QUOTE(hksgmy @ Jun 5 2024, 02:43 PM)

same lah must go tru RM also.. cant say we sell in open market like that..QUOTE(Wedchar2912 @ Jun 5 2024, 02:48 PM)

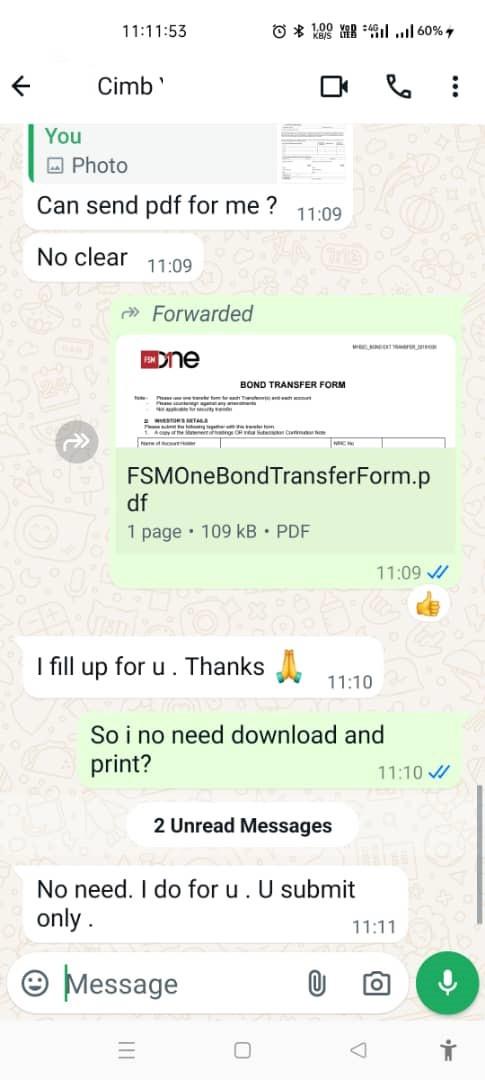

u can read back my old post (post #38) to help you understand bonds better. Its [edit: ok, should not have said near impossible... but it is damn troublesome... same like transferring USD from cimb to say hsbc) and some banks may not even offer such services.

whoa bro true or not...........?really so susah to transfer bond?

bukan macam transfer money kah?

just sign transfer form and go.

which bank is that your experience there?

damn troublesome to transfer one

ada benefit must explore lah..

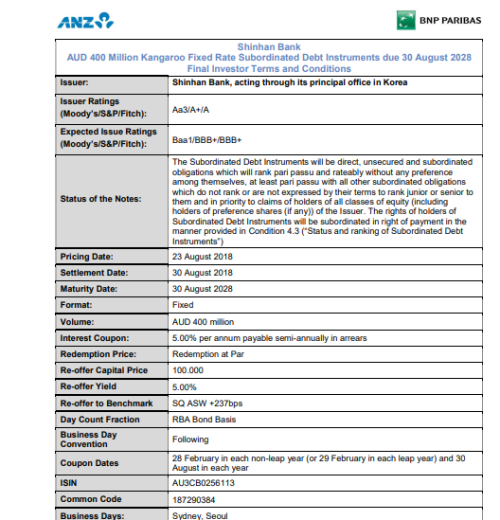

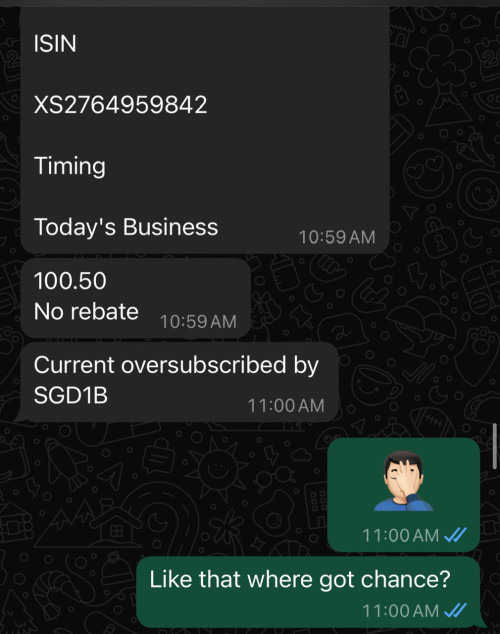

buy in bank A (cheaper price)

transfer to Bank B (higher price) to sell...

question is

1. Can bank A refuse to let me transfer my bond out?

2. Bank B can refuse to accept my transfer in..?

i doubt Bank A can refuse my request if Bank B willing to accept, right?

Jun 5 2024, 05:26 PM

Jun 5 2024, 05:26 PM

Quote

Quote

0.0216sec

0.0216sec

0.53

0.53

6 queries

6 queries

GZIP Disabled

GZIP Disabled