QUOTE(gark @ Nov 30 2011, 06:50 PM)

10 years correlation chart is short term volatility?  Like I say correlation does not mean it has the same value, it measures the correlation between up and down.

Like I say correlation does not mean it has the same value, it measures the correlation between up and down.

W. Buffett does not earn the title as the worlds' best investor for nothing, in fact he does not favor metals very much at all, hence he unloaded all his silver into ETF holdings and made comments on the 'value' of gold. He is a value investor, if he does not see value even as the price is rising fasts he will not touch it. In fact during 1995-2001 when dot.com stocks is going sky high, he said the same thing and did not touch tech stocks even though thousands upon thousands of people got fabulously rich overnight. That time even a magazine declared the end of Warren Buffett's investment style and he is 'behind times' and does not understand the 'new wave'.

Anyway just enjoy the ride while it last, but please diversify properly and not put everything in one basket. Also falling in love with an investment is a no no. In fact I do diversify into gold via Newcrest Mining, but it is just a small percentage

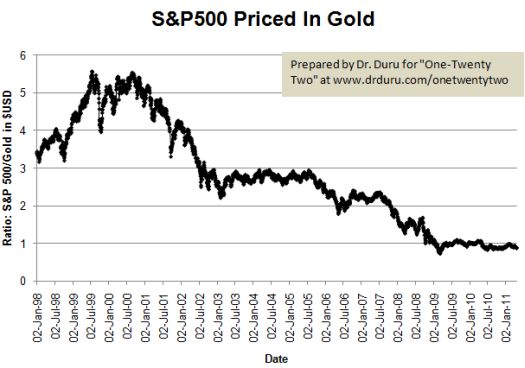

Tell me that the S&P is going the same direction over the last 10 yaers by this chartW. Buffett does not earn the title as the worlds' best investor for nothing, in fact he does not favor metals very much at all, hence he unloaded all his silver into ETF holdings and made comments on the 'value' of gold. He is a value investor, if he does not see value even as the price is rising fasts he will not touch it. In fact during 1995-2001 when dot.com stocks is going sky high, he said the same thing and did not touch tech stocks even though thousands upon thousands of people got fabulously rich overnight. That time even a magazine declared the end of Warren Buffett's investment style and he is 'behind times' and does not understand the 'new wave'.

Anyway just enjoy the ride while it last, but please diversify properly and not put everything in one basket. Also falling in love with an investment is a no no. In fact I do diversify into gold via Newcrest Mining, but it is just a small percentage

You gave me a two year chart. If the S&P was going the direction as gold as YOU have indicated in your post, the

the chart should be pretty FLAT. How come S&P vs gold is DECREASING

If Warren did not value silver why in the world did he buy all of 130mil ozs of the stuff in the first place?

Its not he didnt see value when he unloaded. He just unloaded TOO early.......silver went from $7 to $12 in the next 18 months and to $50 in the next 5 years.

i have been enjoying since 2002........not seen any change in fundamentals to see otherwise.......

Nov 30 2011, 08:30 PM

Nov 30 2011, 08:30 PM

Quote

Quote 0.0262sec

0.0262sec

0.75

0.75

6 queries

6 queries

GZIP Disabled

GZIP Disabled