QUOTE(HolyAssasin4444 @ Sep 30 2021, 04:11 PM)

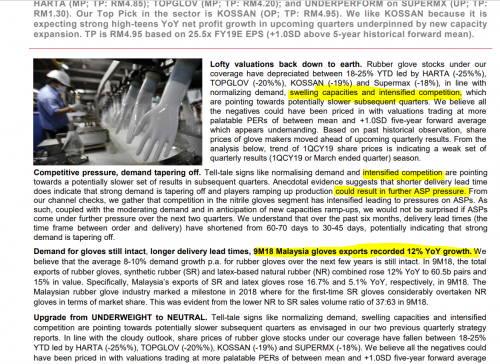

I'm gonna give an unpopular opinion here to all the blind bulls for gloves. Tip, don't hold on to a loser. Averaging down, buy the dip etc are just sunk cost fallacy. Just cut loss, why lose more money as gloves drop further.

Everyone so surprised about analysts downgrading to sub RM2, technical 'analysis' constantly predicting a rebound (as good as astrology for me). Every broken support confirm got sifu come in and say more support, buy more.

Just look at precovid quarterly revenue, compare to covid, and then the most recent quarter. Doesn't take a genius with computers to see that the covid spike in sales is most likely gonna be a one-off thing. ASP price data also shows continuous trend towards normality ie precovid. Doing a simple DCF, even being really optimistic on 15% CAGR next 5 years with 0 capex also doesn't yield a price any higher than RM2.20. New players in the glove industry both locally and in China. You really gotta ask yourself, do you think that TG still can grow revenue and maintain margins as before? I personally don't think so, and there are further downside even when at RM2.20

"But what about covid profit? Must be worth something in the share price no? Share price must be higher than pre covid la." Yes, but no. Previous profit already accounted for in the cash balance of the company + any assets the company reinvested. For TG tho, not so much. Remember the special dividend they issued previously? All the buyback done by the company when it was RM6-ish? That's where all your covid profits went to, all the free cash flow being returned to shareholders already.

I'd be happy to be proven wrong, but if the next few quarters of profit continue to trend back to normality (the scenario that I think is most likely), TG is just gonna slowly trend towards sub RM2 no matter how many squiggly lines you draw on a chart. Even if there are sudden spikes in share price, it's not going to be long term

People will tend to read what they want to read, see what they want to see. This is normal.

It's always about the ASP. Without the insane increase in the selling price (and panic stocking of gloves), glove makers would not have enjoyed their once in a lifetime billion dollar profits.

Pre-Covid, ASP were below USD19.00. (this fact is searchable via the net)

At the height, I believe TG asp hit around USD120.00. (pls feel free to reconfirm)...

Recently.... from TopGlove...

https://www.malaymail.com/news/money/2021/0...ptember/2006341Quote:

As for the average selling prices (ASPs) for the US market, the group is looking at the US$40-level, said Lee. “With the current ASPs, they are still higher than the pre-Covid-19 level.

We do foresee the price adjustments will be there possibly by 8.0 per cent to 10 per cent monthly. But in our case here with our sales back to the US, that can help to mitigate in terms of price adjustments,” he said.

In short: selling prices are falling fast. This is coming from TG itself and not some analysts.

from Hartalega..

https://www.theedgemarkets.com/article/glov...evels-%E2%80%94Quote: Hartalega chief executive officer (CEO) Kuan Mun Leong noted that the

ASP started to ease in the April to June quarter and is expected to decline by 30% every quarter going forward until 1Q22.

Quote: We are experiencing additional costs from social compliance and also the material cost seen today is actually higher.

The second statement.... higher cost of sales.....

These are the statements from the glove makers itself....

