Dear Unitholder, We are pleased to attach the market wrap and bond market review for the week/fortnight ended 10 January 2014 for your information. Regards Customer Service

Public Mutual v4, Public/PB series funds

Public Mutual v4, Public/PB series funds

|

|

Jan 28 2014, 03:31 PM Jan 28 2014, 03:31 PM

|

All Stars

52,874 posts Joined: Jan 2003 |

Dear Unitholder, We are pleased to attach the market wrap and bond market review for the week/fortnight ended 10 January 2014 for your information. Regards Customer Service

|

|

|

|

|

|

Jan 28 2014, 04:19 PM Jan 28 2014, 04:19 PM

|

Senior Member

10,001 posts Joined: May 2013 |

Did any1 manage to buy PISGIF during initial offer period fr 7/1 to 27/1?

|

|

|

Jan 28 2014, 08:49 PM Jan 28 2014, 08:49 PM

|

Senior Member

1,556 posts Joined: Jan 2003 |

for those who bought any public mutual fund since 5 years ago, how much is the exact net return you get today?

|

|

|

Jan 29 2014, 09:32 AM Jan 29 2014, 09:32 AM

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Jan 29 2014, 10:41 AM Jan 29 2014, 10:41 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

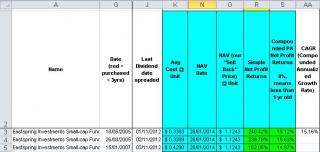

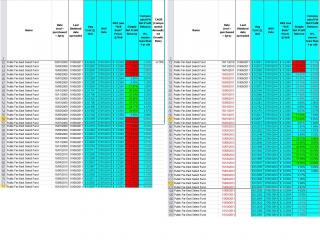

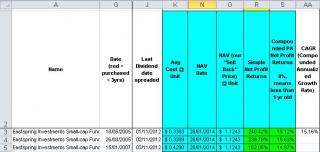

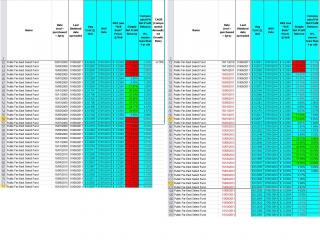

QUOTE(labtec @ Jan 28 2014, 08:49 PM) for those who bought any public mutual fund since 5 years ago, how much is the exact net return you get today? Like Wil-I-Am stated, perhaps in future, best to be more specific.Since it's CNY mood, share share lar a bit Attached are 3 funds that i'm holding with specific transactions from 2009 or before until now. Other funds i've deleted 2009 and before transactions due to asset re-allocation or just closing down the fund for my investment. The 3 funds are: 1. EastSpringInvestments SmallCaps (yes yes this is PM thread but this gives one an idea right - especially comparable to PM's SmallCaps) Done adhoc & lump sum

2. PFES done monthly DCA via agent's pink

3. PSSF done quarterly via EPF and value averaging

To me, bottom line (including my other funds already sold off / SWITCHED due to asset reallocation or closing down): a. When markets are crazily depressed (manic depressive), buy MUCH more on top of DCA or value averaging b. When don't know where market heading (ie. it's not high or low), DCA or value averaging c. Wehn markets are crazily elated (lots of ppl talking - just like REITs in last half 2012 to 2013), better taper off / asset reallocation or value averaging only (not DCA) BIG FAT NOTE: Always have enough emergency funds to avoid selling-off investments at inappropriate times. When i buy, i can hold for minimum 1 year, expected 3 to 5 years, forever until forced to asset rebalance if possible Just a thought This post has been edited by wongmunkeong: Jan 29 2014, 10:48 AM |

|

|

Jan 29 2014, 10:47 AM Jan 29 2014, 10:47 AM

|

Senior Member

4,436 posts Joined: Oct 2008 |

WMK,

Wah... so detail, lu manyak senang type izzit? I just take the published result at their FS and just know the average will do. I lazy to be so detail, as long as I am invested in the most efficient fund, I sleep well. Xuzen |

