QUOTE(yklooi @ Jan 14 2014, 10:02 AM)

Only starting with regular savings... hardly anything compare to my EPF withdrawal at age 55. They want to love me, they better get their act together.

Public Mutual v4, Public/PB series funds

|

|

Jan 14 2014, 10:15 AM Jan 14 2014, 10:15 AM

|

Senior Member

1,639 posts Joined: Nov 2010 |

|

|

|

|

|

|

Jan 14 2014, 11:53 AM Jan 14 2014, 11:53 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(j.passing.by @ Jan 14 2014, 10:15 AM) Only starting with regular savings... hardly anything compare to my EPF withdrawal at age 55. They want to love me, they better get their act together. It's getting to the point where i'm heavily considering moving all my cash into local ETFs & overseas ETFs. The bloody annual mgt fees % is a killer VS ETFs AND i don't get proper "asset allocation" as these mutual funds are usually not >80%+ in the equities VS ETFs ie. in essence i may be holding more "cash" than the cash in my flexi mortgage account thanks to the cash held by these mutual funds". screws up my asset allocation. FSM does help lower initial costs and i'm grateful. However.. as things accumulate and one can transact cost-efficiently (ie. big enough purchases) for ETFs, the pain becomes more on the "yearly management fees" As for EPF A/C1... aargh! *^%$! Stuck between EPF, mutual funds and self-directed investments into KLSE which still have to pay mutual fund-like costs. This post has been edited by wongmunkeong: Jan 14 2014, 11:54 AM |

|

|

Jan 14 2014, 12:16 PM Jan 14 2014, 12:16 PM

|

Junior Member

218 posts Joined: May 2008 |

If the market is stagnant, the yearly mgmt fees of Malaysia UTs (1%-2% which is high!) slowly drains your principal.

This post has been edited by creativ: Jan 14 2014, 12:17 PM |

|

|

Jan 14 2014, 03:33 PM Jan 14 2014, 03:33 PM

|

Senior Member

1,050 posts Joined: Feb 2006 From: KL |

Hi guys, any idea which fund is currently the best to start off with?

I got recommended a few by the agent:- PRSF PISEF PIDF PDSF This is my first time I'm into PM. Regards, Jimmy |

|

|

Jan 14 2014, 05:22 PM Jan 14 2014, 05:22 PM

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

These 4 funds are fine.

|

|

|

Jan 14 2014, 05:54 PM Jan 14 2014, 05:54 PM

|

Senior Member

1,050 posts Joined: Feb 2006 From: KL |

|

|

|

|

|

|

Jan 14 2014, 06:12 PM Jan 14 2014, 06:12 PM

|

Junior Member

360 posts Joined: Jul 2007 From: Island of Oriental Pearl |

|

|

|

Jan 14 2014, 06:38 PM Jan 14 2014, 06:38 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

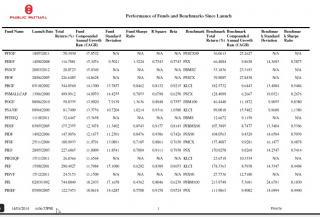

QUOTE(transit @ Jan 14 2014, 06:12 PM) Free Listing for you to choose your 2 funds suitable your investment objective. Each of us has different risk appetite. This listing perhaps may help to assist you. Best Luck

if comparing between funds of with the same benchmark, the higher the value of 1) Fund Std Deviation, 2) Fund Sharpe Ratio, 3) R Square, 4) Beat the better? |

|

|

Jan 14 2014, 07:50 PM Jan 14 2014, 07:50 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

|

|

|

Jan 14 2014, 08:00 PM Jan 14 2014, 08:00 PM

|

Senior Member

4,436 posts Joined: Oct 2008 |

QUOTE(yklooi @ Jan 14 2014, 06:38 PM) if comparing between funds of with the same benchmark, the higher the value of 1) Fund Std Deviation, 2) Fund Sharpe Ratio, 3) R Square, 4) Beat the better? Std Dev is a measurement of how the daily NAV distribute around the mean of the fund over the study period time. R-Sq is the relevancy of the linear regression. The closer it is to 1 means the more correlated the two parameters to each other. The closer to zero, means the variables have very little correlation to each other. Beta is the relationship of the fund to its benchmark. If beta is 1.0, then the fund mirrors the volatility of benchmark. If beta is 0.5, then when benchmark increases 10%, the fund increases by 5%. If beta is -0.5, when benchmark increases 10%, the fund decreases 5%. Now, you must be slapping yourself silly with regrets when you fall asleep during Add Maths class (esp the elective on Stats & Probability topics right?) Xuzen |

