Ahh... I see. Cause in your initial post was 'why not'... nvm...

Yes, investments is all about the risks. Which is why I raised those questions. Those are the risks.

SARS.

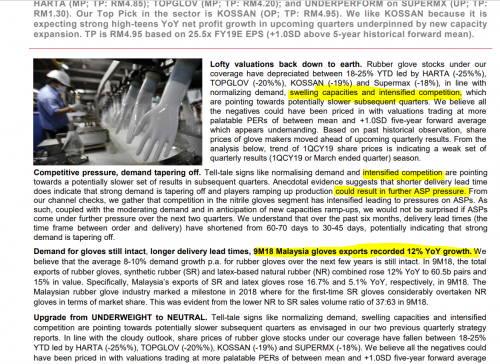

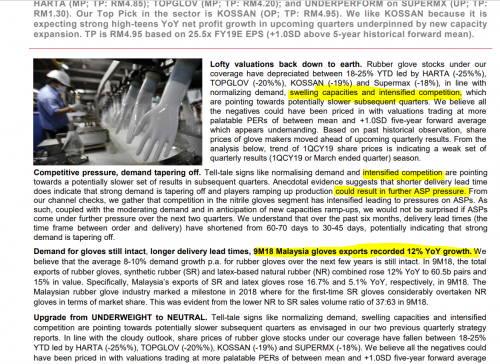

Firstly, here's a sector report on the glove sector just on Sep 2019... not long b4 Covid.

and here is screenshot...

Despite the glove sector export recording 12% y-y growth, swelling capacity and intensified competitions caused pressured on the..... ASP.

See? 2019... and the glove sector had the issue of over capacity and pricing wars... since SARS day...

(that was posted on the stock market discussion thread not too long ago)

So, even from SARS, the gloves sector suffered from a long drawn over capacity and price wars. It was known as a sunset industry until Covid 19 hit.

Hence the risk. Over capacity is going to be worst as we are seeing more players now and then China. If you know China products or had dealt with Chinese players b4, you would know that in nature, they are extremely aggressive. Once they are in an industry, they WILL go all out and price wars follows without fail. It's early days now but the lowering prices can be seen already.

So you have supply issue. And then what about demand issue?

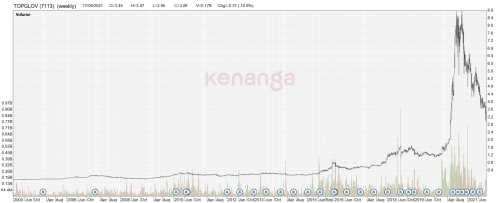

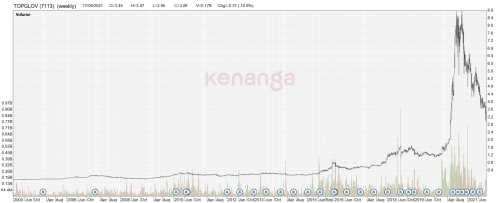

Yes, SARs, TG went up a lot...

but after that .... have a look at this multi year weekly chart (which has been price adjusted for bonus+dividends)

without another worldwide pandemic, glove stocks could be stuck for a long while....

Profits.... what is the risk? A long drawn profit decline is probably the worst scenario.... every year down about 10% type... cos the investor will never know when the rot will end....

or what if profit stagnates for a long time?

Dividends... yeah... dividends did look sexy but since the dividends is tied to a percentage of the profit, once the profit goes down, the dividends will go down in a hurry too.... as dividend drops, the stock price will follow....

lot's of concerns/risks....

and naturally, the logical question is what if the glove sector becomes back a sunset industry, just like how it was b4 Covid..... so does appeal to you as a good no brainer investment?

price declines... naturally will attract some value hunters... but just remember ... not value plays are safe... some do turn into value trap.

so do think about all these.... dun dive in just cos the stock appears to have fallen a lot.

Thanks for taking the time to post this. I do appreciate it, all are valid points. I have considered them as well. Investing in glove companies have always been risky, I don't think people should jump into this right now without considering the risk... for me, it's still a good value stock to own as a part of my overall portfolio. Just a small percentage anyway. It's no big deal.

Sep 16 2020, 10:42 AM

Sep 16 2020, 10:42 AM

Quote

Quote

0.0272sec

0.0272sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled