A Real Estate Investment Trust (REIT) is a fund or a trust that owns and manages income-producing commercial real estate (shopping complexes, hospitals, plantations, industrial properties, hotels and office blocks).

A management company for a REIT is permitted to deduct distribution paid to its shareholders from its corporate taxable income. However, to enjoy this tax-free status, the REIT must have most of its assets and income tied to the real estate and distribute at least 90% of its total income to investors/unit holders annually

2) What are the benefits of investing in listed REITs?

Affordability

-> Investment in REITs cost a fraction of the cost of direct investment in real estate. You can start off with a minimal investment outlay.

Liquidity

-> REITs are more liquid compared to physical properties. Shares of publicly-traded REITs are readily converted to cash as they are traded on the stock exchange.

Stable income stream

-> REITs tend to pay out a steady dividend, which is derived from existing rents paid by tenants who occupy the REIT properties.

Exposure to a large-scale real estate

-> The benefits of the real estate are derived on a pro-rated basis through a REIT.

Professional management

-> REIT properties are managed by professionals who will add value for a higher yield, benefiting investors in the long run.

3) How to invest and where to buy REITs?

Similar to trading in stocks, you will be required to have a Central Depository System (CDS) account and a trading account maintained with a broker. You may buy or sell ETFs through your broker, remisier or via online trading during trading hours.

4) What do I have to pay when buying and selling REITs?

Like buying and selling stocks, investors need to pay brokerage commission, stamp duty and clearing fees.

5) What kind of returns can be expected from REITs?

Income distribution based on the distribution policy stated in the REIT's deed; and/or Capital gains which may arise from appreciation of the REIT's price.

6) Typical Conventional REIT Structure

» Click to show Spoiler - click again to hide... «

7) REIT risk factor

Refinancing Risks

The ability for REITs to refinance their existing banking facilities are critical to their survival.

Downside Dividend Yields

>Global recession putting strain across all businesses.As a result,dividend yields will come under tremendous pressure with negative rental reversions as businesses try to cut costs.

>Increase interest cost/spreads will also affect the bottom line.

Valuation Pressure

>Property valutations will also come under stress should negative rent reversion persist.

>As valuation fall ,REIT gearing level will increase and possible breaching debt covenants.

>May require balance sheet recapitalisation.

Dilutive Capital Raising

>Dilutive capital raising may be unavoidable in the event of balance sheet recapitalisation.

>REITs with ready sponsor participation will likely to be the first to come to the market.

Market factors

REITs are also subject to market demand and supply. As such, market fluctuations, confidence in the economy and changes in the interest rates may affect REITs price.

Risk Assiociated with Borrowing

>Significant fluctuations in interest rates may have an adverse impact on the financial performance of REIT and may lower income distribution to unit holders.There is an inverse correlation between the interest rates and the distributable income to unit holders.

Other risk include :

- Vacancies following expiry or termination of leases that reduces the REIT income

- The Manager's ability to provide adequate management and maintenance

- Not Sufficient insurance cover for the real estate in case of fire

- Sudden changes in tax regulations

- Poor collection of rent from tenants on a timely basis or tenants going bankrupt

- Lower rent when leases are renewed

- Poor cost control resulting in higher operating and other expenses without a corresponding increase in revenue

- Unexpected expenses due to changes in statutory laws,regulations or government policies.

- Amendment or revocation of the present tax incentives for REIT

- Competition for tenants from other building which may affect rental levels and occupancy rates.

8) Is dividend from REIT subjected to taxes? Can we claim back the tax?

Dividend from REIT are subjected witholding tax (10%) and is not claim back-able.

9) How to select a good REIT ?

Credit to Cherroy

QUOTE(cherroy @ Jun 1 2012, 10:20 AM)

Look at

1. Yield

2. Type of property, location.

3. Lease - long term or short term. When is the lease expired, chance of renewal etc. aka stability in lease.

4. Gearing - as refinancing ability and cost is very important for reit for refinancing its borrowing. So level of gearing also need to look at.

5. Management - property need good management to keep in good shape and attract tenant while good managed property can fetch better yield.

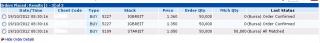

Latest Dividend Distribution Method1. Yield

2. Type of property, location.

3. Lease - long term or short term. When is the lease expired, chance of renewal etc. aka stability in lease.

4. Gearing - as refinancing ability and cost is very important for reit for refinancing its borrowing. So level of gearing also need to look at.

5. Management - property need good management to keep in good shape and attract tenant while good managed property can fetch better yield.

AHP : ??

ALAQAR : Cheque

AMFIRST : E-Dividend

ARREIT : E-Dividend

ATRIUM : E-Dividend

AXREIT : E-Dividend

BSDREIT : Cheque

CMMT : E-Dividend

HEKTAR : E-Dividend

IGBREIT : E-Dividend

PAVREIT : E-Dividend

QCAPITA : E-Dividend

STAREIT : E-Dividend

SUNREIT : E-Dividend

TWRREIT : E-Dividend

UOAREIT : E-Dividend

References

http://www.bursamalaysia.com/market/securi...t-trusts-reits/

http://mreit.reitdata.com/

REIT Presentation Slides from AXIS

http://www.axis-reit.com.my/images/axisrei...resentation.pdf

http://www.axis-reit.com.my/images/axisrei...ment%20Tool.pdf

Previous Thread

REIT V3

REIT V2

REIT V1

This post has been edited by Smurfs: Feb 28 2013, 12:01 PM

Sep 6 2012, 10:50 AM, updated 13y ago

Sep 6 2012, 10:50 AM, updated 13y ago

Quote

Quote

0.2976sec

0.2976sec

0.63

0.63

6 queries

6 queries

GZIP Disabled

GZIP Disabled