Please check the T&C for the reward points for your credit card. I just checked the Citibank, one of the condition is....no point for those transaction which is approved by LHDN for tax relief.

SSPN, Skim Simpanan Pendidikan Nasional

SSPN, Skim Simpanan Pendidikan Nasional

|

|

Dec 29 2015, 02:53 PM Dec 29 2015, 02:53 PM

|

Junior Member

371 posts Joined: Nov 2007 |

Please check the T&C for the reward points for your credit card. I just checked the Citibank, one of the condition is....no point for those transaction which is approved by LHDN for tax relief.

|

|

|

|

|

|

Dec 29 2015, 05:23 PM Dec 29 2015, 05:23 PM

|

Junior Member

257 posts Joined: Jan 2005 |

|

|

|

Dec 30 2015, 03:03 PM Dec 30 2015, 03:03 PM

|

Senior Member

1,229 posts Joined: Jan 2003 From: Malacca |

I get my 9k points (6k myself, 3k my wife) using PB VS card last 2 weeks.

|

|

|

Dec 30 2015, 03:11 PM Dec 30 2015, 03:11 PM

|

Senior Member

5,143 posts Joined: Jan 2015 |

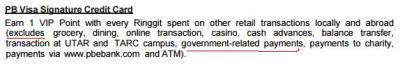

from the Product Disclosure Sheet: https://www.pbebank.com/pdf/Cards/pds/pds_credit_pbb.aspx Attached thumbnail(s)

|

|

|

Dec 30 2015, 03:38 PM Dec 30 2015, 03:38 PM

|

Senior Member

1,229 posts Joined: Jan 2003 From: Malacca |

No idea, the transaction posted as ONEPOINT SERVICE WP KUALA LUMP MY

|

|

|

Dec 30 2015, 06:19 PM Dec 30 2015, 06:19 PM

|

Senior Member

3,294 posts Joined: Dec 2005 |

Any idea the kioks at Metro Prima last until when?

|

|

|

|

|

|

Dec 30 2015, 07:27 PM Dec 30 2015, 07:27 PM

|

Junior Member

8 posts Joined: Dec 2014 |

QUOTE(wil-i-am @ Dec 26 2015, 11:57 PM) Indeed, just checked online statement, reward points credited. Just thinking out loud if next year withdraw all my money out (roughly RM25K), then re-deposit again. Withdraw again, re-deposit again.. I can easily earn lot of reward points to exchange gadget |

|

|

Dec 30 2015, 07:46 PM Dec 30 2015, 07:46 PM

Show posts by this member only | IPv6 | Post

#448

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Dec 30 2015, 07:52 PM Dec 30 2015, 07:52 PM

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(Ahmosai @ Dec 30 2015, 07:27 PM) Indeed, just checked online statement, reward points credited. Just thinking out loud if next year withdraw all my money out (roughly RM25K), then re-deposit again. Withdraw again, re-deposit again.. I can easily earn lot of reward points to exchange gadget Spot onSuggest u try next mth n keep us updated here ya |

|

|

Dec 30 2015, 11:23 PM Dec 30 2015, 11:23 PM

|

Senior Member

1,229 posts Joined: Jan 2003 From: Malacca |

QUOTE(Ahmosai @ Dec 30 2015, 07:27 PM) Indeed, just checked online statement, reward points credited. Just thinking out loud if next year withdraw all my money out (roughly RM25K), then re-deposit again. Withdraw again, re-deposit again.. I can easily earn lot of reward points to exchange gadget how to withdraw all? I thought we can only withdraw 10% / RM500 per year? |

|

|

Dec 31 2015, 08:50 AM Dec 31 2015, 08:50 AM

|

Senior Member

1,311 posts Joined: Oct 2012 |

This cc thing is new to me. So where can we do the top up via cc next year? Many thanks.

|

|

|

Dec 31 2015, 10:40 AM Dec 31 2015, 10:40 AM

|

Senior Member

6,256 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(familyfirst @ Dec 31 2015, 08:50 AM) I would like to know also, missed this when I was doing the 6k top-up this year. Can use cards like AEON Watami to get additional 3% cashback just from these transactions. |

|

|

Dec 31 2015, 10:44 AM Dec 31 2015, 10:44 AM

|

Junior Member

212 posts Joined: May 2013 |

is it easy to withdraw out the money from sspn?

