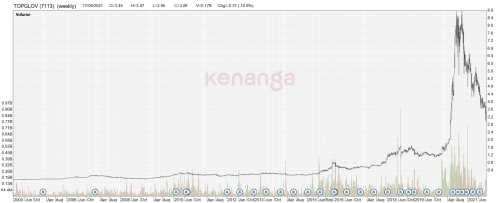

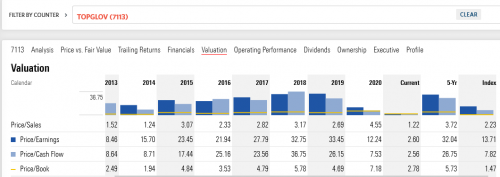

I studied her financial statement found this counter is jet-speeding in growth from the past 6 years.

1) Sales 44%

2) Profit after tax 39%

2) EPS growth 34%

3) Nett Assest 32%

4) Cash grow 60%

People suggested that her fair value should be around triple of current price at RM4 which is about RM12+. Is it too good to be true ? How come the transaction volumn is so low ? I think it is neglected.

What all sifus comment here ?

This post has been edited by rayloo: Nov 16 2008, 02:38 PM

Top Glove 7113, High speed growth

Oct 5 2008, 05:36 PM, updated 16y ago

Oct 5 2008, 05:36 PM, updated 16y ago

Quote

Quote

0.2690sec

0.2690sec

0.32

0.32

6 queries

6 queries

GZIP Disabled

GZIP Disabled