QUOTE(Ramjade @ Apr 6 2025, 08:36 PM)

Actually depends on what you want actually. What works for you can't work for me and vice versa.

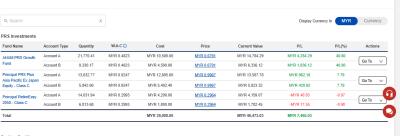

I go for the best growth over time and I prefer foreign holdings Vs Malaysian.

You can consider this 2 if you want the best best growth.

1. Principal retireeasy 2050

2. Rhb Retirement islamic balance

Keep in mind it may swing a lot as I am an aggressive investor.

You can choose and compare your PRS here.

https://www.fsmone.com.my/tools/fund-selector

https://www.fsmone.com.my/funds/tools/chart-centre

Majority of PRS in Malaysia are hopeless and tak boleh pakai. Giving less than EPF return.

I go for the best growth over time and I prefer foreign holdings Vs Malaysian.

You can consider this 2 if you want the best best growth.

1. Principal retireeasy 2050

2. Rhb Retirement islamic balance

Keep in mind it may swing a lot as I am an aggressive investor.

You can choose and compare your PRS here.

https://www.fsmone.com.my/tools/fund-selector

https://www.fsmone.com.my/funds/tools/chart-centre

Majority of PRS in Malaysia are hopeless and tak boleh pakai. Giving less than EPF return.

QUOTE(Cubalagi @ Apr 6 2025, 09:12 PM)

I looked up this principal islamic fund, its quite a new fund. Established in Sept 22. How long have you invested in this fund? Are u expecting positive returns every year? Funds sometimes have bad year or two.

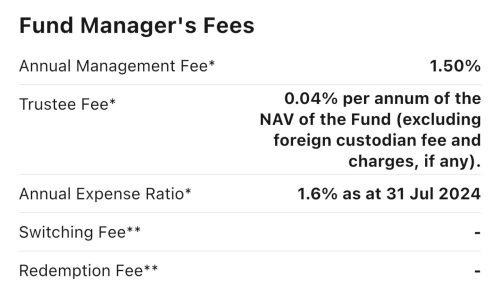

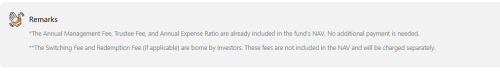

But cons of this fund:

1. Still very new with short track.record

2. Small size, no scale. So fixed expenses will eat up a lot of the returns.

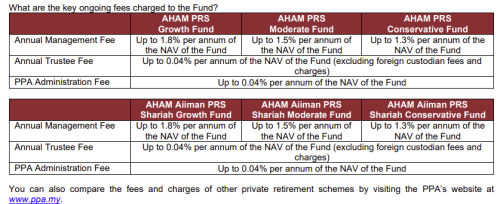

And sorry, I dont have a view of any of the other 3 funds you mentioned. Most PRS have been sub par because of high exposure to Malaysian equities and also bonds.

Thanks for the information @Ramjade @Cubalagi.But cons of this fund:

1. Still very new with short track.record

2. Small size, no scale. So fixed expenses will eat up a lot of the returns.

And sorry, I dont have a view of any of the other 3 funds you mentioned. Most PRS have been sub par because of high exposure to Malaysian equities and also bonds.

I initially invested in the fund around 2022. I'm now looking into PRS options with broader global exposure, hoping to achieve better long-term returns than EPF.

I'll definitely look into the points you all shared in more detail. Appreciate the insights!

Cheers,

Apr 7 2025, 03:15 PM

Apr 7 2025, 03:15 PM

Quote

Quote

0.0202sec

0.0202sec

0.51

0.51

6 queries

6 queries

GZIP Disabled

GZIP Disabled