QUOTE(panaunoo @ Jan 15 2015, 02:27 PM)

usually abt 2 months after EPF announcement.SSPN, Skim Simpanan Pendidikan Nasional

SSPN, Skim Simpanan Pendidikan Nasional

|

|

Jan 15 2015, 02:41 PM Jan 15 2015, 02:41 PM

Return to original view | Post

#1

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Jan 15 2015, 03:10 PM Jan 15 2015, 03:10 PM

Return to original view | Post

#2

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Apr 6 2015, 03:08 PM Apr 6 2015, 03:08 PM

Return to original view | Post

#3

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Apr 6 2015, 03:47 PM Apr 6 2015, 03:47 PM

Return to original view | Post

#4

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Jun 9 2015, 03:37 PM Jun 9 2015, 03:37 PM

Return to original view | Post

#5

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(kochin @ Jun 9 2015, 02:21 PM) i surfed their website...looks likely Father open a/c for son...can contribute RM 6k Mother open a/c for same son...can contribute RM 6k thus total RM 12k Q: 4 and Q: 6 http://www.ptptn.gov.my/web/english/insent...ih-dalam-sspn-i |

|

|

Jun 9 2015, 04:09 PM Jun 9 2015, 04:09 PM

Return to original view | Post

#6

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

|

|

|

Jun 9 2015, 04:17 PM Jun 9 2015, 04:17 PM

Return to original view | Post

#7

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(wil-i-am @ Jun 9 2015, 04:11 PM) |

|

|

Jun 9 2015, 06:21 PM Jun 9 2015, 06:21 PM

Return to original view | Post

#8

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(aeiou228 @ Jun 9 2015, 06:03 PM) The 6k tax relief is based on yearly INCREMENTAL balance. Meaning Last year you deposited 6K, you will get tax relief for 6K for 2014 assessment. This year your SSPN account balance must have a NET increase of 6K (Balance is now RM12K)in order to entitle to another 6K relief for 2015 income tax assessment. |

|

|

Jun 9 2015, 09:08 PM Jun 9 2015, 09:08 PM

Return to original view | Post

#9

|

Senior Member

5,143 posts Joined: Jan 2015 |

got this from the web...

Soalan 22 : SSPN-i Plus dan SSPN-i masing-masing menawarkan pelepasan taksiran cukai pendapatan ke atas simpanan bersih tahun semasa sehingga RM6,000 bagi akaun yang dibuka untuk anak/ anak jagaan yang sah. Jika pendeposit mempunyai kedua-dua akaun, adakah pelepasan taksiran cukai pendapatan yang boleh dinikmati adalah sebanyak RM12,000? Jawapan : Tidak. Pelepasan taksiran cukai pendapatan ke atas simpanan bersih bagi SSPN-i Plus dan SSPN-i hanya diberikan sehingga RM6,000. Walau bagaimanapun bagi akaun SSPN-i Plus, pendeposit boleh menikmati tambahan pelepasan taksiran cukai pendapatan ke atas sumbangan takaful yang dibayar kepada pengendali takaful sebanyak RM6,000, di bawah kategori pelepasan bagi insurans nyawa dan KWSP http://www.ptptn.gov.my/web/guest/pelepasa...ukai-pendapatan not very attractive bcos some had already maxed their EPF at RM6k This post has been edited by T231H: Jun 9 2015, 09:22 PM |

|

|

Dec 28 2015, 01:44 PM Dec 28 2015, 01:44 PM

Return to original view | Post

#10

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(cfc @ Dec 28 2015, 01:41 PM) i also want to open an account to get the tax relief YA2015 Question 1 :for the sspn-i account opening 1. is it only for parent who already has children ? 2. I saw from website, it does have a individual account (age 30 above), can I apply this to get tax relief 3. saw contradicting info on the withdrawal. Some saw can withdraw, some say cannot. Cann't call them to as the line keep engaging ?!!! thanks all Who is eligible for tax relief incentive? Answer : Parents and adopted parents/ legal guardians who deposited in SSPN-i savings account for their children will be given tax relief incentive. Question 2 : Does depositor who opened the account for their ownselves eligible for the incentive? Answer : No, they are not eligible. http://www.ptptn.gov.my/web/english/insent...ih-dalam-sspn-i |

|

|

Dec 28 2015, 01:57 PM Dec 28 2015, 01:57 PM

Return to original view | Post

#11

|

Senior Member

5,143 posts Joined: Jan 2015 |

|

|

|

Dec 30 2015, 03:11 PM Dec 30 2015, 03:11 PM

Return to original view | Post

#12

|

Senior Member

5,143 posts Joined: Jan 2015 |

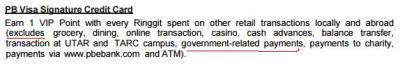

from the Product Disclosure Sheet: https://www.pbebank.com/pdf/Cards/pds/pds_credit_pbb.aspx Attached thumbnail(s)

|

|

|

Jan 29 2016, 10:40 PM Jan 29 2016, 10:40 PM

Return to original view | Post

#13

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Ramjade @ Jan 29 2016, 10:05 PM) Question 1 :Who is eligible for tax relief incentive? Answer : Parents and adopted parents/ legal guardians who deposited in SSPN-i savings account for their children will be given tax relief incentive. Question 2 : Does depositor who opened the account for their ownselves eligible for the incentive? Answer : No, they are not eligible. http://www.ptptn.gov.my/web/english/insent...ih-dalam-sspn-i |

|

|

|

|

|

Feb 28 2016, 09:30 AM Feb 28 2016, 09:30 AM

Return to original view | Post

#14

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(fairyboy @ Feb 28 2016, 04:22 AM) So actually does we get the tax relief if we open the spss account for ourselves? Sorry to ask again due to i saw it from the spss official website, there wrote: Individu yang menyimpan untuk diri sendiri tidak diberi pelepasan taksiran cukai. why do you want to get tax relief for? are you working and is your income bracket subjected to tax?So still confusing whether we get tax relief or not if the account is opened by ourselves and not by parent. |

|

|

Feb 28 2016, 12:05 PM Feb 28 2016, 12:05 PM

Return to original view | Post

#15

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(Sunny zombie @ Feb 28 2016, 11:22 AM) there are some online facilities as per listed here...hope there are what you seek. SSPN-i Facilities http://www.ptptn.gov.my/web/english/sspn-i-facilities |

|

|

Feb 29 2016, 11:06 PM Feb 29 2016, 11:06 PM

Return to original view | Post

#16

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(fairyboy @ Feb 29 2016, 10:49 PM) juz want to know before i step in working environment, after intern will going to work. But i heard if monthly income is RM2000+, I'm subjected to pay tax. But I'm not so sure about that, so want to know whether got tax relief for SPSS holder. Income tax relief on SSPN-i savings:1. Parents and adopted parents/ legal guardians who have an SSPN-i account for their children will be given tax relief up to a maximum of RM6,000.00 per year subject to the total net savings in the current year; 2. Parents who filed separate assessment and have opened separate SSPN-i accounts for the same child will be given tax relief up to a maximum of RM6,000.00 per person per year; 3. Parents who filed a joint assessment and have opened separate SSPN-i accounts will be given tax relief up to a maximum of RM6,000.00 per year; and 4. Individuals who have save for themselves are not given tax relief. http://www.ptptn.gov.my/web/english/tax-relief-assessment Am I taxable? with effect year 2013 an individual who earns an annual employment income of RM30,667 (after EPF deduction) has to register a tax file. http://e-cukai.com/taxable/ This post has been edited by T231H: Feb 29 2016, 11:07 PM |

