QUOTE(leo_kiatez @ Nov 12 2019, 02:51 PM)

depends on tier...you can refer to boost thread share in above post

SSPN, Skim Simpanan Pendidikan Nasional

|

|

Nov 12 2019, 01:55 PM Nov 12 2019, 01:55 PM

|

Senior Member

1,534 posts Joined: Jul 2006 |

|

|

|

|

|

|

Nov 15 2019, 07:44 PM Nov 15 2019, 07:44 PM

Show posts by this member only | IPv6 | Post

#2162

|

Senior Member

5,867 posts Joined: Sep 2009 |

|

|

|

Nov 15 2019, 08:56 PM Nov 15 2019, 08:56 PM

|

|||||||||

All Stars

65,278 posts Joined: Jan 2003 |

QUOTE(guy3288 @ Nov 15 2019, 07:44 PM) i had some withdrawal earlier. based on official FAQ, yes, need to deposit RM33,968.60 (offset the withdrawn amount 25,968.60 + net add 8,000 for relief)in this case need add deposit RM33968.60 by 31.12.2019 ? to get max 8k tax relief is my calculation correct?

hope i get it right |

|||||||||

|

|

Nov 15 2019, 09:01 PM Nov 15 2019, 09:01 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(guy3288 @ Nov 15 2019, 07:44 PM) i had some withdrawal earlier. whatever you had taken out in 2019 + Max of RM8k fresh fund in buy end of Dec 2019 to enable tax relief to be declare in April 2020in this case need add deposit RM33968.60 by 31.12.2019 ? to get max 8k tax relief is my calculation correct? |

|

|

Nov 16 2019, 09:42 AM Nov 16 2019, 09:42 AM

Show posts by this member only | IPv6 | Post

#2165

|

|||||||||

Senior Member

5,867 posts Joined: Sep 2009 |

QUOTE(cybpsych @ Nov 15 2019, 08:56 PM) based on official FAQ, yes, need to deposit RM33,968.60 (offset the withdrawn amount 25,968.60 + net add 8,000 for relief)

hope i get it right QUOTE(yklooi @ Nov 15 2019, 09:01 PM) whatever you had taken out in 2019 + Max of RM8k fresh fund in buy end of Dec 2019 to enable tax relief to be declare in April 2020 Thanks, but a friend said must also add the dividend dated 1.1.2019? |

|||||||||

|

|

Nov 16 2019, 11:21 AM Nov 16 2019, 11:21 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

|

|

|

Nov 16 2019, 01:55 PM Nov 16 2019, 01:55 PM

|

Senior Member

6,261 posts Joined: Jul 2005 From: UEP Subang Jaya |

QUOTE(guy3288 @ Nov 15 2019, 07:44 PM) i had some withdrawal earlier. in this case need add deposit RM33968.60 by 31.12.2019 ? to get max 8k tax relief is my calculation correct? QUOTE(guy3288 @ Nov 16 2019, 09:42 AM) Yes your friend is right. The previously posted calculation is one way, the other way is like this:-Amount you need to topup = Current balance - Opening balance + dividend given at start of year + RM8000 The other way to think about it is that by 31st December you should have this amount inside your account:- End-year balance = Opening balance + dividend given + RM8000 |

|

|

Nov 16 2019, 04:23 PM Nov 16 2019, 04:23 PM

|

Senior Member

5,867 posts Joined: Sep 2009 |

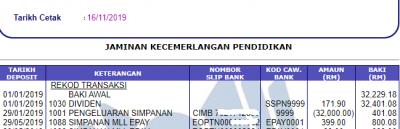

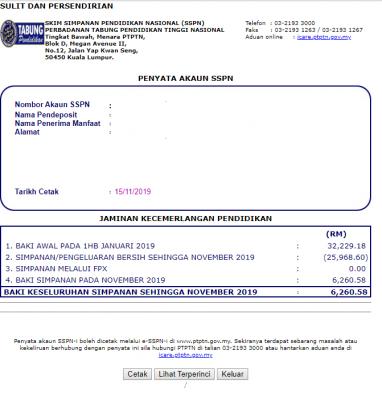

QUOTE(yklooi @ Nov 16 2019, 11:21 AM) just checked i took out RM32k in Jan 2019, it seems " i did not touch" the Dividend RM171.90.later made many deposits hard to go add them all. QUOTE(LostAndFound @ Nov 16 2019, 01:55 PM) Yes your friend is right. The previously posted calculation is one way, the other way is like this:- it seems the opening balance did not include current/2019 dividend, as you can see in my case.Amount you need to topup = Current balance - Opening balance + dividend given at start of year + RM8000 The other way to think about it is that by 31st December you should have this amount inside your account:- End-year balance = Opening balance + dividend given + RM8000 so is the amount RM33968.60 still correct? or must add that RM171.90 ? This post has been edited by guy3288: Nov 16 2019, 04:41 PM Attached thumbnail(s)

