QUOTE(sidefulnes @ Dec 1 2021, 10:56 AM)

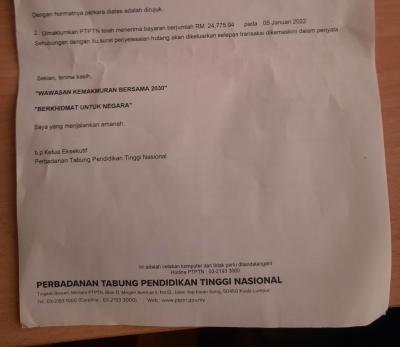

Status update on the 10% rebate for November 2021 deduction for those who are wondering why it is not reflected in the statement yet.

Rebate reflected

Attached thumbnail(s)

Need advice on repaying PTPTN loan, all ur News and Questions on PTPTN

|

|

Dec 7 2021, 08:17 AM Dec 7 2021, 08:17 AM

|

Junior Member

281 posts Joined: May 2015 |

|

|

|

|

|

|

Dec 7 2021, 11:38 AM Dec 7 2021, 11:38 AM

|

Senior Member

1,046 posts Joined: Nov 2014 |

|

|

|

Dec 8 2021, 05:39 PM Dec 8 2021, 05:39 PM

|

Junior Member

187 posts Joined: Jul 2017 |

Seem already reflected on my side. I already use debit since 2 years ago |

|

|

Dec 8 2021, 11:58 PM Dec 8 2021, 11:58 PM

|

Junior Member

185 posts Joined: Dec 2015 From: Malaysia |

https://amirazman.my/tutorial-pendaftaran-d...ct-debit-ptptn/

Saya harap ini membantu untuk sesiapa yang ingin buat pendaftaran direct debit PTPTN |

|

|

Dec 15 2021, 12:39 AM Dec 15 2021, 12:39 AM

|

Senior Member

1,202 posts Joined: Dec 2010 From: HELL |

QUOTE(hostingmalaya @ Dec 8 2021, 11:58 PM) https://amirazman.my/tutorial-pendaftaran-d...ct-debit-ptptn/ thank you appreciate itSaya harap ini membantu untuk sesiapa yang ingin buat pendaftaran direct debit PTPTN |

|

|

Dec 15 2021, 03:28 PM Dec 15 2021, 03:28 PM

Show posts by this member only | IPv6 | Post

#3226

|

Junior Member

281 posts Joined: May 2015 |

|

|

|

|

|

|

Jan 6 2022, 06:05 PM Jan 6 2022, 06:05 PM

|

Senior Member

867 posts Joined: Apr 2010 From: Buddha Hand |

Hi all,

I'm considering paying the full amount of PTPTN to grab the discount of 15% given by our beloved government by using KWSP Account 2. After the workout which seems like not worth doing so? here is my calculation Here is my calculation:- PTPTN amount of RM 38,500.00 Monthly payment RM 245.50 (RM 212.92 payment and RM 34.58 interest) Full payment to save RM 5,775.00 (15% from RM 38,500) If monthly stick to the monthly pre-payment required 181 months (RM 38,500.00 / RM 212.92 = 181 months equivalent to 15 years) to clear the PTPTN. With this 15 years, KWSP Account 2 compound interest of 5.5% p.a (assumption) will be earned about RM 49,200.00. In order to save you RM 12,033.98 (RM 5,775.00 plus RM 6,258.98 (RM 34.58 x 181 Months)). You're losing RM 37,166.02 (RM49,200.00 - RM 12,033.98) Meaning to say, it's not worth clearing PTPTN using KWSP Account 2. Any sifu can enlighten me? Just a simple calculation. This post has been edited by BlackPen: Jan 6 2022, 06:11 PM |

