QUOTE(guy3288 @ Nov 23 2023, 01:59 AM)

She already advised me to sell sometime ago at around RM99

she told me all her other clients already exited.

i hate selling below cost

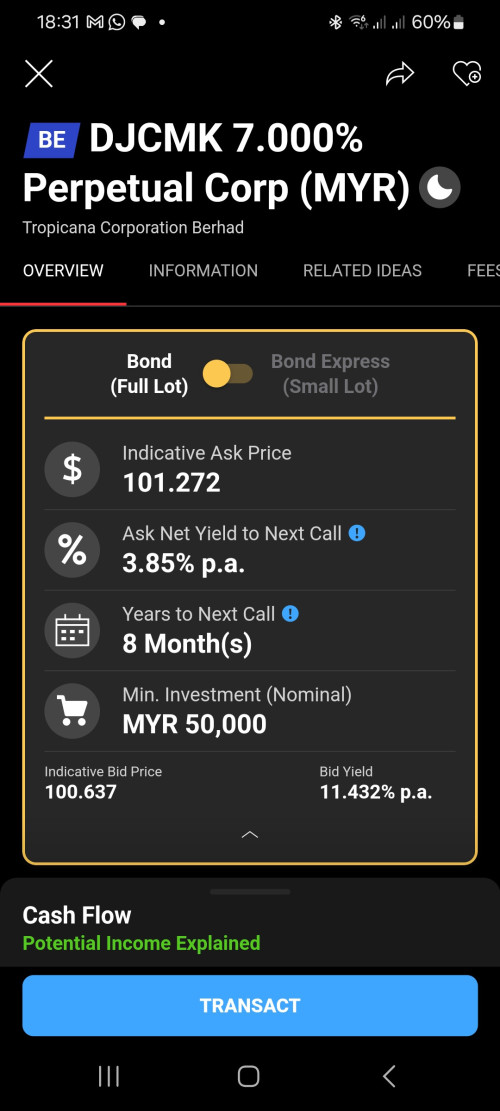

also the coupon so high 7.0%

she wouldnt know if i quietly buy from FSM

the DRB Hicom bonds i quietly bought some from FSM

in this Tropicana cheap sale i tried to get from her at below FSM price

she tried and got it but ..

after she put me on videoconference

with the head Investment Advisory & Research ,

prior to taking my signature, i changed my mind at last.

she was just doing her job in case i got burnt she had done her part.

like docs getting informed consent,

telling you all the highest possible risk of injury, dying from this and that

sudah dengar takut sampai boleh lari...

Hahaha.... talking about CYA....she told me all her other clients already exited.

i hate selling below cost

also the coupon so high 7.0%

she wouldnt know if i quietly buy from FSM

the DRB Hicom bonds i quietly bought some from FSM

in this Tropicana cheap sale i tried to get from her at below FSM price

she tried and got it but ..

after she put me on videoconference

with the head Investment Advisory & Research ,

prior to taking my signature, i changed my mind at last.

she was just doing her job in case i got burnt she had done her part.

like docs getting informed consent,

telling you all the highest possible risk of injury, dying from this and that

sudah dengar takut sampai boleh lari...

Nov 23 2023, 01:13 PM

Nov 23 2023, 01:13 PM

Quote

Quote

0.0451sec

0.0451sec

0.92

0.92

6 queries

6 queries

GZIP Disabled

GZIP Disabled