|

|

|

Nov 16 2019, 04:33 PM Nov 16 2019, 04:33 PM

|

All Stars

14,863 posts Joined: Mar 2015 |

QUOTE(guy3288 @ Nov 16 2019, 04:23 PM) just checked i took out RM32k in Jan 2019, it seems " i did not tough" the Dividend RM171.90. dividend received does not qualified (or added into) as sumbangan bersih to qualify as tax relief value.later made many deposits hard to go add them all. it seems the opening balance did not include current/2019 dividend, as you can see in my case. so is the amount RM33968.60 still correct? or must add that RM171.90 ? |

|

|

Nov 16 2019, 04:40 PM Nov 16 2019, 04:40 PM

|

Senior Member

5,867 posts Joined: Sep 2009 |

QUOTE(MUM @ Nov 16 2019, 04:33 PM) dividend received does not qualified (or added into) as sumbangan bersih to qualify as tax relief value. Yes i think you are right. Just curious how to use the sspn online table to calculate .............on paper seems like i did not withdraw that dividend,now i must add back Attached thumbnail(s)

|

|

|

Nov 16 2019, 05:07 PM Nov 16 2019, 05:07 PM

|

Senior Member

2,600 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Nov 16 2019, 04:40 PM) Yes i think you are right. Just curious how to use the sspn online table to calculate .............on paper seems like i did not withdraw that dividend, I assume you have a better vehicle to gain > 4%. That’s the reason you withdrew a big sum in Jan. Can you share what investment you have done?now i must add back |

|

|

Nov 16 2019, 05:18 PM Nov 16 2019, 05:18 PM

|

All Stars

14,863 posts Joined: Mar 2015 |

QUOTE(guy3288 @ Nov 16 2019, 04:40 PM) Yes i think you are right. Just curious how to use the sspn online table to calculate .............on paper seems like i did not withdraw that dividend, now i must add back is the number tally as RM 6,260.58? |

|

|

Nov 16 2019, 05:48 PM Nov 16 2019, 05:48 PM

|

Senior Member

5,867 posts Joined: Sep 2009 |

QUOTE(LostAndFound @ Nov 16 2019, 01:55 PM) Yes i come to the conclusion just use above formula, no headache.QUOTE(jefftan4888 @ Nov 16 2019, 05:07 PM) I assume you have a better vehicle to gain > 4%. That’s the reason you withdrew a big sum in Jan. Can you share what investment you have done? i dont leave money in SSPN, is only for tax relief.If you want passive return >4% must look out for good FD promotion, highest in hand now BR 4.85% til 2023 if dare take risk buy Bonds,Tropicana Bond 7% FSm UTs also can get 5+%, Amanah Saham also Properties even 8-12% if you go for Lelong houses SSPN dividend is <4%. QUOTE(MUM @ Nov 16 2019, 05:18 PM) is the number tally as RM 6,260.58? but i finally realised that i must add back that dividend RM171.90 as it is included in the RM6260.58. So the amount for me to deposit by 31.12.19 is RM33968.60 + 171.90 to get exactly NETT RM8k. Thanks for all those who try to help. |

|

|

|

|

|

Nov 16 2019, 06:27 PM Nov 16 2019, 06:27 PM

|

Senior Member

2,600 posts Joined: Apr 2019 |

QUOTE(guy3288 @ Nov 16 2019, 05:48 PM) Yes i come to the conclusion just use above formula, no headache. You have withdrawn (32,229.18 + 171.90) - 6,260.58 = 26,140.50.i dont leave money in SSPN, is only for tax relief. If you want passive return >4% must look out for good FD promotion, highest in hand now BR 4.85% til 2023 if dare take risk buy Bonds,Tropicana Bond 7% FSm UTs also can get 5+%, Amanah Saham also Properties even 8-12% if you go for Lelong houses SSPN dividend is <4%. I have too many ins and outs that i cant do above suggestion. but i finally realised that i must add back that dividend RM171.90 as it is included in the RM6260.58. So the amount for me to deposit by 31.12.19 is RM33968.60 + 171.90 to get exactly NETT RM8k. Thanks for all those who try to help. So you have to deposit (26,140.50 + 8,000) = 34,140.50 by 31/12/19. I mean where did you keep or invest the amount RM26,140.50 for these few months? For example, FD, shares, etc. |

|

|

Nov 17 2019, 09:31 AM Nov 17 2019, 09:31 AM

|

Junior Member

402 posts Joined: Dec 2005 |

i withdrawed sspn-i fund from ptptn counter. the counter girl said need to wait 14 business days to reach my bank account. is it really need to wait that long time?

|

|

|

Nov 17 2019, 10:14 AM Nov 17 2019, 10:14 AM

|

All Stars

18,406 posts Joined: Oct 2010 |

QUOTE(ktyong123 @ Nov 17 2019, 09:31 AM) i withdrawed sspn-i fund from ptptn counter. the counter girl said need to wait 14 business days to reach my bank account. is it really need to wait that long time? That is their standard reply, normally only take couple of days. But if withdraw btw 1st-7th of the month(for system maintenance??) will probably get it on 8th-10th. |

|

|

Nov 17 2019, 10:38 AM Nov 17 2019, 10:38 AM

Show posts by this member only | IPv6 | Post

#2177

|

All Stars

10,820 posts Joined: Jan 2010 From: KL/PJ |

|

|

|

Nov 17 2019, 10:59 AM Nov 17 2019, 10:59 AM

Show posts by this member only | IPv6 | Post

#2178

|

Senior Member

5,867 posts Joined: Sep 2009 |

QUOTE(jefftan4888 @ Nov 16 2019, 06:27 PM) You have withdrawn (32,229.18 + 171.90) - 6,260.58 = 26,140.50. Yes your calculation is perfect So you have to deposit (26,140.50 + 8,000) = 34,140.50 by 31/12/19. I mean where did you keep or invest the amount RM26,140.50 for these few months? For example, FD, shares, etc. You asked exactly where that RM26140.50 went to, that is a very difficult Q as i rolled the money around, perhaps i used it to pay creditcards then and use my creditcard allocation to invest somewhere......FYI i withdrew much more that that amount, many times |

|

|

Nov 17 2019, 05:05 PM Nov 17 2019, 05:05 PM

|

Junior Member

181 posts Joined: Jan 2003 |

hi all, about this SSPN for tax relief 8k, i have a few question:

1. for registration, is the SSPN-i Plus the right account? or just the SSPN? 2. if we took out RM8k the following year, will the IRB asked for lower tax paid in coming year tax assessment? 3. under SSPN registration, i choose which type of account? i intend to open for deposit in saving for daughter future education. their choice as per below: a. akaun untuk anak jagaan yang sah b.akaun untuk diri sendiri c. akaun untuk lain lain hope to have someone guide. thank you. This post has been edited by aliluya: Nov 17 2019, 05:38 PM |

|

|

Nov 17 2019, 06:15 PM Nov 17 2019, 06:15 PM

|

All Stars

14,863 posts Joined: Mar 2015 |

QUOTE(aliluya @ Nov 17 2019, 05:05 PM) hi all, about this SSPN for tax relief 8k, i have a few question: 1) normally most would select the SSPN-I over the SSPN-I PLUS (pay more for takaful coverage)1. for registration, is the SSPN-i Plus the right account? or just the SSPN? 2. if we took out RM8k the following year, will the IRB asked for lower tax paid in coming year tax assessment? 3. under SSPN registration, i choose which type of account? i intend to open for deposit in saving for daughter future education. their choice as per below: a. akaun untuk anak jagaan yang sah b.akaun untuk diri sendiri c. akaun untuk lain lain hope to have someone guide. thank you. the different? https://www.itguy.my/web/know-what/what-are...nd-sspn-i-plus/ 2) if a parent deposit RM8k by Dec 2019, he/she can claim tax relief in April 2020 if he take out this RM8k in 2020, he can still claim tax relief in April 2020, but he has to put in RM8k + RM8k by Dec 2020 to be eligible to claim tax relief in April 2021 3) looks like the selection is a) per this... https://www.ptptn.gov.my/pelepasan-taksiran...kai-sspn-i-side |

| Change to: |  0.0188sec 0.0188sec

0.72 0.72

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 12:17 AM |