|

|

Jan 6 2022, 06:17 PM Jan 6 2022, 06:17 PM

Show posts by this member only | IPv6 | Post

#3228

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(BlackPen @ Jan 6 2022, 06:05 PM) Hi all, The govt is not asking borrowers to withdraw from EPF. If you think is not a good decision, then cont with the instalment.I'm considering paying the full amount of PTPTN to grab the discount of 15% given by our beloved government by using KWSP Account 2. After the workout which seems like not worth doing so? here is my calculation Example, PTPTN amount of RM 38,500.00 Monthly payment RM 245.50 (RM 212.92 payment and RM 34.58 interest) Full payment to save RM 5,775.00 (15% from RM 38,500) If monthly stick to the payment required 181 months (RM 38,500.00 / RM 212.92 = 181 months equivalent to 15 years) to clear the PTPTN With this 15 years, KWSP Account 2 compound interest 5.5% p.a will earn you about RM 49,200.00 In order to save you RM 12,033.98 (RM 5,775.00 plus RM 6,258.98 (RM 34.58 x 181 Months)). You're losing RM 37,166.02 (RM49,200.00 - RM 12,033.98) Meaning to say, it's not worth clearing PTPTN using KWSP Account 2. Any sifu can enlighten me? Just a simple calculation Anyway, just settled yesterday through CC and converted to 12 months interest free instalment.

|

|

|

Jan 6 2022, 07:07 PM Jan 6 2022, 07:07 PM

|

Senior Member

867 posts Joined: Apr 2010 From: Buddha Hand |

QUOTE(mini orchard @ Jan 6 2022, 06:17 PM) The govt is not asking borrowers to withdraw from EPF. If you think is not a good decision, then cont with the instalment. Yea, government not specifically mention borrowers to withdrawn money from epf account 2 to clear the outstanding, but government are encouraging borrowers to clear the debt. That why government giving out discount. Anyway, just settled yesterday through CC and converted to 12 months interest free instalment.

I’m just sharing the calculation for discussion which is the best way nor best interest to pay the ptptn loan. This is what lowyat forum for and not just reply “if you think not a good decision, then continue with the instalment”. It’s not benefits to this thread. This post has been edited by BlackPen: Jan 6 2022, 07:26 PM |

|

|

Jan 6 2022, 07:23 PM Jan 6 2022, 07:23 PM

Show posts by this member only | IPv6 | Post

#3230

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(BlackPen @ Jan 6 2022, 07:07 PM) Yea, government not specifically mention borrowers to withdrawn money from epf account 2 to clear the outstanding, but government are encouraging borrowers to clear the debt. That why government giving out discount. Withdrawing epf money with compound interest to payoff is never a good decision from the start.I’m just sharing the calculation for discussion which is the best way nor best interest to pay the ptptn loan. This is what lowyat forum for. Your reply ain’t benefits to anyone reading this thread tho. Epf is for retirement and never a solution to settle a debt. But if one wants a debt free mind then dont think too much about interest loss. This post has been edited by mini orchard: Jan 6 2022, 07:28 PM |

|

|

Jan 6 2022, 07:28 PM Jan 6 2022, 07:28 PM

Show posts by this member only | IPv6 | Post

#3231

|

Senior Member

867 posts Joined: Apr 2010 From: Buddha Hand |

QUOTE(mini orchard @ Jan 6 2022, 07:23 PM) Withdrawing epf money with compound interest to payoff is never a good decision from the start. I’m agree with you. This option might not the best but KWSP did given an option to borrowers to payoff / offset by using account 2. No harm to compare the option to opt the best option. Some borrowers might think it’s worth? Who knows? Might have different opinions worth to discuss for?Epf is for retirement and never a solution to settle a debt. This post has been edited by BlackPen: Jan 6 2022, 07:29 PM |

|

|

Jan 6 2022, 07:33 PM Jan 6 2022, 07:33 PM

Show posts by this member only | IPv6 | Post

#3232

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(BlackPen @ Jan 6 2022, 07:28 PM) I’m agree with you. This option might not the best but KWSP did given an option to borrowers to payoff / offset by using account 2. No harm to compare the option to opt the best option. Some borrowers might think it’s worth? Who knows? Might have different opinions worth to discuss for? But if one wants a debt free mind then dont think too much about interest loss.....is not wrong also with this approach....more of personal choice. |

|

|

Jan 11 2022, 03:32 PM Jan 11 2022, 03:32 PM

|

Senior Member

1,634 posts Joined: Mar 2006 From: Ipoh @ Puchong |

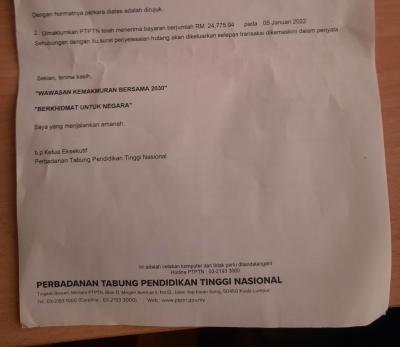

i have already cleared all the PTPTN outstanding amount and received the "SURAT PENYELESAIAN HUTANG (SPH) PINJAMAN PENDIDIKAN PTPTN", do I have to notify PTPTN for them to take action to credit my rebate? Or i can just wait for them to take the action? ceo684 liked this post

