QUOTE(HolyAssasin4444 @ Sep 30 2021, 04:11 PM)

I'm gonna give an unpopular opinion here to all the blind bulls for gloves. Tip, don't hold on to a loser. Averaging down, buy the dip etc are just sunk cost fallacy. Just cut loss, why lose more money as gloves drop further.

Everyone so surprised about analysts downgrading to sub RM2, technical 'analysis' constantly predicting a rebound (as good as astrology for me). Every broken support confirm got sifu come in and say more support, buy more.

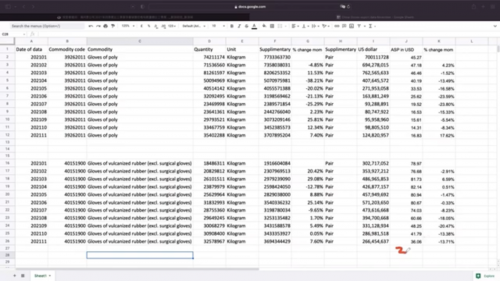

Just look at precovid quarterly revenue, compare to covid, and then the most recent quarter. Doesn't take a genius with computers to see that the covid spike in sales is most likely gonna be a one-off thing. ASP price data also shows continuous trend towards normality ie precovid. Doing a simple DCF, even being really optimistic on 15% CAGR next 5 years with 0 capex also doesn't yield a price any higher than RM2.20. New players in the glove industry both locally and in China. You really gotta ask yourself, do you think that TG still can grow revenue and maintain margins as before? I personally don't think so, and there are further downside even when at RM2.20

"But what about covid profit? Must be worth something in the share price no? Share price must be higher than pre covid la." Yes, but no. Previous profit already accounted for in the cash balance of the company + any assets the company reinvested. For TG tho, not so much. Remember the special dividend they issued previously? All the buyback done by the company when it was RM6-ish? That's where all your covid profits went to, all the free cash flow being returned to shareholders already.

I'd be happy to be proven wrong, but if the next few quarters of profit continue to trend back to normality (the scenario that I think is most likely), TG is just gonna slowly trend towards sub RM2 no matter how many squiggly lines you draw on a chart. Even if there are sudden spikes in share price, it's not going to be long term

If Thats the case, Small and newcomers will crash soon as ASP back to precovid. Margin unsustainable. LolEveryone so surprised about analysts downgrading to sub RM2, technical 'analysis' constantly predicting a rebound (as good as astrology for me). Every broken support confirm got sifu come in and say more support, buy more.

Just look at precovid quarterly revenue, compare to covid, and then the most recent quarter. Doesn't take a genius with computers to see that the covid spike in sales is most likely gonna be a one-off thing. ASP price data also shows continuous trend towards normality ie precovid. Doing a simple DCF, even being really optimistic on 15% CAGR next 5 years with 0 capex also doesn't yield a price any higher than RM2.20. New players in the glove industry both locally and in China. You really gotta ask yourself, do you think that TG still can grow revenue and maintain margins as before? I personally don't think so, and there are further downside even when at RM2.20

"But what about covid profit? Must be worth something in the share price no? Share price must be higher than pre covid la." Yes, but no. Previous profit already accounted for in the cash balance of the company + any assets the company reinvested. For TG tho, not so much. Remember the special dividend they issued previously? All the buyback done by the company when it was RM6-ish? That's where all your covid profits went to, all the free cash flow being returned to shareholders already.

I'd be happy to be proven wrong, but if the next few quarters of profit continue to trend back to normality (the scenario that I think is most likely), TG is just gonna slowly trend towards sub RM2 no matter how many squiggly lines you draw on a chart. Even if there are sudden spikes in share price, it's not going to be long term

Oct 1 2021, 11:03 AM

Oct 1 2021, 11:03 AM

Quote

Quote

0.0360sec

0.0360sec

0.32

0.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled