,.....UTs investing is not FD.....(eventhough some UTs are behaving like FDs in terms of returns)...to be on extreme for discussion sake....some funds can get 10% per month (some can go to MINUS and some can go to POSITIVE) Goto FSM MY again. FUNDS INFO>>>FUND RANKING "that doesn't look very worth it?"..... |

|

|

|

|

|

May 31 2016, 07:53 AM May 31 2016, 07:53 AM

|

Junior Member

194 posts Joined: Mar 2016 |

QUOTE(T231H @ May 22 2016, 09:04 AM) use the Fund Return tools in the FSM page to see the returns over a period of specified time period. well i have about 150k in tabung haji.FSM MY main page >> FUNDS INFO>>>FUND RETURN then click FUNDS INFO>>>FUND PRICES ...this will shows the price of particular date. compare the data from the 2 tools to see how the returns are calculated? does the RETURN shown excludes the Sales Charges or inclusive? I may be wrong...but my monitored ROI data is almost similar to FSM. and my data are comparing the NAVs...and NAV is already net (after minus Sales charges and other charges). that doesnt look very worth it?" in mind.....(nothing wrong with what you think...most people are doing that). Hope you had not stepped into UTs investing......for one,.....UTs investing is not FD.....(eventhough some UTs are behaving like FDs in terms of returns)...to be on extreme for discussion sake....some funds can get 10% per month (some can go to MINUS and some can go to POSITIVE) Goto FSM MY again. FUNDS INFO>>>FUND RANKING "that doesn't look very worth it?"..... 30-40k in fixed deposit. and some extra 20-30k for high risk investment. ive tried stock market recently but difficult to do and require extensive research especially if you do fundamental analysis. technical analysis require more time during the day but i am busy working during the day so dont have time to watch the market. tried FA and bought some stock but havent got good enough return i dont think. hm... any other suggestion? i dont really like land/housing investment because i dont like them. haha. |

|

|

May 31 2016, 08:06 AM May 31 2016, 08:06 AM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(blackseed202 @ May 31 2016, 07:53 AM) well i have about 150k in tabung haji. 30-40k in fixed deposit. and some extra 20-30k for high risk investment. ive tried stock market recently but difficult to do and require extensive research especially if you do fundamental analysis. technical analysis require more time during the day but i am busy working during the day so dont have time to watch the market. tried FA and bought some stock but havent got good enough return i dont think. hm... any other suggestion? i dont really like land/housing investment because i dont like them. haha. what is your expected returns? how long period do you intent to invest? how long have you tried the FA and under his advise you bought some stock and how long have you held them? equities investment are subjected to volatility......prepared to hold during the down/stagnant periods and reduce the expectation?....... |

|

|

May 31 2016, 08:15 AM May 31 2016, 08:15 AM

|

Junior Member

194 posts Joined: Mar 2016 |

well im in no rush to use the money so maybe 3-5y for big amount and 10-15y for small amount like 20-30k.

i wanted to try fundsupermart and i am not very convinced with my result and research so far. i do know you guys are pro, but im pretty sure it requires a lot of experience and know how to learn the market. is that true? ive hold few stocks for at least 3-4months. i just though maybe the market is down at the moment, so i do some averaging as well when they are at lower price. |

|

|

May 31 2016, 08:20 AM May 31 2016, 08:20 AM

|

All Stars

14,888 posts Joined: Mar 2015 |

try this for a start??

5 Investment Mistakes To Avoid https://www.fundsupermart.com.my/main/resea...-6-May-16--7072 |

|

|

Jun 1 2016, 08:55 AM Jun 1 2016, 08:55 AM

|

Junior Member

134 posts Joined: Aug 2010 |

Hello all sifus,

is that true that PRSF (Public Regular Saving Fund) already closed? I emailed the customer service and they replied: "We wish to inform you that Public Regular Savings Fund (PRSF) has been closed for investment. Hence, additional investment into PRSF is not allowed." Regards Public Mutual Berhad Customer Service Department What to do if i wish to continue invest in this fund? |

|

|

Jun 7 2016, 04:58 PM Jun 7 2016, 04:58 PM

|

All Stars

48,447 posts Joined: Sep 2014 From: REality |

The Securities Commission Malaysia (SC) has warned the public to be wary of get-rich-quick schemes which were being promoted under the guise of bond investments.