|

|

|

|

|

|

Jan 11 2022, 08:07 PM Jan 11 2022, 08:07 PM

Show posts by this member only | IPv6 | Post

#3234

|

All Stars

11,667 posts Joined: Jan 2003 From: Klang/Subang |

QUOTE(victorian @ Oct 30 2021, 01:41 PM) No need to overthink le. Yeah.. time to be only single loan debt (house loan) Just settle fully and have a peace of mind. 15% guaranteed discount, why not QUOTE(victorian @ Oct 30 2021, 03:05 PM) Err if you want to continue paying, your only benefit from this budget is the direct debit discount (dunno last how long). Your intention to continue paying should not be affected before after this budget. W/o the 15% discount and EPF withdrawal.. I am already running out of time to pay The 15% discount for lump sum is new, so people will have more incentive to settle the payment now. It's up to u whether u think you can beat the 15% discount now, previously there's no discount so you have more incentive to drag your payment. QUOTE(GreenSamurai @ Oct 30 2021, 06:50 PM) You can don’t pay then pay back lump sump after 15 years. Ccris hancur only. If don’t plan to buy anything huge for 15 years then just do it. To me it’s penny wise pound foolish only but maybe not to other people. Sudah hancur.. luckily all the things I needed already obtained loan before CCRIS calculate ptptnQUOTE(Lewbes @ Nov 21 2021, 12:25 AM) I paid full last week on friday, with guidance of PTPTN officer, he said i would be getting an email within a week stating that my loans have been repayed. upon checking on my statement it says I still ower the 15%, I have sent him a message but pending his reply. Hmm should i way till the end of the month or perhaps check with him again over the counter? QUOTE(Lewbes @ Dec 1 2021, 01:55 PM) good news after paying back in full with 15% discount 3 weeks ago. the discount got reflected and says i have fully paid So from your experience it take 3 weeks to get the clearance letter from PTPTN Anyone withdraw EPF to settle Acc 2 ? I still need to top up a bit but small amount (pay via CC) How long does EPF take to settle the Acc 2 withdrawal to PTPTN side? Technically, procedure is get the balance (with 15% off) confirmed for this month JAN and make sure everything is paid up to that discounted amount all within JAN right? |

|

|

Jan 15 2022, 11:54 PM Jan 15 2022, 11:54 PM

Show posts by this member only | IPv6 | Post

#3235

|

Senior Member

776 posts Joined: Nov 2005 From: Symphonia |

QUOTE(mini orchard @ Jan 6 2022, 06:17 PM) The govt is not asking borrowers to withdraw from EPF. If you think is not a good decision, then cont with the instalment. Hi, where can I find detail which credit card can be use to convert into 0% interest free installment? which CC did you useAnyway, just settled yesterday through CC and converted to 12 months interest free instalment.

|

|

|

Jan 16 2022, 05:51 AM Jan 16 2022, 05:51 AM

Show posts by this member only | IPv6 | Post

#3236

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(lordzarx @ Jan 15 2022, 11:54 PM) Hi, where can I find detail which credit card can be use to convert into 0% interest free installment? which CC did you use Hong Leong Bank ..... Free Flexi Payment which is currently having a promo until 31.01.22 for selected customers. Not sure what is their tnc thou but they send me an email.PBB is having 0% for 12 months for new card application untilI 31.03.22. For others, I am not sure as I dont have theirs.