|

|

Apr 18 2016, 02:30 AM Apr 18 2016, 02:30 AM

Return to original view | Post

#17

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(lowyat101 @ Apr 17 2016, 09:31 PM) Hi, This post has been edited by T231H: Apr 18 2016, 02:35 AMJust got my baby few weeks ago and found about this SSPN thing when filling up my tax return form earlier today. Seems like a good way to get the tax relief with reasonable interest rate (similar to FD). But I have a few questions based on my reading in the SSPN website and this thread, as follows: 1) From the SSPN website, it's mentioned that the withdrawal is only allowed for 10% or RM500, but in this thread I read that this T&C has been revised and now it's free to withdraw anytime. Is it correct? If yes, are there any charges for withdrawal? And if I open the SSPN account via Maybank, can I do the withdrawal online right into my Maybank account? see page 23, post 458 Mengemukakan nombor akaun bank pendeposit sekiranya ingin wang simpanan tersebut dikreditkan ke akaun pendeposit.(Akaun mestilah atas nama pendeposit dan bukan akaun bersama) http://www.ptptn.gov.my/web/guest/simpanan...penutupan-akaun 2) In the tax return form, the max tax relief is RM6k per year, but in this thread it was mentioned that we need RM12k to be eligible for the relief. May I know is this only applicable for the 1st year? see this.... http://www.ptptn.gov.my/web/guest/simpanan/cukai 3) I understand that I can open the SSPN account at Maybank branch. Since now we can't make the SSPN deposit via CC, can I use M2U to transfer in the deposit? check this out http://www.ptptn.gov.my/web/guest/simpanan/kemudahan-sspn-i see page 22, post 430...CC can use 4) From the SSPN website, I see that there's another product called SSPN-i Plus, which is SSPN + additional insurance coverage. May I know is the insurance package provided a good package to bundle with? Or it's better to go with the normal SSPN and buy the separate insurance outside? just a note...see page 21, post 412 Thanks |

|

|

May 8 2016, 11:21 AM May 8 2016, 11:21 AM

Return to original view | Post

#18

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(lalachong @ May 8 2016, 10:58 AM) Ahad, 08 Mei 2016Kadar Dividen SSPN-i 4 Peratus KUALA LUMPUR, 6 Mei (Bernama) -- Menteri Pendidikan Tinggi Datuk Seri Idris Jusoh hari ini mengumumkan dividen Skim Simpanan Pendidikan Nasional (SSPN-i) bagi tahun 2015 adalah sebanyak 4 peratus. http://www.bernama.com/bernama/v8/bm/ge/ne....php?id=1242913 |

|

|

May 9 2016, 02:40 AM May 9 2016, 02:40 AM

Return to original view | Post

#19

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(whoopsylai @ May 8 2016, 11:12 PM) question...i went to CIMB that day to enquire about SSPN, I was attended by one of the general enquiry clerk, an uncle (40++) quite know-it-all fellow (my own impression) of course it won't be as easy as withdrawing money from saving account in Maybank....apparently the one thing that he told me and i remembered, was IT IS DAMN HARD TO WITHDRAW THE MONEY...THE PAPERWORK IS A LOT...AND YOU NEED TO WAIT WAIT WAIT... i am not sure if it is true or he is just damn lazy to help me with it... let say i need money for my ailing pet....need the money for surgery...can i withdraw it like my other savings account in Maybank?? but I am sure after reading from the past many postings in here, it won't be "NEED TO WAIT WAIT WAIT......" that long. for more info,..try their link http://www.ptptn.gov.my/web/guest/simpanan...penutupan-akaun |

|

|

May 9 2016, 05:16 PM May 9 2016, 05:16 PM

Return to original view | Post

#20

|

Senior Member

5,143 posts Joined: Jan 2015 |

QUOTE(jsflim @ May 9 2016, 04:12 PM) that is my concern as well, for my point of view, the depositor need to be dead only can withdraw, which is stupid term. QUOTE(jsflim @ May 9 2016, 04:13 PM) i was skeptical too until i read...Page 25, post 484, 489, 496, 500 page 26, post 515~ 520 |

| Change to: |  0.0602sec 0.0602sec

0.38 0.38

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 28th November 2025 - 08:07 AM |