|

|

Jan 15 2014, 09:48 AM Jan 15 2014, 09:48 AM

|

Senior Member

1,050 posts Joined: Feb 2006 From: KL |

|

|

|

Jan 15 2014, 11:52 AM Jan 15 2014, 11:52 AM

|

Senior Member

2,603 posts Joined: May 2006 From: USJ Taipan + PJ SS2 |

QUOTE(jimmy.soo @ Jan 14 2014, 03:33 PM) Hi guys, any idea which fund is currently the best to start off with? at least your agent recommend you good fund I got recommended a few by the agent:- PRSF PISEF PIDF PDSF This is my first time I'm into PM. Regards, Jimmy |

|

|

Jan 15 2014, 12:11 PM Jan 15 2014, 12:11 PM

|

Senior Member

2,050 posts Joined: Dec 2009 From: DC |

QUOTE(Clareen @ Jan 15 2014, 11:52 AM) at least your agent recommend you good fund PBIEF is on upward since 1 Sep 2013 from 0.25 and now at 0.27 level. Maybe you mean you bought at 0.28. If do DDI is gooding... |

|

|

|

|

|

Jan 15 2014, 12:46 PM Jan 15 2014, 12:46 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(Clareen @ Jan 15 2014, 11:52 AM) at least your agent recommend you good fund Let's get the facts straight. The date of investment makes a lot of difference. Using a different start date in a performance analysis will give different results.If you take the performance chart right now(the most handy tool provided by PM) http://www.publicmutual.com.my/application...formancenw.aspx and selecting 1-year performance, you will get this: PIDF 10.13% PISEF 11.00% PDSF 11.29% PRSF 15.28% and PBIEF 12.99%. All the above funds are local, large-cap, and EPF approved. All of them are similar; and most probably if they were ranked, they would rotate and take turns to be number 1. Just like the teams in any football league, only an extraordinary team can emerge champion continuously. To have bragging rights in holding the champion, maybe hold all 5 of them. (I'm holding 3. BTW. PBIEF is PUBLIC BANK series. There is only 2 local, large-cap, EPF approved funds in PB series. What else can the bank agent recommend? Cheers. PS. Since the start date would makes a lot of difference, hedge the bet with multiple start dates... DCA, DCA, DCA! |

|

|

Jan 15 2014, 12:59 PM Jan 15 2014, 12:59 PM

|

Senior Member

1,050 posts Joined: Feb 2006 From: KL |

QUOTE(Clareen @ Jan 15 2014, 11:52 AM) at least your agent recommend you good fund I'm not sure if its a good fund or not as well, since this is my first time so whatever she said I guess I have to believe in her (convincing part). And I seek advises/recommendations from the pros here QUOTE(j.passing.by @ Jan 15 2014, 12:46 PM) Let's get the facts straight. The date of investment makes a lot of difference. Using a different start date in a performance analysis will give different results. Is it good to hold all of them? I have not much to start off actually, holding more or less (which is better)?If you take the performance chart right now(the most handy tool provided by PM) http://www.publicmutual.com.my/application...formancenw.aspx and selecting 1-year performance, you will get this: PIDF 10.13% PISEF 11.00% PDSF 11.29% PRSF 15.28% and PBIEF 12.99%. All the above funds are local, large-cap, and EPF approved. All of them are similar; and most probably if they were ranked, they would rotate and take turns to be number 1. Just like the teams in any football league, only an extraordinary team can emerge champion continuously. To have bragging rights in holding the champion, maybe hold all 5 of them. (I'm holding 3. BTW. PBIEF is PUBLIC BANK series. There is only 2 local, large-cap, EPF approved funds in PB series. What else can the bank agent recommend? Cheers. PS. Since the start date would makes a lot of difference, hedge the bet with multiple start dates... DCA, DCA, DCA! |

