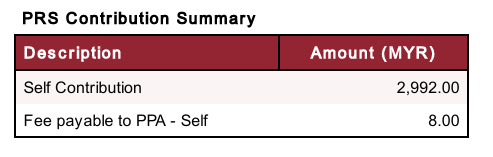

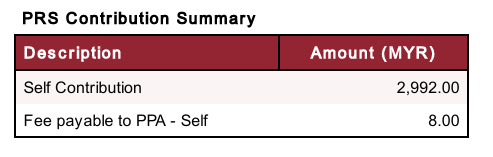

Can I still claim RM3000 in my Income Tax PRS relief for Y2024??

This post has been edited by ronnie: Jan 5 2025, 12:19 AM

Private Retirement Fund, What the hell is that??

|

|

Jan 5 2025, 12:18 AM Jan 5 2025, 12:18 AM

Show posts by this member only | IPv6 | Post

#6461

|

All Stars

21,332 posts Joined: Jan 2003 From: Kuala Lumpur |

|

|

|

|

|

|

Jan 5 2025, 01:55 AM Jan 5 2025, 01:55 AM

|

All Stars

14,959 posts Joined: Mar 2015 |

QUOTE(ronnie @ Jan 5 2025, 12:18 AM) My latest statement for PRS from AHAM says this If I can still recall it correctly, that 3000 max is the total you pay to buy the PRS which also includes all other fees and charges. Can I still claim RM3000 in my Income Tax PRS relief for Y2024?? Just for some fun, 3000 @20% tax bracket, will pay 600 less tax 2992 @20% tax bracket, will pay 598.40 (598) less tax,... a RM2 variance between claiming 3000 vs 2992 kimi0148 liked this post

|

|

|

Jan 5 2025, 08:37 AM Jan 5 2025, 08:37 AM

|

Senior Member

1,604 posts Joined: Aug 2014 |

For this year, is the recommended PRS fund still Principal PRS Plus Principal RetireEasy 2050 - Class C?

|

|

|

Jan 5 2025, 09:22 AM Jan 5 2025, 09:22 AM

|

All Stars

24,427 posts Joined: Feb 2011 |

QUOTE(kart @ Jan 5 2025, 08:37 AM) For this year, is the recommended PRS fund still Principal PRS Plus Principal RetireEasy 2050 - Class C? No. Depends on what you want and your risk profile.This post has been edited by Ramjade: Jan 5 2025, 09:23 AM MUM liked this post

|

|

|

Jan 5 2025, 09:42 AM Jan 5 2025, 09:42 AM

Show posts by this member only | IPv6 | Post

#6465

|

All Stars

14,959 posts Joined: Mar 2015 |

|

|

|

Jan 6 2025, 08:58 AM Jan 6 2025, 08:58 AM

|

Senior Member

1,604 posts Joined: Aug 2014 |

|

|

|

|

|

|

Jan 6 2025, 10:10 AM Jan 6 2025, 10:10 AM

Show posts by this member only | IPv6 | Post

#6467

|

All Stars

24,427 posts Joined: Feb 2011 |

QUOTE(kart @ Jan 6 2025, 08:58 AM) My objective is to obtain the highest return. Highest return one year does not means highest return forever. Lots of Malaysia focus funds are doing great last year cause oversold.I can tolerate the risk of the potential drastic drop in the NAV of the PRS fund, as long as the return should be the highest many years later. You can chase and be at the party/late to the party or go for consistent returns. As you can see in the pic principal retireeasy is not in the pic. Your choice. |

|

|

Jan 6 2025, 11:59 AM Jan 6 2025, 11:59 AM

Show posts by this member only | IPv6 | Post

#6468

|

Senior Member

960 posts Joined: Mar 2013 |

QUOTE(MUM @ Jan 5 2025, 09:42 AM) hi,may i know is this meanexample AHAM PRS Growth 1 year return is 10.96% and 5 years return is just 3.40%? This post has been edited by Dyson Jin: Jan 6 2025, 12:00 PM |

|

|

Jan 6 2025, 12:17 PM Jan 6 2025, 12:17 PM

|

Senior Member

7,106 posts Joined: Jan 2003 |

QUOTE(Dyson Jin @ Jan 6 2025, 11:59 AM) hi,may i know is this mean Annualised means on average the past 5 years each year just 3.4%, but last year was 10.96%. This is VERY poor performer, given 3.4% is lower than whatever conventional safe asset you could invest in.example AHAM PRS Growth 1 year return is 10.96% and 5 years return is just 3.40%? |

