QUOTE(cherroy @ Nov 30 2011, 02:26 PM)

I don't see I can buy a bowl of mee with gold, nor I can buy a house with 1kg of gold, or buy a car with 1/2kg of gold. They do not accept it as payment, do they?

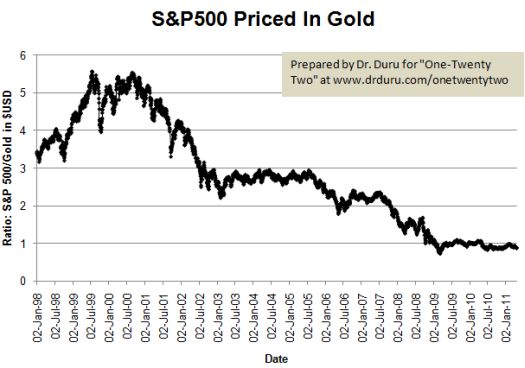

Correlated or not, I don't know, but I only know stock market beat gold "value", at least from Dow Jones perspective in longer term perspective.

That's why Warren Buffett become the richest man in the world.

If using 2000-2011, surely gold beat stock market, but for the 20 or 25 years period, stock market still beat gold.

Because 1999-2000 we had tech bubble in stock market.

Can we purchase farmland using gold right now?

Do seller accept gold as payment?

I don't know, may be there is, but so far I never see people use gold to pay off car purchase, house purchase or land purchase.

If can without converting to fiat money for valuation, then may be we have a case.

Like I want to sell a land at 1kg of gold like that, disregard how much the gold price is.

When you use fiat ringgit or USD, then gold is valued at fiat face already, the value is depended on fiat money already.

The gold value is 1oz, and never will give you more than 1oz.

If you use fiat as benchmark for return, then it is investment, and benchmark valuation is fiat money.

Corelated or not? DJ beat becos of Warren Buffet?

i suppose everyone is Warren and all are billionire as long as they are invested in Dow Jones?

Warreb Buffet sold his 130mil ozs of silver at $7 per oz in 2006....hes real smart.....

On the matter of farmland i presume gark is refering to badtimes as in TSHTF. Pls read the context.

Dont just shoot off yer hip.

i guess you have not seen Zimbawe or Utah accepting gold as payment. Hell, even Trump Donald accept

gold for payment of his properties!

Added on November 30, 2011, 2:48 pmQUOTE(gark @ Nov 30 2011, 02:39 PM)

If you say the trading of gold is fiat gold, then why is your physical gold 'value' follow the 'price' of fiat (traded) gold?

Try selling your gold to it's true 'value' (whatever you perceive it to be) without following the traded price, see anyone want to buy from you or not?

The graph is nothing new, as price of gold exceed the rise in equities, it is natural the price of single equity is worth less than the traded gold. It still brings to the argument that price is what you pay, value is what you get.

Still you say you have earn so much and much, isn't that also follow the 'price' of traded (fiat?) gold? Correlation is based on beta, and not a comparison graph. Beta means if no1 goes up, no 2 also goes up and vice versa.

Oh yeah, they do trade tulips for land, food, etc during the tulip mania...

You said when mkt falls, gold falls......dont detract from that. i showed you it depneds on the timeline.

Beta is reaction.....i am showing you a trend which rebutts your saying

QUOTE

Gold nowadays is more like a trading instrument, where it performs more or less like the stock market, if stock falls, it falls, if it goes up, gold goes up. The 'hedging' is no longer there as the 'beta' of gold is correlated to the world stock market.

Show me evidence where they traded using tulips.....during the tulip mania. Thanks

Link pls?

Did tulips ever return as an asset for exchange? Did gold?

This post has been edited by prophetjul: Nov 30 2011, 02:50 PM

Nov 30 2011, 05:51 AM

Nov 30 2011, 05:51 AM

Quote

Quote

0.0256sec

0.0256sec

0.56

0.56

6 queries

6 queries

GZIP Disabled

GZIP Disabled