|

|

Jan 15 2014, 01:11 PM Jan 15 2014, 01:11 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jan 15 2014, 01:14 PM Jan 15 2014, 01:14 PM

|

Senior Member

1,050 posts Joined: Feb 2006 From: KL |

QUOTE(yklooi @ Jan 15 2014, 01:11 PM) do you want to have over lapping coverage? PRSF PISEF PIDF PDSF What are the pros on having over lapping coverage? If + then + 2 times if - then it will - 2 times I guess? What Xuzen recommended me are PISEF & PIDF. This post has been edited by jimmy.soo: Jan 15 2014, 01:15 PM |

|

|

Jan 15 2014, 01:29 PM Jan 15 2014, 01:29 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Jan 15 2014, 02:08 PM Jan 15 2014, 02:08 PM

|

Senior Member

1,639 posts Joined: Nov 2010 |

QUOTE(jimmy.soo @ Jan 15 2014, 12:59 PM) And I seek advises/recommendations from the pros here There is no short answer to your question without repeating all my previous posts. So maybe the best advice would be start by reading the previous pages, and then maybe some in other financial website and/or threads in this website, so that we can assumed you have the basic, fundamental facts and concepts; and the charges/fees (the cost/expenses in any investments).Is it good to hold all of them? I have not much to start off actually, holding more or less (which is better)? To begin with, you need to know what is your financial objective in putting your savings in mutual funds. Then read the posts with this objective in mind and see whether it is applicable to your situation. There is much difference in savings for, say, 5-10 years for a around-the-world trip, than putting aside savings for 10-20 years for retirement. Not many people start off with a huge sum (and it is not necessary to wait till there is a pile of money before investing), but it is crucial to know the destination, the financial goal. 1. Estimate how much the final total you will invest. 2. Take a look at a previous post on the Supreme Buy-and-Hold Portfolio Model. 3. The model suggests no more than 5% in any one fund. In general, it is advisable not to have more than 10%. 4. Now, calculate how much is 5% to 10% of the estimated final total you have in mind. 5. Then purchase (using Dollar Cost Averaging method) till that 5-10% limit before diversifying into another fund. (This is assuming that you can barely meet the initial RM1000 investment into a new fund; and follow up with regular DCA purchases.) Cheers. PS. Investing can be emotional; and the kiasu-ness in me makes me think that I'm losing something if I'm not holding the top fund with the best returns. But there is a cost in switching from fund to fund every year in hunting for the best fund. So how? Hold all of them la. |

|

|

Jan 15 2014, 04:44 PM Jan 15 2014, 04:44 PM

|

Senior Member

8,259 posts Joined: Sep 2009 |

QUOTE(j.passing.by @ Jan 15 2014, 03:08 PM) There is no short answer to your question without repeating all my previous posts. So maybe the best advice would be start by reading the previous pages, and then maybe some in other financial website and/or threads in this website, so that we can assumed you have the basic, fundamental facts and concepts; and the charges/fees (the cost/expenses in any investments). wah.. you hold how many funds lo...?To begin with, you need to know what is your financial objective in putting your savings in mutual funds. Then read the posts with this objective in mind and see whether it is applicable to your situation. There is much difference in savings for, say, 5-10 years for a around-the-world trip, than putting aside savings for 10-20 years for retirement. Not many people start off with a huge sum (and it is not necessary to wait till there is a pile of money before investing), but it is crucial to know the destination, the financial goal. 1. Estimate how much the final total you will invest. 2. Take a look at a previous post on the Supreme Buy-and-Hold Portfolio Model. 3. The model suggests no more than 5% in any one fund. In general, it is advisable not to have more than 10%. 4. Now, calculate how much is 5% to 10% of the estimated final total you have in mind. 5. Then purchase (using Dollar Cost Averaging method) till that 5-10% limit before diversifying into another fund. (This is assuming that you can barely meet the initial RM1000 investment into a new fund; and follow up with regular DCA purchases.) Cheers. PS. Investing can be emotional; and the kiasu-ness in me makes me think that I'm losing something if I'm not holding the top fund with the best returns. But there is a cost in switching from fund to fund every year in hunting for the best fund. So how? Hold all of them la. |

|

Topic ClosedOptions

|

| Change to: |  0.0308sec 0.0308sec

0.53 0.53

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 06:54 PM |