|

|

|

|

|

Jan 29 2014, 10:51 AM Jan 29 2014, 10:51 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(xuzen @ Jan 29 2014, 10:47 AM) WMK, Susan-hubby, i'm anal-retentive mar hehe.Wah... so detail, lu manyak senang type izzit? I just take the published result at their FS and just know the average will do. I lazy to be so detail, as long as I am invested in the most efficient fund, I sleep well. Xuzen Didn't type specially for asker lar - unless asker hot SYT lar I track per transaction and even redistribute re-invested units based on units held before dividend reinvestment. Gives me ultra-clear details when needed - to continue OR chop OR rebalance within sub-asset. Thus, kinda easy for me to just hide lots of other details and snapshot for asker - was just lazy yesterday to "play" heheh. |

|

|

Jan 29 2014, 12:39 PM Jan 29 2014, 12:39 PM

|

Senior Member

1,556 posts Joined: Jan 2003 |

QUOTE(wongmunkeong @ Jan 29 2014, 10:41 AM) Like Wil-I-Am stated, perhaps in future, best to be more specific. looks good Since it's CNY mood, share share lar a bit Attached are 3 funds that i'm holding with specific transactions from 2009 or before until now. Other funds i've deleted 2009 and before transactions due to asset re-allocation or just closing down the fund for my investment. The 3 funds are: 1. EastSpringInvestments SmallCaps (yes yes this is PM thread but this gives one an idea right - especially comparable to PM's SmallCaps) Done adhoc & lump sum

2. PFES done monthly DCA via agent's pink

3. PSSF done quarterly via EPF and value averaging

To me, bottom line (including my other funds already sold off / SWITCHED due to asset reallocation or closing down): a. When markets are crazily depressed (manic depressive), buy MUCH more on top of DCA or value averaging b. When don't know where market heading (ie. it's not high or low), DCA or value averaging c. Wehn markets are crazily elated (lots of ppl talking - just like REITs in last half 2012 to 2013), better taper off / asset reallocation or value averaging only (not DCA) BIG FAT NOTE: Always have enough emergency funds to avoid selling-off investments at inappropriate times. When i buy, i can hold for minimum 1 year, expected 3 to 5 years, forever until forced to asset rebalance if possible Just a thought does these returns you stated are after deducted the 5% deduction at first and also the 1-2% management fee? |

|

|

Jan 29 2014, 02:02 PM Jan 29 2014, 02:02 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

|

|

|

Jan 29 2014, 03:07 PM Jan 29 2014, 03:07 PM

|

Senior Member

1,556 posts Joined: Jan 2003 |

|

|

|

Jan 30 2014, 08:16 AM Jan 30 2014, 08:16 AM

|

Senior Member

4,524 posts Joined: Oct 2007 From: ~Still finding the place~ |

Good morning all & Happy Chinese New Year..

I just joined EPF Member Investment Scheme and according to agent, I'm investing into Public Dividend Select Fund.. Apart from that, I'm interested to invest into Public Mutual using cash for saving and dividend..as the agent told me, PM definitely better than FD.. As I'm new in mutual fund, what should I take note before I invest? Which fund should I invest into? Thanks all for helping me.. |

|

|

Jan 30 2014, 09:42 AM Jan 30 2014, 09:42 AM

|

Senior Member

605 posts Joined: Nov 2012 |

QUOTE(Lineage @ Jan 30 2014, 08:16 AM) Good morning all & Happy Chinese New Year.. Since u r new, suggest u go to Public Mutual Online website and read this:I just joined EPF Member Investment Scheme and according to agent, I'm investing into Public Dividend Select Fund.. Apart from that, I'm interested to invest into Public Mutual using cash for saving and dividend..as the agent told me, PM definitely better than FD.. As I'm new in mutual fund, what should I take note before I invest? Which fund should I invest into? Thanks all for helping me.. http://www.publicmutual.com.my/Resources/U...ustLessons.aspx "Which fund should I invest into?" This question will hv vary answer, the correct way is not choose a fund, but build a portfolio that consist of few funds from different type/location/ etc. "PM definitely better than FD" Be aware this statement may not true if looking in short term, unit trust would require minimum 3 to 5 years, in order it can be better than FD. Do not expect unit trust give consistent return of more than 3% each year. |