In a statement Tuesday, the SC said sometimes the offerings were purportedly linked to foreign bonds, masquerading to feign legitimate schemes. "The schemes entice investors with guaranteed high returns or profits as high as 40 per cent with little or no risk to them. ~Bernama |

|

|

Jun 7 2016, 07:30 PM Jun 7 2016, 07:30 PM

|

Senior Member

1,515 posts Joined: Dec 2005 |

Take a look (listen) at PaulMerriman.com

Although he is basing discussion on USA funds, a lot might be applied to Malaysia as well. |

|

|

|

|

|

Jun 9 2016, 05:33 PM Jun 9 2016, 05:33 PM

|

Senior Member

10,001 posts Joined: May 2013 |

Public Mutual launches Public Strategic Balanced Fund

http://www.thestar.com.my/business/busines...-balanced-fund/ |

|

|

Jun 10 2016, 04:49 PM Jun 10 2016, 04:49 PM

|

Senior Member

1,842 posts Joined: Jan 2003 |

Hi guys,

I'm new to this and doesn't own any UT for Mutual fund. May I know is this the right time to invest? I make some searching for CIMB UT (easier for me as i'm using this bank) and it seems like the fund doesn't seems to grow much but dropping. What do you think? |

|

|

Jun 10 2016, 06:58 PM Jun 10 2016, 06:58 PM

|

Senior Member

1,498 posts Joined: Nov 2012 |

QUOTE(knight @ Jun 10 2016, 04:49 PM) Hi guys, Hop over to the fundsupermart thread to see all the actions on funds. There are quite a lot of folks here who DIY their mutual fund investment instead of getting from agents or banksI'm new to this and doesn't own any UT for Mutual fund. May I know is this the right time to invest? I make some searching for CIMB UT (easier for me as i'm using this bank) and it seems like the fund doesn't seems to grow much but dropping. What do you think? https://forum.lowyat.net/topic/3892713 Alternatively you can pay agent to buy, public mutual and CIMB Wealth advisor I would seriously advise against because their funds are not doing great in the past few years and the sales charge is steep Okla, if there are agents who can distribute funds from various fund house and set up a proper portfolio maybe it's worthwhile paying sales charge for. Especially if you are not into doing much homework to understand how to DIY. |

|

|

Jun 10 2016, 06:59 PM Jun 10 2016, 06:59 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

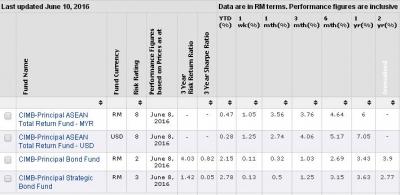

QUOTE(knight @ Jun 10 2016, 04:49 PM) Hi guys, i cannot tell exactly if this is the right time to invest....i depends some other factors..example.... on how long do you want to see the ROI to materialise? what is your expected ROI? etc, etc...I'm new to this and doesn't own any UT for Mutual fund. May I know is this the right time to invest? I make some searching for CIMB UT (easier for me as i'm using this bank) and it seems like the fund doesn't seems to grow much but dropping. What do you think? regarding this CIMB funds....some funds is growing...depends also on the selection and the duration you looked at it... Attached thumbnail(s)

|

|

|

Jun 10 2016, 11:43 PM Jun 10 2016, 11:43 PM

Show posts by this member only | IPv6 | Post

#2238

|

Senior Member

2,702 posts Joined: Dec 2004 From: P8X-86A |

Who still holds CIMB global Titan? Good time to sell and park at FD?

|

|

|

Jun 13 2016, 01:02 PM Jun 13 2016, 01:02 PM

Show posts by this member only | IPv6 | Post

#2239

|

Senior Member

2,702 posts Joined: Dec 2004 From: P8X-86A |

Will brexit affect our unit trust performance especially those global exposure to usa?

|

|

|

Jun 13 2016, 02:15 PM Jun 13 2016, 02:15 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(nightzstar @ Jun 13 2016, 01:02 PM) try this article.....hope it can explains it....https://secure.fundsupermart.com/main/artic...as-Brexit-11529 |

| Change to: |  0.0244sec 0.0244sec

0.80 0.80

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 04:04 PM |