This post has been edited by mini orchard: Jan 16 2022, 05:52 AM |

|

|

Jan 16 2022, 11:57 AM Jan 16 2022, 11:57 AM

Show posts by this member only | IPv6 | Post

#3237

|

Senior Member

5,551 posts Joined: Aug 2011 |

QUOTE(BlackPen @ Jan 6 2022, 06:05 PM) Hi all, Obviously you don't trade an asset yielding 5% to clear off a liability costing 1%. Just doesn't make sense. Not even with the 15% upfront discount.I'm considering paying the full amount of PTPTN to grab the discount of 15% given by our beloved government by using KWSP Account 2. After the workout which seems like not worth doing so? here is my calculation Here is my calculation:- PTPTN amount of RM 38,500.00 Monthly payment RM 245.50 (RM 212.92 payment and RM 34.58 interest) Full payment to save RM 5,775.00 (15% from RM 38,500) If monthly stick to the monthly pre-payment required 181 months (RM 38,500.00 / RM 212.92 = 181 months equivalent to 15 years) to clear the PTPTN. With this 15 years, KWSP Account 2 compound interest of 5.5% p.a (assumption) will be earned about RM 49,200.00. In order to save you RM 12,033.98 (RM 5,775.00 plus RM 6,258.98 (RM 34.58 x 181 Months)). You're losing RM 37,166.02 (RM49,200.00 - RM 12,033.98) Meaning to say, it's not worth clearing PTPTN using KWSP Account 2. Any sifu can enlighten me? Just a simple calculation. Don't touch epf to clear ptptn |

|

|

Jan 16 2022, 07:52 PM Jan 16 2022, 07:52 PM

Show posts by this member only | IPv6 | Post

#3238

|

Junior Member

506 posts Joined: Mar 2012 |

QUOTE(BlackPen @ Jan 6 2022, 06:05 PM) Hi all, U just discovered the power of OPM.I'm considering paying the full amount of PTPTN to grab the discount of 15% given by our beloved government by using KWSP Account 2. After the workout which seems like not worth doing so? here is my calculation Here is my calculation:- PTPTN amount of RM 38,500.00 Monthly payment RM 245.50 (RM 212.92 payment and RM 34.58 interest) Full payment to save RM 5,775.00 (15% from RM 38,500) If monthly stick to the monthly pre-payment required 181 months (RM 38,500.00 / RM 212.92 = 181 months equivalent to 15 years) to clear the PTPTN. With this 15 years, KWSP Account 2 compound interest of 5.5% p.a (assumption) will be earned about RM 49,200.00. In order to save you RM 12,033.98 (RM 5,775.00 plus RM 6,258.98 (RM 34.58 x 181 Months)). You're losing RM 37,166.02 (RM49,200.00 - RM 12,033.98) Meaning to say, it's not worth clearing PTPTN using KWSP Account 2. Any sifu can enlighten me? Just a simple calculation. As per ur calculation, u are correct to continue paying a low interest against taking money from higher dividend fund. I'm not financial advisor, but u r correct to defer the payment. Also, if you have extra money, dump more in EPF and don't extra pay your ptptn. Or save more money to get mortgage. People who say peace of mind from debt is just people who are not disciplined enough to control debt to profit from them. I never heard successful business is done without investor or debt. |

|

|

Jan 17 2022, 11:20 AM Jan 17 2022, 11:20 AM

Show posts by this member only | IPv6 | Post

#3239

|

All Stars

14,511 posts Joined: Sep 2017 |

QUOTE(yugimudo @ Jan 16 2022, 07:52 PM) U just discovered the power of OPM. I am sure you have also heard failed business also done with investors or debt.As per ur calculation, u are correct to continue paying a low interest against taking money from higher dividend fund. I'm not financial advisor, but u r correct to defer the payment. Also, if you have extra money, dump more in EPF and don't extra pay your ptptn. Or save more money to get mortgage. People who say peace of mind from debt is just people who are not disciplined enough to control debt to profit from them. I never heard successful business is done without investor or debt. |

|

|

Jan 17 2022, 11:32 AM Jan 17 2022, 11:32 AM

Show posts by this member only | IPv6 | Post

#3240

|

Junior Member

506 posts Joined: Mar 2012 |

QUOTE(mini orchard @ Jan 17 2022, 11:20 AM) That is because those debt or loan are taken to pay operation cost or in other word, the business is failing fundamentally.Capital injection must always be used for expansion not to cover your digged hole. Example in laymen, u find investor to pump RM30k. Instead opening few more branches or expand the space of your premise, you use it to pay utilities, worker salary or your raw material. Hence you failed to leverage OPM and digg your business grave deeper. Air Asia is a good example of loaning to pay salary and fail miserably. Amazon and Ali Baba are good examples of getting more fund to expand operations. If Jack Ma didn't get enough fund back then, Ali Baba will not become as big as it is. |

| Change to: |  0.0298sec 0.0298sec

0.65 0.65

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 03:50 PM |