|

|

|

|

|

|

Dec 31 2015, 10:51 AM Dec 31 2015, 10:51 AM

|

Junior Member

212 posts Joined: May 2013 |

Hey guys, got a ques.. let's say if i save 6k today, is it easy to withdraw in jan and also would the 6k i saved be eligible for the 2015 tax relief?

|

|

|

Dec 31 2015, 10:56 AM Dec 31 2015, 10:56 AM

|

Senior Member

6,256 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(studentsurvey @ Dec 31 2015, 10:51 AM) Hey guys, got a ques.. let's say if i save 6k today, is it easy to withdraw in jan and also would the 6k i saved be eligible for the 2015 tax relief? Can, but then you won't be able to claim 2016 tax relief unless you put in 12k.Best way to 'play' is probably to put 6k per year for a few years until its sizable amount (let's say you go for 5 years), then withdraw one short in the 6th year. 7th year start putting 6k again. This will result in much better interest rate (just put the withdrawn amount in some investment or long-term FD) IMO compared to every year just add and add. |

|

|

Dec 31 2015, 11:06 AM Dec 31 2015, 11:06 AM

|

Junior Member

212 posts Joined: May 2013 |

QUOTE(LostAndFound @ Dec 31 2015, 10:56 AM) Can, but then you won't be able to claim 2016 tax relief unless you put in 12k. Thanks for the prompt reply. Best way to 'play' is probably to put 6k per year for a few years until its sizable amount (let's say you go for 5 years), then withdraw one short in the 6th year. 7th year start putting 6k again. This will result in much better interest rate (just put the withdrawn amount in some investment or long-term FD) IMO compared to every year just add and add. At year 7, i wont be able to enjoy the tax relief right? since it us suppose to the net difference between the year before and the current year's savings.. I am more concerned about withdrawing the money as I have heard stories that people are only able to withdraw only a small portion. Should this be of a concern? Gonna try to go maybank and open the account before the year end to try it out.. hehe |

|

|

Dec 31 2015, 11:57 AM Dec 31 2015, 11:57 AM

|

Senior Member

10,001 posts Joined: May 2013 |

|

|

|

Dec 31 2015, 12:05 PM Dec 31 2015, 12:05 PM

|

Senior Member

10,001 posts Joined: May 2013 |

QUOTE(familyfirst @ Dec 31 2015, 08:50 AM) PTPTN branchesQUOTE(LostAndFound @ Dec 31 2015, 10:40 AM) I would like to know also, missed this when I was doing the 6k top-up this year. Can use cards like AEON Watami to get additional 3% cashback just from these transactions. Any cc will do |

|

|

Dec 31 2015, 04:54 PM Dec 31 2015, 04:54 PM

|

All Stars

48,418 posts Joined: Sep 2014 From: REality |

QUOTE(LostAndFound @ Dec 31 2015, 10:56 AM) Best way to 'play' is probably to put 6k per year for a few years until its sizable amount (let's say you go for 5 years), then withdraw one short in the 6th year. 7th year start putting 6k again. This will result in much better interest rate (just put the withdrawn amount in some investment or long-term FD) IMO compared to every year just add and add. |

|

|

Dec 31 2015, 09:46 PM Dec 31 2015, 09:46 PM

|

|

Elite

5,608 posts Joined: May 2011 From: Here, There, Everywhere |

QUOTE(LostAndFound @ Dec 31 2015, 10:56 AM) Can, but then you won't be able to claim 2016 tax relief unless you put in 12k. Works only IF:Best way to 'play' is probably to put 6k per year for a few years until its sizable amount (let's say you go for 5 years), then withdraw one short in the 6th year. 7th year start putting 6k again. This will result in much better interest rate (just put the withdrawn amount in some investment or long-term FD) IMO compared to every year just add and add. 1. when withdraw on 6th year, we willingly "give up" on 6th year's XX% tax relief 2. and on the 7th year, SSPN "resets" as we were "missing for 1 year" (6th year) I'm interested in doing it BUT unsure whether (2.) happens or not (reset). If doesn't "reset", like a previous forumer shared - coz on the 7th year, put in $6K pun tak cukup because took out say $20K 2 years ago (ie. net inwards still -$14K) However, IF the credit card is still acceptable AND can make points/cashback... heheh... every year withdraw 100% (eg $20K $26K $32K etc as it grows) then year end or close to Dec, plonk back in via credit card +$X,xxx |

| Change to: |  0.0201sec 0.0201sec

0.56 0.56

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 11:32 AM |