|

|

Jan 30 2014, 10:14 AM Jan 30 2014, 10:14 AM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(Lineage @ Jan 30 2014, 08:16 AM) Good morning all & Happy Chinese New Year.. Pls keep in mind (in any situation):I just joined EPF Member Investment Scheme and according to agent, I'm investing into Public Dividend Select Fund.. Apart from that, I'm interested to invest into Public Mutual using cash for saving and dividend..as the agent told me, PM definitely better than FD.. As I'm new in mutual fund, what should I take note before I invest? Which fund should I invest into? Thanks all for helping me.. Flower sellers usually say flowers smell good Diamond sellers usually say diamonds are forever, say it with a diamond Gold sellers usually say gold is real $, not fiat $ etc. All based on self interest, NOT YOURS. Better than FD in WHAT situations and WHY? The devil's in the details What i'd suggest is, don't be looking only at Pub Mut - U may want to look at Fundsupermart as well. However, even better, U may want to look at what is "Asset Allocation", "Dollar Cost Averaging", "Value Cost Averaging" then only U'd have the "lay of the land" to execute properly. Then again, if you're a typical fellow - heck, why not, just do it - Public Mutual and other agents needs more investors for their livelihood. Just a thought respect: |

|

|

|

|

|

Jan 30 2014, 10:40 AM Jan 30 2014, 10:40 AM

|

Senior Member

4,524 posts Joined: Oct 2007 From: ~Still finding the place~ |

QUOTE(birdman13200 @ Jan 30 2014, 09:42 AM) Since u r new, suggest u go to Public Mutual Online website and read this: Hi, thanks for your reply..understand that unit trust is for long term..minimum 3 to 5 years is not an issue here..http://www.publicmutual.com.my/Resources/U...ustLessons.aspx "Which fund should I invest into?" This question will hv vary answer, the correct way is not choose a fund, but build a portfolio that consist of few funds from different type/location/ etc. "PM definitely better than FD" Be aware this statement may not true if looking in short term, unit trust would require minimum 3 to 5 years, in order it can be better than FD. Do not expect unit trust give consistent return of more than 3% each year. Example for PDSF, for past years record, all also above 3% return, so consider this fund is stable enough for saving? My main objective is to get more interest(FD) or dividend(UT).. QUOTE(wongmunkeong @ Jan 30 2014, 10:14 AM) Pls keep in mind (in any situation): Thanks for your information, understand that salesman always a salesman..he mentioned that UT is for mid-long term investment which need at least 3-5 years to see the outcome..Flower sellers usually say flowers smell good Diamond sellers usually say diamonds are forever, say it with a diamond Gold sellers usually say gold is real $, not fiat $ etc. All based on self interest, NOT YOURS. Better than FD in WHAT situations and WHY? The devil's in the details What i'd suggest is, don't be looking only at Pub Mut - U may want to look at Fundsupermart as well. However, even better, U may want to look at what is "Asset Allocation", "Dollar Cost Averaging", "Value Cost Averaging" then only U'd have the "lay of the land" to execute properly. Then again, if you're a typical fellow - heck, why not, just do it - Public Mutual and other agents needs more investors for their livelihood. Just a thought respect: Better than FD is yearly return which is higher than 3% based on the previous record(PDSF).. I'm asking here to make sure what information he told me is true and to understand more before I invest into it..hardly for me to listen to 1 people only and make my decision, so I hope I can get more information from those who got experience like you all.. Thank u. |

|

|

Jan 30 2014, 11:32 AM Jan 30 2014, 11:32 AM

|

Senior Member

605 posts Joined: Nov 2012 |

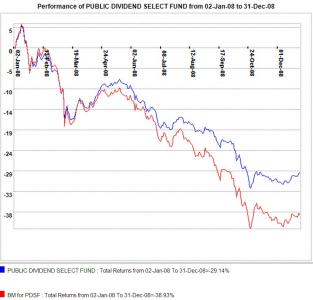

Hi lineage, below statement may not be correct.

