i read some where. It's a private deal lah.

4 more info PM me.

QUOTE(prophetjul @ Nov 30 2011, 08:30 PM)

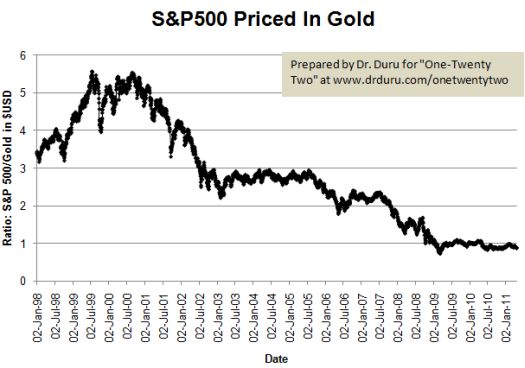

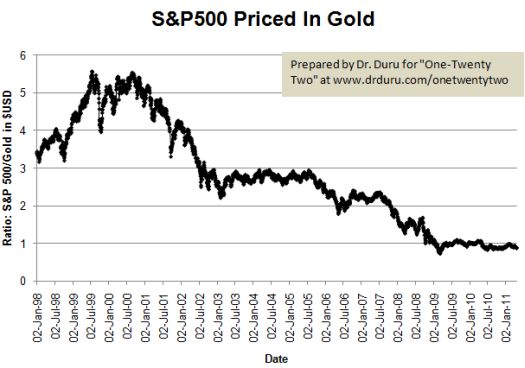

Tell me that the S&P is going the same direction over the last 10 yaers by this chart

You gave me a two year chart. If the S&P was going the direction as gold as YOU have indicated in your post, the

the chart should be pretty FLAT. How come S&P vs gold is DECREASING

If Warren did not value silver why in the world did he buy all of

130mil ozs of the stuff in the first place?

Its not he didnt see value when he unloaded. He just unloaded TOO early.......silver went from $7 to $12 in the next 18 months and to

$50 in the next 5 years.

i have been enjoying since 2002........not seen any change in fundamentals to see otherwise.......

Added on December 2, 2011, 11:19 pmQUOTE(alex_quah @ Dec 1 2011, 10:47 PM)

It means you did not read previous post thoroughly.

I went to PBB checked already, the spreading is too much which is around RM7, but with the best benefit to trade gold online from 9am to 4pm business days. However, consider invest 100g@RM200, you losses RM1400 immediately.

Compared to Sg, the spreading using UOB Sg is surprisingly as low as S$0.20 only. However, UOB Sg incurs charge which is 0.12g/month or 0.25%/year whichever is higher. If you are small kaki, then not worth to invest gold with this scheme, but if you are big kaki can easily buy >100g every time, pls consider come in Sg to invest gold instead of in Malaysia cause the spreading charge in Malaysia simply too high already. Looking at long term investment and if you stay in JB south peninsular, you may consider to do that. Somemore, dollar conversion to RM may get higher over the next 10 years.

Btw, I work in sg, and planning to buy some lately. These were my findings to share here.

I think UOB MY can lower their gold trading to RM1 and RM.50 but i don;t know how other bank will react and how bank negara will policy it.

i see lot of people still on paper gold but one day those on paper will kena kau kau lah.

my policy is always physical.

This post has been edited by GoldChan: Dec 2 2011, 11:19 PM

Dec 2 2011, 09:41 PM

Dec 2 2011, 09:41 PM

Quote

Quote

0.0294sec

0.0294sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled