QUOTE(sjteh @ Nov 4 2021, 05:33 PM)

he may already know even before announcement CEO himself started buying his own stock at 2.6

https://www.theedgemarkets.com/article/lim-...-dips-below-rm3

Top Glove 7113, High speed growth

|

|

Nov 4 2021, 05:54 PM Nov 4 2021, 05:54 PM

Return to original view | Post

#1

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(sjteh @ Nov 4 2021, 05:33 PM) he may already know even before announcement CEO himself started buying his own stock at 2.6 https://www.theedgemarkets.com/article/lim-...-dips-below-rm3 |

|

|

|

|

|

Nov 4 2021, 07:27 PM Nov 4 2021, 07:27 PM

Return to original view | Post

#2

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(Boon3 @ Nov 4 2021, 06:41 PM) Considered old news ya since that was Sep article. you have a trader's mindset. But remember, the CEO of his own company is not a trader He's not a good indicator as his own purchases of Top Glove shares is sitting on paper losses of close to 150 million. Ya. That bad. And he's another perfect example on why one should think twice about following a ceo own share purchases. Many a times, these ceo thinks they are smarter than the market... sadly many times they also lose big time. And in regards to share buybacks.. I am not an accountant but I dont recall any company ever marking their share buybacks to market prices. Hence, they cannot claim such losses. ( pls feel free to correct me on this point) |

|

|

Nov 4 2021, 07:40 PM Nov 4 2021, 07:40 PM

Return to original view | Post

#3

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(Boon3 @ Nov 4 2021, 07:37 PM) Did you follow how he bought back his shares? I did. The shares buyback was insane. Then, he used Tropicana to purchase his shares. Only then he used his own money. At current price, all these shares have lost more than one billion already. the problem is when the messenger injects his own viewpoint into the message, he becomes a biased messenger Yes, I am a trader. Do not judge the messenger but the content of the message itself, ya. cucumber liked this post

|

|

|

Nov 4 2021, 07:56 PM Nov 4 2021, 07:56 PM

Return to original view | Post

#4

|

Junior Member

611 posts Joined: Feb 2018 |

|

|

|

Nov 4 2021, 07:58 PM Nov 4 2021, 07:58 PM

Return to original view | Post

#5

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(Boon3 @ Nov 4 2021, 07:55 PM) a CEO "indulge in stock market" vs a CEO buying his own company shares are two very different things. The motivations are very different.for the record, all the big 4 glove companies have made stock buybacks, just to varying degrees cucumber liked this post

|

|

|

Nov 4 2021, 08:15 PM Nov 4 2021, 08:15 PM

Return to original view | Post

#6

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(Boon3 @ Nov 4 2021, 08:07 PM) Well, you be the judge based on the following facts yourself. this is just my speculation, but the stock buybacks have nothing to do with good financials, rather it is a political compromise.The company has splashed out 1.412 billion on share buybacks. Average price of those buybacks is 7.13. The shares closed the other day at 2.49. Which means those share buybacks is now worth only 492.843 million. These share buybacks is now worth 919.6 million less.... So how would you define this 919.6 million? Gone? Evaporated? Lost? Remember the time when EPF needed to raise alot of funds to implement the i-sinar ilestari etc programmes. The stock buybacks coincides with EPF heavily disposing those shares https://www.klsescreener.com/v2/news/view/7...ntinues-selling that's why i have said that the motivations from the company standpoint and the trader standpoint is very different. But as a value investor, you need to look closely at the fundamentals in the long term, and not the short term political maneuvering. So the question is, is RM2.49 reflective of topglove's fundamentals? |

|

|

|

|

|

Nov 4 2021, 08:21 PM Nov 4 2021, 08:21 PM

Return to original view | Post

#7

|

Junior Member

611 posts Joined: Feb 2018 |

|

|

|

Nov 4 2021, 08:34 PM Nov 4 2021, 08:34 PM

Return to original view | Post

#8

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(Boon3 @ Nov 4 2021, 08:27 PM) LOL!! erm, even a layman will know that in order to profit, you buy low and sell high. If you do it the other way round, either you are retarded, or you have some other motives.Okay... here's another one...  That's the actual trading data for Top Glove on 26th Nov. The share price had already rose significantly that day, yes? But Top Glove splashed out 9.978 million on buyback that day. Min price was 6.90. Max price was 6.92. Source: https://www.bursamalaysia.com/market_inform...?ann_id=3108687 This plus what happened on 11th Sep... how would describe such buybacks? Would it be wrong to say that the buybacks were aggressive? Or is it political again? So do you think the management of top glove is worse than a 10 yo child, or do you think something forced their hand? |

|

|

Nov 4 2021, 08:38 PM Nov 4 2021, 08:38 PM

Return to original view | Post

#9

|

Junior Member

611 posts Joined: Feb 2018 |

|

|

|

Nov 4 2021, 08:48 PM Nov 4 2021, 08:48 PM

Return to original view | Post

#10

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(xander83 @ Nov 4 2021, 08:43 PM) Don’t forget the taxes write off which is the key yes i agree that retail investor got the short end of the stick, but that's just life Most of the buybacks are political play when EPF will lend their shares to IB to short hence TG got trapped into buy back which LWC is silly instead The only way is to consolidate the shares instead of buy back which makes it worse because most have already disposed big time while retail got trapped big time but to discount the value of the company just because of the "losses" made from stock buybacks is to me, quite frankly, silly. Of course, I'm giving my opinion from a value investing point of view. |

|

|

Nov 4 2021, 09:10 PM Nov 4 2021, 09:10 PM

Return to original view | Post

#11

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(Boon3 @ Nov 4 2021, 09:08 PM) Firstly, whose paper loss? TG share buybacks? The boss own paper loss? Or Tropicana paper loss? TG is currently priced at 2.49. Whether it is worth 2.49 is just your own opinion Now TG is worth only 2.49. That's the current market price. It is what it is worth now. So how else would you address it? |

|

|

Nov 4 2021, 09:16 PM Nov 4 2021, 09:16 PM

Return to original view | Post

#12

|

Junior Member

611 posts Joined: Feb 2018 |

QUOTE(Boon3 @ Nov 4 2021, 09:13 PM) that's why, you are a trader and thus you use trader's language to describe things. I'm just a long term investor who looks at the value.and this is also why you don't try to go into the mind of LWC, because you're not him, and LWC is not a trader either. Whatever actions he took that doesn't make sense to you, is very different to those in the position of the CEO |

|

|

Nov 4 2021, 09:32 PM Nov 4 2021, 09:32 PM

Return to original view | Post

#13

|

Junior Member

611 posts Joined: Feb 2018 |

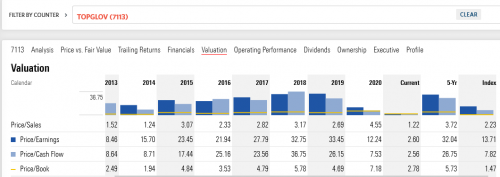

This is the data from Morningstar, you can see for yourself. From 2013 - 2020 their PE and PB ratio all point towards an overvaluation of the stock. If you ask me to buy topglove when it is priced at 6,7,8,9 etc i will not touch it with a 10-foot pole. But in 2021, after the crash, the PE is not 2.6 and PB is 2.78. Is it a good value? I'm not sure. But if the numbers continue to drop then maybe it can be a consideration |

| Change to: |  0.0168sec 0.0168sec

0.40 0.40

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 5th December 2025 - 05:56 AM |