|

|

Jan 6 2025, 12:23 PM Jan 6 2025, 12:23 PM

Show posts by this member only | IPv6 | Post

#6470

|

Senior Member

960 posts Joined: Mar 2013 |

QUOTE(fuzzy @ Jan 6 2025, 12:17 PM) Annualised means on average the past 5 years each year just 3.4%, but last year was 10.96%. This is VERY poor performer, given 3.4% is lower than whatever conventional safe asset you could invest in. yes indeed,if not because of 3k tax relief,i wont topup as well.Still got charges&fees Tax relief until 2025,if no extend,then will stop topup.. |

|

|

Jan 6 2025, 12:24 PM Jan 6 2025, 12:24 PM

|

Senior Member

7,106 posts Joined: Jan 2003 |

|

|

|

Jan 6 2025, 12:55 PM Jan 6 2025, 12:55 PM

Show posts by this member only | IPv6 | Post

#6472

|

Senior Member

960 posts Joined: Mar 2013 |

|

|

|

Jan 6 2025, 01:27 PM Jan 6 2025, 01:27 PM

Show posts by this member only | IPv6 | Post

#6473

|

All Stars

14,959 posts Joined: Mar 2015 |

|

|

|

|

|

|

Jan 6 2025, 01:37 PM Jan 6 2025, 01:37 PM

Show posts by this member only | IPv6 | Post

#6474

|

All Stars

24,427 posts Joined: Feb 2011 |

QUOTE(Dyson Jin @ Jan 6 2025, 12:55 PM) Please don't use versa. The marketing trick used by versa by giving you free money to buy versa is not worth buying AHAM funds. I would forego the reward and choose a good fund as reward is one time only and good returns should be consistent until. |

|

|

Jan 6 2025, 01:38 PM Jan 6 2025, 01:38 PM

|

Junior Member

615 posts Joined: Feb 2018 |

QUOTE(MUM @ Jan 5 2025, 09:42 AM) my pick for 2024 was Public Mutual PRS Equity, both 1-year and 5-year track record are consistent and show promise. I think highly likely i'll pick the same for 2025 MUM liked this post

|

|

|

Jan 6 2025, 03:13 PM Jan 6 2025, 03:13 PM

Show posts by this member only | IPv6 | Post

#6476

|

Senior Member

1,618 posts Joined: Mar 2020 |

QUOTE(koja6049 @ Jan 6 2025, 01:38 PM) my pick for 2024 was Public Mutual PRS Equity, both 1-year and 5-year track record are consistent and show promise. I think highly likely i'll pick the same for 2025 how much was the fees when you bought for 2024?heard about their prs funds but their website is just hard to navigate. Cant find historical price movements and fees. Cant find summary what their recent investments, only info found was the investment disclosed in their previous annual report dated March 2024. |

|

|

Jan 6 2025, 03:15 PM Jan 6 2025, 03:15 PM

Show posts by this member only | IPv6 | Post

#6477

|

All Stars

24,427 posts Joined: Feb 2011 |

QUOTE(thecurious @ Jan 6 2025, 03:13 PM) how much was the fees when you bought for 2024? 3% service charge to buy. heard about their prs funds but their website is just hard to navigate. Cant find historical price movements and fees. Cant find summary what their recent investments, only info found was the investment disclosed in their previous annual report dated March 2024. The standard 1.5-1.8%p.a annual expense ratio. By choosing public mutual you are already losing 3% out of the gate. So the returns better be better than other funds that can be bought from FSM as FSM is zero percent service charge. This post has been edited by Ramjade: Jan 6 2025, 03:16 PM thecurious liked this post

|

|

|

Jan 6 2025, 03:49 PM Jan 6 2025, 03:49 PM

Show posts by this member only | IPv6 | Post

#6478

|

Senior Member

960 posts Joined: Mar 2013 |

QUOTE(Ramjade @ Jan 6 2025, 01:37 PM) Please don't use versa. The marketing trick used by versa by giving you free money to buy versa is not worth buying AHAM funds. oh dear...alright luckily is just first time using versa..so stuck 3k there only..might consider FSM as per advice hereI would forego the reward and choose a good fund as reward is one time only and good returns should be consistent until. |

|

|

Jan 6 2025, 04:15 PM Jan 6 2025, 04:15 PM

Show posts by this member only | IPv6 | Post

#6479

|

All Stars

24,427 posts Joined: Feb 2011 |

QUOTE(Dyson Jin @ Jan 6 2025, 03:49 PM) oh dear...alright luckily is just first time using versa..so stuck 3k there only..might consider FSM as per advice here If they got good funds, it's a different story. I think you can contact FSM and ask them if you can transfer over to them or not. Dyson Jin liked this post

|

|

|

Jan 31 2025, 01:59 PM Jan 31 2025, 01:59 PM

|

Senior Member

4,165 posts Joined: May 2005 |

Anyone knows any PRS which has exposure in China?

|

| Change to: |  0.0206sec 0.0206sec

0.37 0.37

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 07:59 AM |