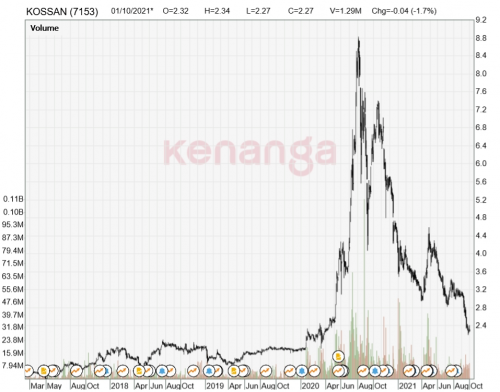

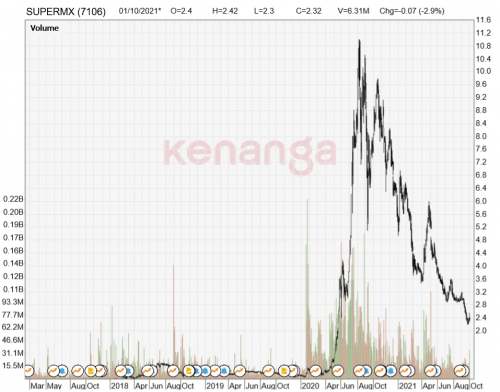

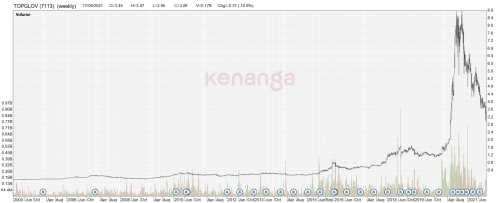

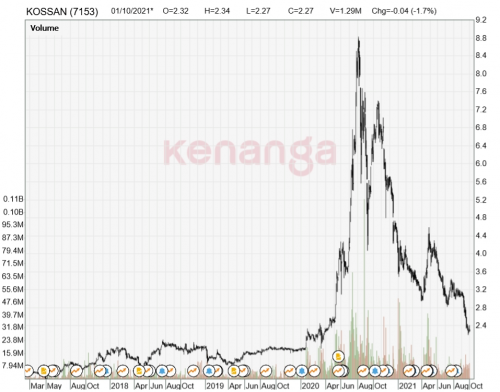

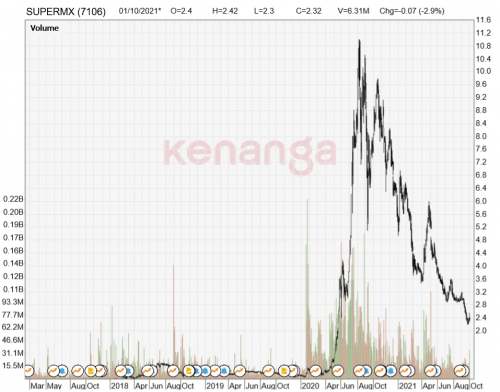

and when you have the ASP going from USD19 to USD120 and now crashing back down just as quickly as it rose.... we will get the boom and bust cycle.... these are the typical boom/bust charts and normally when it bust... it can go really low....

Moving forward...

Moving forward...

Will we see increased demand of the glove? I shall leave that as ___________________

But on the supply side...

we know all about the countless new players jumping into the glove bandwagon.....

and then we have the aggressive Chinese glove makers and their aggressiveness in pricing

( see report on UG Healthcare and the point made on the Chinese glove makers

https://research.sginvestors.io/2021/05/ug-...2021-05-14.html .... this statement:

)

the capex issue from our main glove makers... I copy and paste what I posted in May 2021..)

Accordingly, Top Glove expansion is even greater...

QUOTE

With the RM7.7 billion raised, Top Glove intends to spend RM4.61 billion for expansion of production capacity and developing a data-driven manufacturing system, including adding 333 double former production lines to boost its annual production capacity to 193 billion pieces of gloves by the end of 2025.

https://www.msn.com/en-my/money/topstories/...ile/ar-BB1e87DpHarta capex is ...

https://www.msn.com/en-my/money/topstories/...87m/ar-BB1eqF81QUOTE

As it currently stands, Hartalega produces 43 billion pieces of gloves per year. Its expansion plans include the NGC 1.5 in Sepang, which will boost its capacity to 63 billion pieces per year once it is completed.

With this longer-term expansion in Kedah, Hartalega will add another 80 billion pieces per year, resulting in its total capacity rising to 143 billion pieces per annum once fully completed.

Yeah, Supermax is 48b...

https://www.thesundaily.my/business/superma...3-sen-FM7824340QUOTE

“We are seeing a full-quarter contribution in the quarter ending March and going forward. We are building five glove manufacturing plants concurrently and scheduled for completion progressively between now and next year. The new plants will add 22.25 billion new capacity bringing the group’s total capacity to 48.42 billion gloves by the end of 2022. The group will invest a total capital expenditure of RM1.39 billion for the new plants,“ the glove maker said in a statement.

And then you have our Thai friend, Sri Triang.

QUOTE

Under its investment plan, the latex and nitrile examination and industrial gloves maker aims to reach an annual production capacity of 50 billion pieces by 2022, and 80 billion pieces by 2024.

Source:

https://www.rubbernews.com/expansion/sri-tr...acity-expansionYeah... the capex issue is real .... every major player has huge mega expansion plans.... so one just gotta ask... with everyone expanding/new players/china x factor ....

surely there is a huge possibility that this will lead to a long drawn out price war.... which most likely pushes the glove industry back to nothing but a sunset industry <-- this is the biggest risk concern one has to address!!!

*** yes, Top Glove said in its latest QR that it is scaling down a little bit of its expansion...

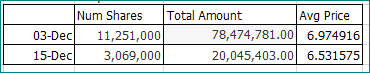

*** and yea... TG boss bought shares of TG again. This is after many months of absence... which was a positive 'sentiment' factor..... However.... given his terrible result of buying shares (TG share buybacks/his own buybacks/Tropicana investment of TG shares all which are losing millions and millions and millions of ringgit.... how safe is it to buy TG share just cause TG boss bought some recently?

These are the as it is concerns....... so really... one has to ask themselves... it glove stocks a good bet now? yup, is this the best available bet in the market now?

This post has been edited by Boon3: Oct 1 2021, 12:13 PM

Feb 10 2021, 04:45 PM

Feb 10 2021, 04:45 PM

Quote

Quote

0.0302sec

0.0302sec

0.74

0.74

7 queries

7 queries

GZIP Disabled

GZIP Disabled