QUOTE Example for PDSF, for past years record, all also above 3% return, During economic downturn, the unit trust may not give u positive return, see below performance of PDSF during year 2008. It is not something above 3%. U need to prepare urself for this before enter unit trust, else u will panic when see this type of negative return. It is easy to look back the history, but when u r in it, it is a different story. Attached thumbnail(s)

|

|

|

Jan 30 2014, 12:15 PM Jan 30 2014, 12:15 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(birdman13200 @ Jan 30 2014, 11:32 AM) Hi lineage, below statement may not be correct. During economic downturn, the unit trust may not give u positive return, see below performance of PDSF during year 2008. It is not something above 3%. U need to prepare urself for this before enter unit trust, else u will panic when see this type of negative return. It is easy to look back the history, but when u r in it, it is a different story. me too was shown by UTC about the returns of PDSF but minus the data of -30% as shown in yr provided chart. |

|

|

Jan 30 2014, 03:29 PM Jan 30 2014, 03:29 PM

|

Senior Member

7,142 posts Joined: Oct 2008 From: Sin City |

Public Mutual declares distributions for 4 funds

Public Mutual has declared distributions ranging from 1.5 sen to 5.0 sen for four of its funds for the financial year ending Jan 31, 2014. The gross distribution for the Public Index Fund and the Public Enhanced Bond Fund was 5.0 sen per unit. For the Public Money Market Fund it was 3.0 sen per unit and Public Islamic Optimal Growth Fund 1.5 sen. |

|

|

Jan 30 2014, 04:53 PM Jan 30 2014, 04:53 PM

|

Senior Member

4,524 posts Joined: Oct 2007 From: ~Still finding the place~ |

QUOTE(birdman13200 @ Jan 30 2014, 11:32 AM) Hi lineage, below statement may not be correct. Oh..I see..thank for your information..During economic downturn, the unit trust may not give u positive return, see below performance of PDSF during year 2008. It is not something above 3%. U need to prepare urself for this before enter unit trust, else u will panic when see this type of negative return. It is easy to look back the history, but when u r in it, it is a different story. So should I stop investing to PM using my EPF before I know what I am doing? |

|

|

Jan 30 2014, 05:04 PM Jan 30 2014, 05:04 PM

|

Senior Member

605 posts Joined: Nov 2012 |

QUOTE(Lineage @ Jan 30 2014, 04:53 PM) Oh..I see..thank for your information.. If u already purchased, just let it be, since u hv pay 3% of service charge. Don't be panic if ur return not as expected, especially for the first year, since u need to overcome the 3% SC before hv positive return. So should I stop investing to PM using my EPF before I know what I am doing? For the cash investment, it is better u study in detail before go in, u need to pay 5.5% sc for cash investment, it is difficult to hv positive in short period, the typical case for newbie is buy->long time negative return->panic and sell the fund=get negative profit. Just add on, I not saying unit trust not good, but u need to aware what u r buying and how it is function, else wrong decision will be made. This post has been edited by birdman13200: Jan 30 2014, 05:05 PM |

|

|

Jan 30 2014, 05:19 PM Jan 30 2014, 05:19 PM

|

Senior Member

4,524 posts Joined: Oct 2007 From: ~Still finding the place~ |

QUOTE(birdman13200 @ Jan 30 2014, 05:04 PM) If u already purchased, just let it be, since u hv pay 3% of service charge. Don't be panic if ur return not as expected, especially for the first year, since u need to overcome the 3% SC before hv positive return. Understand that why people will said unit trust not good..and money loss..For the cash investment, it is better u study in detail before go in, u need to pay 5.5% sc for cash investment, it is difficult to hv positive in short period, the typical case for newbie is buy->long time negative return->panic and sell the fund=get negative profit. Just add on, I not saying unit trust not good, but u need to aware what u r buying and how it is function, else wrong decision will be made. Then I should study more before I start invest into it.. |

|

Topic ClosedOptions

|

| Change to: |  0.0274sec 0.0274sec

0.55 0.55

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 10:07 PM |